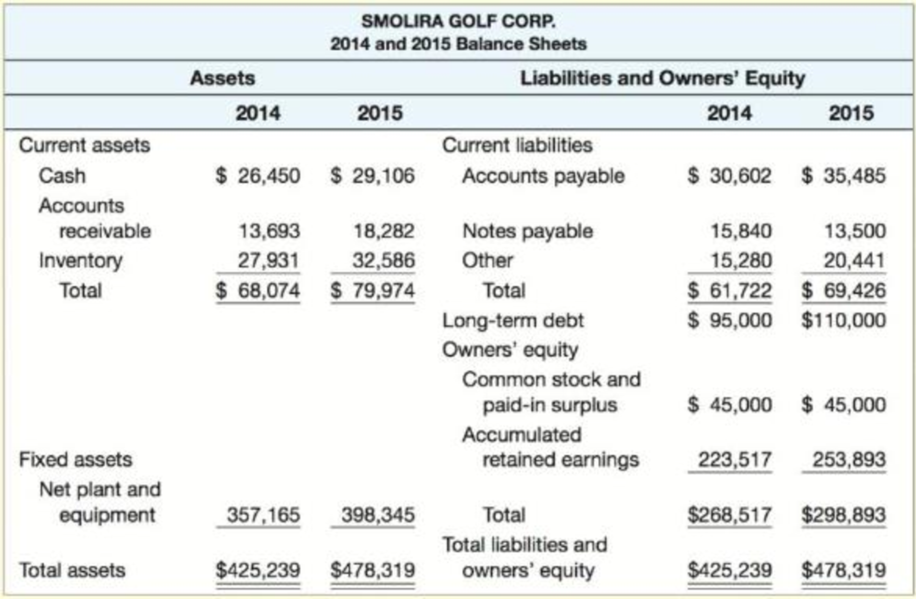

Some recent financial statements for Smolira Golf Corp. follow. Use this information to work Problems 26 through 30.

| SMOLIRA GOLF CORP. 2015 Income Statement | ||

| Sales | $422,045 | |

| Cost of goods sold | 291,090 | |

| 37,053 | ||

| Earnings before interest and taxes | $ 93,902 | |

| Interest paid | 16,400 | |

| Taxable income | $ 77,502 | |

| Taxes (35%) | 27,126 | |

| Net income | $ 50,376 | |

| Dividends | $20,000 | |

| |

30,376 | |

26. Calculating Financial Ratios [LO2] Find the following financial ratios for Smolira Golf Corp. (use year-end figures rather than average values where appropriate):

Short-term solvency ratios:

| a. Current ratio | ____________________ |

| b. Quick ratio | ____________________ |

| c. Cash ratio | ____________________ |

Asset utilization ratios:

| d. Total asset turnover | ____________________ |

| e. Inventory turnover | ____________________ |

| f. Receivables turnover | ____________________ |

Long-term solvency ratios:

| g. Total debt ratio | ____________________ |

| h. Debt–equity ratio | ____________________ |

| i. Equity multiplier | ____________________ |

| j. Times interest earned ratio | ____________________ |

| k. Cash coverage ratio | ____________________ |

Profitability ratios:

| l. Profit margin | ____________________ |

| m. |

____________________ |

| n. |

____________________ |

a)

To find: The financial current ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The current ratio for 2014 and 2015 is 1.10 times and 1.15 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Short-term solvency ratios:

Formula to calculate the current ratio:

Compute the current ratio:

Hence, the current ratio for 2014 is 1.10 times

Hence, the current ratio for 2015 is 1.15 times

b)

To find: The financial quick ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The quick ratio for 2014 and 2015 is 0.65 and 0.68 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate Quick ratio:

Compute the quick ratio:

Hence, the quick ratio for 2014 is 0.65 times

Hence, the quick ratio for 2015 is 0.68 times.

c)

To find: The financial cash ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The cash ratio for 2014 and 2015 is 0.43 times and 0.42 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the cash ratio:

Compute the cash ratio:

Hence, the cash ratio for 2014 is 0.43 times

Hence, the cash ratio for 2015 is 0.42 times

d)

To find: The financial total asset turnover ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The total asset turnover ratio is 0.88 times.

Explanation of Solution

Asset utilization ratios:

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the total asset turnover ratio:

Compute the total asset turnover ratio:

Hence, the total asset turnover ratio is 0.88 times.

e)

To find: The inventory turnover ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The inventory turnover ratio is 8.93 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the inventory turnover ratio:

Compute the inventory turnover ratio:

Hence, the inventory turnover ratio is 8.93 times.

f)

To find: The receivables turnover ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The receivables turnover ratio is 23.09 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the receivables turnover ratio:

Compute the receivables turnover ratio:

Hence, the receivables turnover ratio is 23.09 times.

g)

To find: The total debt ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The total debt ratio for 2014 is 0.37 timesand for 2015 is 0.38 times.

Explanation of Solution

Long-term solvency ratios:

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the total debt ratio:

Compute the total debt ratio:

Hence, the total debt ratio for 2014 is 0.37 times.

Hence, the total debt ratio for 2015 is 0.38 times.

h)

To find: The debt equity ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The debt-equity ratio for the year 2014 is 0.58 timesand the debt-equity ratio for the year 2015 is 0.60 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the debt-equity ratio:

Compute the debt-equity:

Hence, the debt-equity ratio for the year 2014 is 0.58 times.

Hence, the debt-equity ratio for the year 2015 is 0.60 times.

Note: The total debt is calculated by adding the total-long term debt and total current liabilities.

i)

To find: The equity multiplier ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The equity multiplier ratio for the year 2014 is 1.58 timesand the equity multiplier ratio for the year 2015 is 1.60 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the equity multiplier:

Compute the equity multiplier ratio for the year 2015:

Hence, the equity multiplier ratio for the year 2014 is 1.58 times.

Hence, the equity multiplier ratio for the year 2015 is 1.60 times.

j)

To find: The times interest earned of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The times interest earned is 5.73 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the times interest earned ratio:

Compute the times interest earned ratio:

Hence, the times interest earned is 5.73 times.

k)

To find: The cash coverage ratio of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The cash coverage ratio is 7.99 times.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the cash coverage ratio:

Compute the cash coverage ratio:

Hence, the cash coverage ratio is 7.99 times.

l)

To find: The profit margin of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The profit margin is 11.94%.

Explanation of Solution

Profitability ratios:

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the profit margin ratio:

Compute the profit margin:

Hence, the profit margin is 11.94%.

m)

To find: The return on assets of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The return on assets is 0.1194.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the Return on assets (ROA):

Compute the Return on assets (ROA):

Hence, the return on assets is 0.1194 or 11.94%.

n)

To find: The return on equity of Company SG

Introduction:

The process of analyzing and calculating the financial ratios for the evaluation of the performance of the firm and to find the actions that are necessary to improve the firm’s performance is ratio analysis.

Answer to Problem 26QP

The return on equity is 0.1685.

Explanation of Solution

Given information:

The balance sheet of the Company SG shows the following information:

- The total assets for the year 2014 is $425,239 and for 2015 is $478,319

- The total liabilities and equity for the year 2014 is 425,239 and for 2015 is $478,319

- The cash at the beginning and end of the year are $26,450 and $29,106 respectively.

- The accounts receivable for the year 2014 and 2015 are $13,693 and $18,282 respectively.

- The inventory for the year 2014 and 2015 are $27,931 and $32,586 respectively.

- The fixed asset for the year 2014 and 2015 are $357,165 and $398,345 respectively.

- The accounts payable for the year 2014 and 2015 are $30,602 and $35,485 respectively.

- The other current liabilities for the year 2014 and 2015 are $15,280 and $20,441 respectively.

- The notes payable for the year 2014 and 2015 are $15,840 and $13,500 respectively.

- The long-term debt for the year 2014 and 2015 are $95,000 and $110,000.

- The common stock and paid in surplus for 2014 is $45,000 and for 2015 is $45,000

- The accumulated retained earnings for 2014 is $223,517 and 2015 is $253,893

- The net income is $50,376.

- The depreciation is $37,053.

- The dividend paid is $20,000.

- The cost of goods sold amounts to $291,090

- The sales is $422,045

- The earnings before interest and taxes is $93,902

- The interest paid is $16,400

- The retained earnings is $30,376

- The taxable income is $77,502

Formula to calculate the Return on equity (ROE):

Compute the Return on equity (ROE):

Hence, the return on equity is 0.1685 or 16.85%.

Want to see more full solutions like this?

Chapter 3 Solutions

Fundamentals of Corporate Finance

- Please help with problem 4-6arrow_forwardYour father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 5%. He currently has $180,000 saved, and he expects to earn 8% annually on his savings. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Required annuity payments Retirement income today $45,000 Years to retirement 10 Years of retirement 25 Inflation rate 5.00% Savings $180,000 Rate of return 8.00%arrow_forwardA textile company produces shirts and pants. Each shirt requires three square yards of cloth, and each pair of pants requires two square yards of cloth. During the next two months the following demands for shirts and pants must be met (on time): month 1, 2,000 shirts and 1,500 pairs of pants; month 2, 1,200 shirts and 1,400 pairs of pants. During each month the following resources are available: month 1, 9,000 square yards of cloth; month 2, 6,000 square yards of cloth. In addition, cloth that is available during month 1 and is not used can be used during month 2. During each month it costs $10 to produce an article of clothing with regular time labor and $16 with overtime labor. During each month a total of at most 2,000 articles of clothing can be produced with regular time labor, and an unlimited number of articles of clothing can be produced with overtime labor. At the end of each month, a holding cost of $1 per article of clothing is incurred (There is no holding cost for cloth.)…arrow_forward

- What is the general problem statement of the leaders lack an understanding and how to address job demands, resulting in an increase in voluntary termination? Refer to the article of Bank leaders discovered from customer surveys that customers are closing accounts because their rates are not competitive with area credit unions. Job demands such as a heavy workload interfered with employee performance, leading to decreased job performance.arrow_forwardDon't used hand raitingarrow_forward1 2 Fast Clipboard F17 DITECTIONS. BIU- Font B X C A. fx =C17+D17-E17 E F Merge & Center - 4 $ - % 9 4.0.00 Conditional Format as .00 9.0 Alignment Number Cell Formatting - Table - Table Styles - Styles Insert Delete Fe Cells H Mario Armando Perez is the kitchen manager at the Asahi Sushi House. Mario's restaurant offers five popular types of sushi roll. Mario keeps 4 careful records of the number of each roll type sold, from which he computes each item's popularity index. For March 1, Mario estimates 150 5 guests will be served. 6 8 9 10 11 04 At the end of the day, Mario also records his actual number sold in order to calculate his carryover amount for the next day. 7 Based on his experience, and to ensure he does not run out of any item, Mario would like to have extra servings (planned overage) of selected menu items available for sale. Using planned overage, the popularity index of his menu items, and his prior day's carryover information, help Mario determine the amount of new…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning