FUNDAMENTAL ACCT PRIN CONNECT ACCESS

24th Edition

ISBN: 9781266494604

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 2E

Exercise 3.2

Classifying

C3

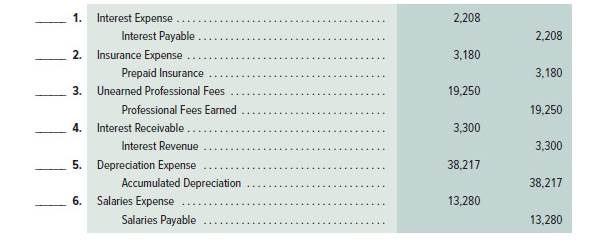

In the blank space beside each adjusting entry, enter the letter of the explanation A through F that most closely describes the entry.

A. To record this period’s

B. To record accrued salaries expense.

C. To record this period’s use of a prepaid expense.

D. To record accrued interest revenue.

E. To record accrued interest expense.

F. To record the earning of previously unearned income.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Get correct answer general accounting question

The Ford Company developed the following

Do fast answer of this accounting questions

Chapter 3 Solutions

FUNDAMENTAL ACCT PRIN CONNECT ACCESS

Ch. 3 - Prob. 1DQCh. 3 - Why is the accrual basis of accounting generally...Ch. 3 - Prob. 3DQCh. 3 - What is a prepaid expense and where is it reported...Ch. 3 - What type of assets requires adjusting entries to...Ch. 3 - 6. What contra account is used when recording and...Ch. 3 - What is an accrued revenue? Give an example..Ch. 3 - 8. If a company initially records prepaid expenses...Ch. 3 - Review the balance sheet of Apple in Appendix À....Ch. 3 - Prob. 10DQ

Ch. 3 - Prob. 11DQCh. 3 - Prob. 12DQCh. 3 - Periodic reporting C1 Choose from the following...Ch. 3 - Prob. 2QSCh. 3 - Identifying accounting adjustments Classify the...Ch. 3 - Concepts 0f adjusting entries During the year, a...Ch. 3 - Prepaid (deferred) expenses adjustments Pl For...Ch. 3 - Prepaid (deferred) expenses adjustments For each...Ch. 3 - Prob. 7QSCh. 3 - Accumulated depreciation adjustments Pl For each...Ch. 3 - Adjusting for depreciation P1 For each separate...Ch. 3 - Unearned (deferred) revenues adjustments For each...Ch. 3 - Adjusting for unearned (deferred) revenues P2 For...Ch. 3 - Accrued expenses adjustments Pl For each separate...Ch. 3 - Prob. 13QSCh. 3 - Accrued revenues adjustments P4 For each separate...Ch. 3 - Recording and analysing adjusting entries A1...Ch. 3 - QS3-16

Determining effects of adjusting...Ch. 3 - Preparing an adjusted trial balance P5 Following...Ch. 3 - Prob. 18QSCh. 3 - Prob. 19QSCh. 3 - Prob. 20QSCh. 3 - Preparing adjusting entries P4 Garcia Company had...Ch. 3 - Preparing adjusting entries P4 Cal Consulting...Ch. 3 - Prob. 1ECh. 3 - Exercise 3.2 Classifying adjusting entries C3 In...Ch. 3 - Exercise 3-3 Adjusting and paying accrued wages P3...Ch. 3 - Prob. 4ECh. 3 - Exercise 3-5 Adjusting and paying accrued expenses...Ch. 3 - Exercise 3-6 Preparing adjusting entries P1 P2 P3...Ch. 3 - Exercise 3-7 Preparing adjusting entries P1 P3 P4...Ch. 3 - Exercise 3-8 Analyzing and preparing adjusting...Ch. 3 - Prob. 9ECh. 3 - Preparing financial statements from a trial...Ch. 3 - Prob. 11ECh. 3 - Exercise 3-11 Adjusting for prepaid recorded as...Ch. 3 - Prob. 13ECh. 3 - Exercise 3-14 Preparing adjusting entries P1 P2 P3...Ch. 3 - Problem 3-1A Identifying adjusting entries with...Ch. 3 - Problem 3-2B Preparing adjusting and subsequent...Ch. 3 - Problem 3-3A Preparing adjusting entries, adjusted...Ch. 3 - Problem 3-4A Interpreting unadjusted and adjusted...Ch. 3 - Problem 3-5A Preparing financial statements from...Ch. 3 - Problem 3-6A

Recording prepaid expenses and...Ch. 3 - Prob. 1BPSBCh. 3 - Problem 3-2B Preparing adjusting and subsequent...Ch. 3 - Problem 3-3B Preparing adjusting entries, adjusted...Ch. 3 - Prolme 3-4B Interpreting unadjusted and adjusted...Ch. 3 - Problem 3-5B Preparing financial statements from...Ch. 3 - Problem 3-6B Recording prepaid expenses and...Ch. 3 - Prob. 3SPCh. 3 - Prob. 1GLPCh. 3 - Using transactions from the following assignments,...Ch. 3 - Using transactions from the following assignments,...Ch. 3 - Prob. 4GLPCh. 3 - Prob. 5GLPCh. 3 - Prob. 1AACh. 3 - Key figures for the recent two years of both Apple...Ch. 3 - Key comparative figures for Samsung. Apple, and...Ch. 3 - Prob. 1BTNCh. 3 - Prob. 2BTNCh. 3 - Access EDGAR online (SEC.gov) and locate the...Ch. 3 - Prob. 4BTNCh. 3 - BTN 3-5 Access EDGAR online (SEC.gov) and locate...Ch. 3 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this question solution general accountingarrow_forwardchoose best answerarrow_forwardIngram Enterprises has variable expenses equal to 65% of sales. At a $500,000 sales level, the degree of operating leverage is 4.5. If sales increase by $50,000, what will be the new degree of operating leverage? please provide answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License