Pearson eText for Governmental and Nonprofit Accounting -- Instant Access (Pearson+)

11th Edition

ISBN: 9780137561667

Author: Robert Freeman, Craig Shoulders

Publisher: PEARSON+

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 2C

(a) Prepare general ledger and subsidiary ledger entries to record the following transactions of the City of Ann Arbor, Michigan, Community Television Network Special Revenue Fund for the year ended June 30, 20X3. (b) Reconcile the general ledger and the subsidiary ledgers at year end. (c) Close the accounts.

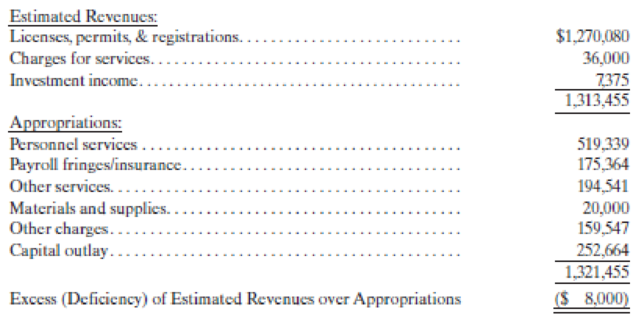

- 1. The Ann Arbor City Council adopted the following budget on the modified accrual basis for the Community Television Network Special Revenue Fund:

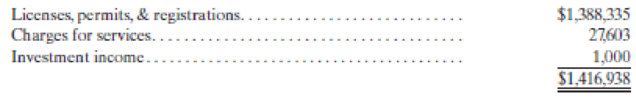

- 2. The city collected cash for the network as follows:

- 3. City Council revised the Community Television Network Special Revenue Fund appropriations for “Personnel services” and “Payroll fringes/insurance” upward by $40,000 and $15,000, respectively, as a result of hiring an additional employee and minor modifications to the employees’ insurance benefits. Appropriations for “Materials and supplies” and “Capital outlay” were reduced by $3,000 and $60,000, respectively.

- 4. The payroll was approved and paid, $559,339.

- 5. Payroll

fringe benefit and insurance costs of $190,000 were incurred during the year; $10,000 was not paid by year end. - 6. The network ordered materials and supplies with an estimated cost of $17,000 and equipment expected to cost $192,664.

- 7. “Other services” of $194,000 and “Other charges” of $159,547 were incurred and paid.

- 8. The network received the materials and supplies ordered. The actual cost was $16,980. The network also received must of the equipment ordered, but orders for $50,000 of transmission equipment had not been received by year end. The actual cost of the equipment received was equal to the expected costs.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

SUBJECT FINANCIAL ACCOUNTING

Need answer the financial accounting question not use ai and chatgpt

The company's assets turnover ratio for 2014 ?

Chapter 3 Solutions

Pearson eText for Governmental and Nonprofit Accounting -- Instant Access (Pearson+)

Ch. 3 - Governmental budgeting and budgetary control are...Ch. 3 - Distinguish between the following types of...Ch. 3 - Prob. 3QCh. 3 - What are budgetary control points? How do they...Ch. 3 - Prob. 5QCh. 3 - Why might a local government not prepare and adopt...Ch. 3 - Revenue estimates and appropriations enacted are...Ch. 3 - In business accounting, a single general ledger...Ch. 3 - Illustrations 3-2 and 3-3 show Revenues Subsidiary...Ch. 3 - An interim budgetary comparison statement for a...

Ch. 3 - Prob. 11QCh. 3 - An annual budgetary comparison schedule for a...Ch. 3 - General budgets are most common for which of the...Ch. 3 - Special budgets are best defined as budgets a....Ch. 3 - Prob. 1.3ECh. 3 - Which of the following statements is false? a....Ch. 3 - Which of the following statements is true? a....Ch. 3 - Appropriation requests for the General Fund are...Ch. 3 - Which of the following statements would be true...Ch. 3 - Prob. 2.3ECh. 3 - Which of the following GAAP requirements for...Ch. 3 - Prob. 2.5ECh. 3 - Prob. 3.1ECh. 3 - Which of the following items does a government...Ch. 3 - The budget data presented in a school district...Ch. 3 - Allotments are best defined as a. legislative...Ch. 3 - Prob. 4ECh. 3 - Prob. 5ECh. 3 - (Budgetary EntriesGeneral Ledger) The city of...Ch. 3 - (General LedgerSubsidiary Ledgers Relationship,...Ch. 3 - (General Ledger Entries) Record the following...Ch. 3 - (Encumbrances) Record the following transactions...Ch. 3 - (Operating Budget Preparation) The finance...Ch. 3 - (Budgetary and Other EntriesGeneral and Subsidiary...Ch. 3 - Prob. 3PCh. 3 - (Budgetary Comparison StatementBudgetary Basis...Ch. 3 - (a) Prepare general ledger and subsidiary ledger...Ch. 3 - Using the information from C3-2 and assuming that...

Additional Business Textbook Solutions

Find more solutions based on key concepts

2. Identify four people who have contributed to the theory and techniques of operations management.

Operations Management

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Whether callable bonds have a higher or lower yield than otherwise identical bonds without a call feature. Intr...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the amount of the annual net income for the year?arrow_forwardNeed answerarrow_forwardHarvey’s Home Decor common stock is currently selling at $72.50 per share. The company follows a 65% dividend payout ratio and has a P/E ratio of 22. There are 50,000 shares of stock outstanding. What is the amount of the annual net income for the firm?arrow_forward

- What is the value of the total assetsarrow_forwardIn a certain standard costing system, the following results occurred last period: total labor variance, 3200 F; labor efficiency variance, 4,300 F; and the actual labor rate was $0.35 more per hour than the standard labor rate. The number of direct labor hours used last period was __.arrow_forwardThe annual fixed overhead is 250000, variable overhead:35arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License