Concept explainers

a & b

Prepare the necessary journal entries and post to the ledger accounts.

a & b

Explanation of Solution

Prepare the journal entries in the books of W Catering Service.

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| July 1 | Cash (A+) | 18,000 | |

| Common stock (E+) | 18,000 | ||

| (To record the issuance of common stock) | |||

| July 2 | Delivery van (A+) | 3,780 | |

| Equipment (A+) | 3,240 | ||

| Supplies (A+) | 1,700 | ||

| Cash(A-) | 8,720 | ||

| (To record the purchase of asset) | |||

| July 3 | Prepaid insurance (A+) | 2,160 | |

| Cash (A-) | 2,160 | ||

| (To record the payment of insurance premium) | |||

| July 4 | Cash (A+) | 6,000 | |

| Unearned catering fees revenue (L+) | 6,000 | ||

| (To record the receipt of cash in advance for unearned catering fees revenue) | |||

| July 5 | Prepaid rent (A+) | 2,340 | |

| Cash (A-) | 2,340 | ||

| (To record the prepaid rent) | |||

| July 6 | Wages expense (E-) | 1,700 | |

| Cash (A-) | 1,700 | ||

| (To record the wages expense) | |||

| July 7 | 5,000 | ||

| Catering fees revenue (E+) | 5,000 | ||

| (To record the revenue on account) | |||

| July 8 | Supplies (A+) | 3,400 | |

| Accounts payable ((L+) | 3,400 | ||

| (To record the purchase of supplies on account) | |||

| July 9 | Wages expense(E+) | 1,800 | |

| Cash (A-) | 1,800 | ||

| (To record the payment of wages) | |||

| July 10 | Delivery van expense(E+) | 850 | |

| Cash (A-) | 850 | ||

| (To record the payment of delivery van expense) | |||

| July 11 | Cash (A+) | 3,700 | |

| Accounts receivable (A-) | 3,700 | ||

| (To record the collection of cash from customers) | |||

| July 12 | Accounts receivable (A+) | 4,800 | |

| Catering Fees Revenue (E+) | 4,800 | ||

| (To record the revenues on account) | |||

| July 13 | Dividends (E-) | 2,000 | |

| Cash(A-) | 2,000 | ||

| (To record the payment of cash dividends) |

Table (1)

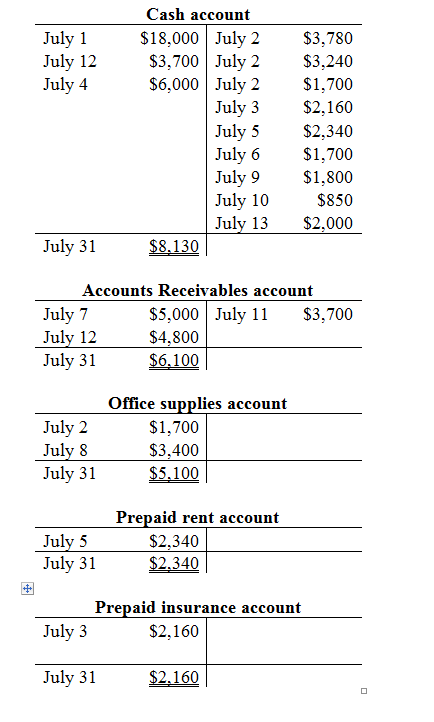

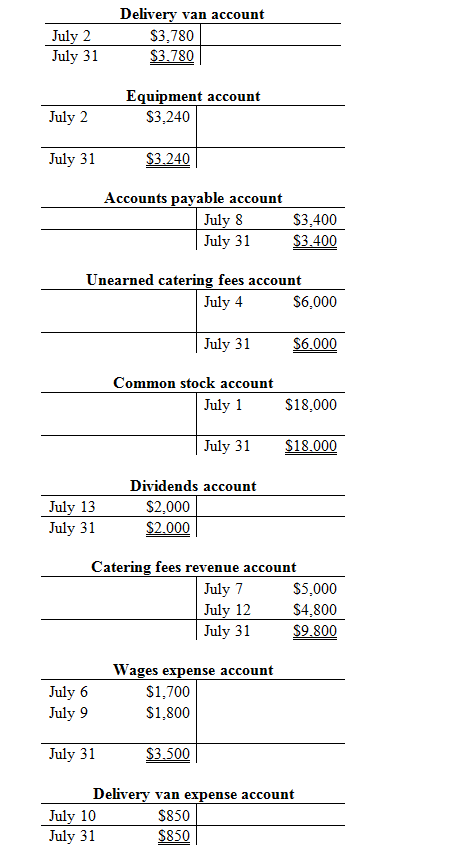

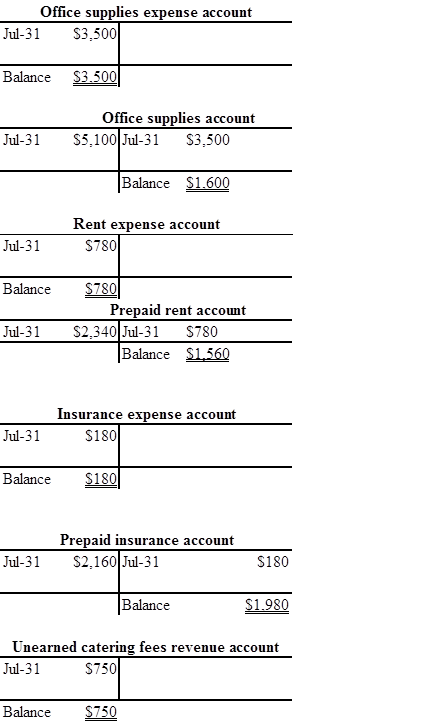

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

Prepare the T-accounts:

c.

Prepare an unadjusted

c.

Explanation of Solution

Unadjusted trial balance:

Unadjusted trial balance is that statement which contains complete list of accounts with their unadjusted balances. This statement is prepared at the end of every financial period.

Prepare the unadjusted trial balance as of 31st July.

| W Catering Services | ||

| Unadjusted Trial Balance | ||

| For the year ended 31st July | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | 8,130 | |

| Supplies | 5,100 | |

| Accounts receivable | 6,100 | |

| Prepaid insurance | 2,160 | |

| Prepaid rent | 2,340 | |

| Equipment | 3,240 | |

| Delivery Van | 3,780 | |

| Accounts Payable | 3,400 | |

| Common Stock | 18,000 | |

| Dividends | 2,000 | |

| Catering Fees Revenue | 9,800 | |

| Unearned Catering Fees Revenue | 6,000 | |

| Wages Expense | 3,500 | |

| Delivery Van Expenses | 850 | |

| Total | 37,200 | 37,200 |

Table (2)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $37,200.

d.

Prepare the

d.

Explanation of Solution

Adjusting entries: Adjusting entries are the journal entries which are recorded at the end of the accounting period to correct or adjust the revenue and expense accounts, to concede with the accrual principle of accounting.

Prepare the adjusting entries in the books of W Catering Service.

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| July 31 | Office Supplies Expense (E+) (1) | 3,500 | |

| Office Supplies (A–) | 3,500 | ||

| (To record the adjusting entry for office supplies expense) | |||

| July 31 | Wages Expense (E+) | 525 | |

| Wages Payable (L+) | 525 | ||

| (To record the adjusting entry for wages expense | |||

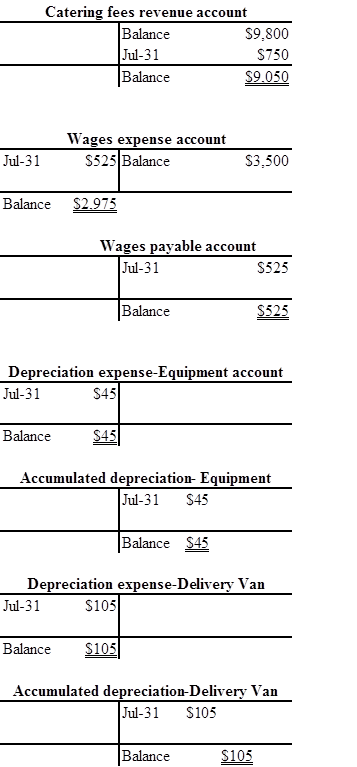

| July 31 | 45 | ||

| 45 | |||

| (To record the amount of depreciation for July) | |||

| July 31 | Depreciation Expense- Delivery van (E+) (3) | 105 | |

| Accumulated Depreciation - Delivery van (A–) | 105 | ||

| (To record the amount of depreciation for July) | |||

| July 31 | Rent Expense (E+) (4) | 780 | |

| Prepaid Rent(A–) | 780 | ||

| (To record the adjusting entry for rent expense) | |||

| July 31 | Insurance Expense (E+) (5) | 180 | |

| Prepaid Insurance(A–) | 180 | ||

| (To record the adjusting entry for insurance expense) | |||

| July 31 | Unearned Catering Fees (L–) | 750 | |

| Catering Fees Revenue (E+) | 750 | ||

| (To record the adjusting entry for unearned catering fees) |

Table (3)

Working note:

Calculate the amount of office supplies used during the year:

Calculate the amount of depreciation on equipment for the month July:

Calculate the amount of depreciation on delivery van for the month July:

Calculate the rent expense for the month of July:

Calculate the insurance expense for the month of July:

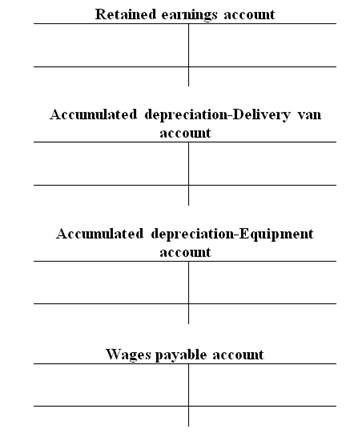

T-account:

T-account is the form of the ledger account, where the journal entries are posted to this account. It is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.

The components of the T-account are as follows:

a) The title of the account

b) The left or debit side

c) The right or credit side

Prepare the T-accounts:

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCT.F/UNDERGRADS-W/ACCESS

- Summit Inc. issued a one-year, 9%, $250,000 note on October 1, 2022. What was the interest expense for the year ended December 31, 2022? A. $5,625 B. $6,750 C. $22,500 D. $4,500arrow_forwardGeneral accountingarrow_forwardUnsure wether the chart is filled out correctly or not. If need changes, please explain why. 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3, using the first-in, first-out method. Under FIFO, if units are in inventory at two different costs, enter the units with the lowerrr unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. 2. Determine the total sales and the total cost of goods sold for the period. Journalize summary entries for the sales and corresponding cost of goods sold for the period. Assume that all sales were on account. Description Debit Credit Record sale ____Acct Title______ D ___ C _____ ____Acct Title______ D ___ C _____ Record Cost ____Acct Title______ D ___ C _____ ____Acct Title______ D ___ C _____ 3. Determine the gross profit from sales for the period. $ 4. Determine the ending inventory cost as of June 30. $ 5. Based…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education