Reporting for a Variable Interest Entity

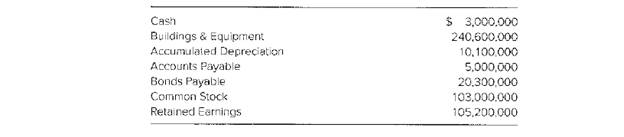

Gamble Company convinced Conservative Corporation that the two Companies should establish Simpletown Corporation to build a new gambling casino in Simpletown Coiner. Although chances for the casino’s success were relatively low, a local bank loaned $140 million to the new corporation, which built, the casino at a cost of $130 million. Conservative purchased 100 percent of the initial capital stock offering for $5.6 million, md Gamble agreed to supply 100 percent of the management which would include directing Simpletown’s day-to-day activities. Gamble also agreed to guarantee the bank loan. Additionally, Gamble guaranteed a 20 percent return to Conservative on its investment for the first 10 years. Gamble will receive all profits in excess of the 20 percent return to Conservative. Immediately after the casino’s construction, Gamble reported the following amounts:

The only disclosure that Gamble currently provides in its financial reports about its relationships to Conservative and Simpletown is a brief footnote indicating that a

Required

Prepare a consolidated

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

- provide correct answer plzarrow_forwardNeed answerarrow_forwardJason Corp. bought equipment for $150,000 on January 1, 2018. Jason estimated the useful life to be 12 years with no salvage value, and the straight-line method of depreciation will be used. On January 1, 2019, Jason decides that the business will use the equipment for a total of 14 years. What is the revised depreciation expense for 2019?arrow_forward

- Business Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning