Fundamentals of Cost Accounting

6th Edition

ISBN: 9781260708783

Author: LANEN, William

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 29E

Basic Decision Analysis Using CVP

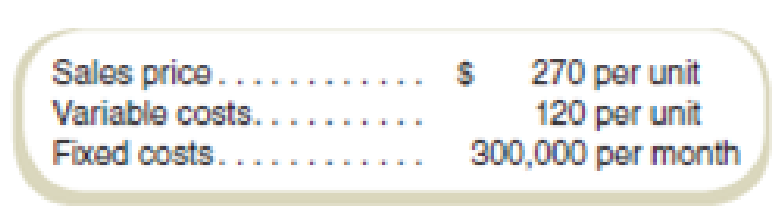

Derby Phones is considering the introduction of a new model of headphones with the following price and cost characteristics:

Required

- a. What number must Derby sell per month to break even?

- b. What number must Derby sell to make an operating profit of $180,000 for the month?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hello teacher please solve questions general accounting

Campbell Soup Company reported pension expense of $94 million and contributed $81.5 million to the pension fund.

Prepare Campbell's journal entry to record pension expense and funding, assuming campbell has no OCI amounts.

Provide accounting question

Chapter 3 Solutions

Fundamentals of Cost Accounting

Ch. 3 - Write out the profit equation and describe each...Ch. 3 - What are the components of total costs in the...Ch. 3 - How does the total contribution margin differ from...Ch. 3 - Compare cost-volume-profit (CVP) analysis with...Ch. 3 - Fixed costs are often defined as fixed over the...Ch. 3 - Prob. 6RQCh. 3 - What is the margin of safety? Why is this...Ch. 3 - Prob. 8RQCh. 3 - Write out the equation for the target volume (in...Ch. 3 - How do income taxes affect the break-even...

Ch. 3 - Why is it common to assume a fixed sales mix...Ch. 3 - What are some important assumptions commonly made...Ch. 3 - Prob. 13CADQCh. 3 - Prob. 14CADQCh. 3 - The typical cost-volume-profit graph assumes that...Ch. 3 - The assumptions of CVP analysis are so simplistic...Ch. 3 - Prob. 17CADQCh. 3 - Consider a class in a business school where volume...Ch. 3 - Prob. 19CADQCh. 3 - Prob. 20CADQCh. 3 - Consider the Business Application,...Ch. 3 - Consider the Business Application,...Ch. 3 - Prob. 23CADQCh. 3 - Profit Equation Components Identify each of the...Ch. 3 - Profit Equation Components Identify the letter of...Ch. 3 - Basic Decision Analysis Using CVP Anus Amusement...Ch. 3 - Basic CVP Analysis The manager of Dukeys Shoe...Ch. 3 - CVP AnalysisEthical Issues Mark Ting desperately...Ch. 3 - Basic Decision Analysis Using CVP Derby Phones is...Ch. 3 - Prob. 30ECh. 3 - Basic Decision Analysis Using CVP Warner Clothing...Ch. 3 - Basic Decision Analysis Using CVP Refer to the...Ch. 3 - Prob. 33ECh. 3 - Prob. 34ECh. 3 - Analysis of Cost Structure Spring Companys cost...Ch. 3 - CVP and Margin of Safety Bristol Car Service...Ch. 3 - CVP and Margin of Safety Caseys Cases sells cell...Ch. 3 - Prob. 38ECh. 3 - Prob. 39ECh. 3 - Refer to the data for Derby Phones in Exercise...Ch. 3 - Refer to the data for Warner Clothing in Exercise...Ch. 3 - CVP with Income Taxes Hunter Sons sells a single...Ch. 3 - CVP with Income Taxes Hammerhead Charters runs...Ch. 3 - Prob. 44ECh. 3 - Prob. 45ECh. 3 - Prob. 46ECh. 3 - Prob. 47ECh. 3 - CVP Analysis and Price Changes Argentina Partners...Ch. 3 - Prob. 49PCh. 3 - CVP AnalysisMissing Data Breed Products has...Ch. 3 - Prob. 51PCh. 3 - Prob. 52PCh. 3 - CVP AnalysisSensitivity Analysis (spreadsheet...Ch. 3 - Prob. 54PCh. 3 - Prob. 55PCh. 3 - Extensions of the CVP ModelSemifixed (Step) Costs...Ch. 3 - Prob. 57PCh. 3 - Extensions of the CVP ModelTaxes Odd Wallow Drinks...Ch. 3 - Prob. 59PCh. 3 - Prob. 60PCh. 3 - Extensions of the CVP ModelTaxes Toys 4 Us sells...Ch. 3 - Extensions of the CVP AnalysisTaxes Eagle Company...Ch. 3 - Extensions of the CVP ModelMultiple Products...Ch. 3 - Extensions of the CVP ModelMultiple Products...Ch. 3 - Prob. 65PCh. 3 - Prob. 66PCh. 3 - Prob. 67PCh. 3 - Prob. 68PCh. 3 - Extensions of the CVP ModelMultiple Products and...Ch. 3 - Extensions of the CVP ModelTaxes With Graduated...Ch. 3 - Prob. 71PCh. 3 - Financial Modeling Three entrepreneurs were...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Pricing Decisions; Author: Rutgers Accounting Web;https://www.youtube.com/watch?v=rQHbIVEAOvM;License: Standard Youtube License