ACCOUNTING F/GOV.+..(LL)-W/CODE>CUSTOM<

18th Edition

ISBN: 9781264107919

Author: RECK

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 21EP

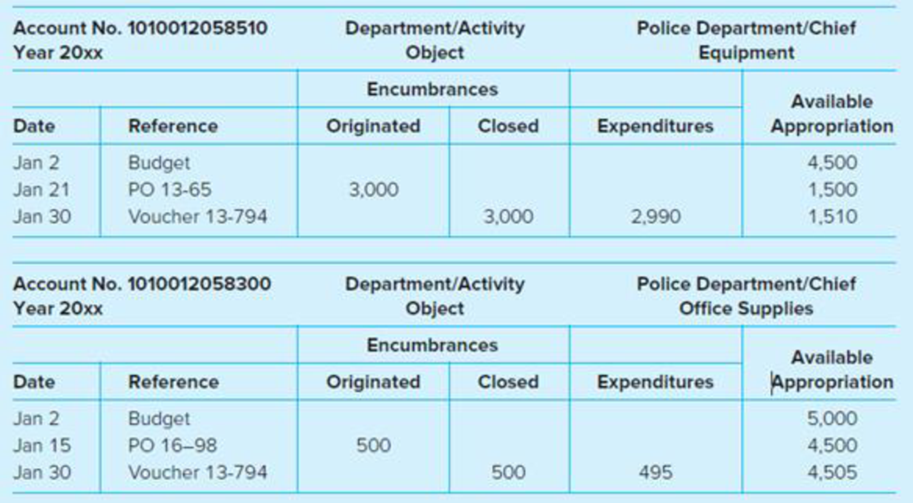

On February 15, the Town of Evergreen police chief’s administrative assistant is preparing a purchase order to place an order for a new computer. The computer is estimated to cost $1,600. Prior to submitting the purchase order, he is required to verify that an appropriation is available in a sufficient amount to cover the cost of the new computer. His computer display shows the following current information for the Police Chief Equipment account and Office Supplies account.

Required

Review the police chief accounts as of February 15, and answer the following questions, assuming you are the administrative assistant.

- a. Is the available appropriation balance sufficient to authorize placing the purchase order for the new computer?

- b. You notice an available appropriation balance in the office supply account. Under what circumstances might the office supplies appropriation balance be used for the equipment purchase?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

On January 1, 2024, Wright Transport sold four school buses to the Elmira School District. In exchange for the buses, Wright received a note requiring payment of $532,000 by Elmira on December 31, 2026. The effective interest rate is 8%.

Note: Use appropriate factor(s) from the tables provided. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

How much sales revenue would Wright recognize on January 1, 2024, for this transaction?

Prepare journal entries to record the sale of merchandise on January 1, 2024 (omit any entry that might be required for the cost of the goods sold), the December 31, 2024, interest accrual, the December 31, 2025, interest accrual, and receipt of payment of the note on December 31, 2026.

Johnson Company calculates its allowance for uncollectible accounts as 10% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $28,000 at the beginning of 2024. No previously written-off accounts receivable were reinstated during 2024. At 12/31/2024, gross accounts receivable totaled $466,700, and prior to recording the adjusting entry to recognize bad debts expense for 2024, the allowance for uncollectible accounts had a debit balance of 51,300.

Required:

Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2024. Determine the amount of accounts receivable written off during 2024.

If Johnson instead used the direct write-off method, what would bad debt expense be for 2024?

Johnson Company calculates its allowance for uncollectible accounts as 10% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $28,000 at the beginning of 2024. No previously written-off accounts receivable were reinstated during 2024. At 12/31/2024, gross accounts receivable totaled $466,700, and prior to recording the adjusting entry to recognize bad debts expense for 2024, the allowance for uncollectible accounts had a debit balance of 51,300.

Required:

What was the balance in gross accounts receivable as of 12/31/2023?

What journal entry should Johnson record to recognize bad debt expense for 2024?

Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2024. Determine the amount of accounts receivable written off during 2024.

If Johnson instead used the direct write-off method, what would bad debt expense be for 2024?

Chapter 3 Solutions

ACCOUNTING F/GOV.+..(LL)-W/CODE>CUSTOM<

Ch. 3 - Prob. 1QCh. 3 - Discuss the different ways in which depreciation...Ch. 3 - Prob. 3QCh. 3 - Prob. 4QCh. 3 - Explain the essential differences between revenues...Ch. 3 - Prob. 6QCh. 3 - How do Budgetary Fund Balance and Fund Balances...Ch. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - Prob. 10Q

Ch. 3 - The city manager of University City is finalizing...Ch. 3 - Prob. 16.1EPCh. 3 - Prob. 16.2EPCh. 3 - Which of the following accounts neither increases...Ch. 3 - Prob. 16.4EPCh. 3 - Which of the following statements is true for...Ch. 3 - An internal allocation of funds on a periodic...Ch. 3 - Prob. 16.7EPCh. 3 - Prob. 16.8EPCh. 3 - Before placing a purchase order, a department...Ch. 3 - Prob. 16.10EPCh. 3 - Which of the following is correct concerning the...Ch. 3 - Prob. 16.12EPCh. 3 - Prob. 16.13EPCh. 3 - Prob. 16.14EPCh. 3 - Supplies ordered by the Public Works function of...Ch. 3 - Prob. 17EPCh. 3 - Prob. 18EPCh. 3 - Prob. 19EPCh. 3 - The following information is provided about the...Ch. 3 - On February 15, the Town of Evergreen police...Ch. 3 - The Town of Willingdon adopted the following...Ch. 3 - During July, the first month of the fiscal year,...Ch. 3 - The Town of Bedford Falls approved a General Fund...Ch. 3 - The printout of the Revenues and Appropriations...Ch. 3 - Review the computer-generated budgetary comparison...Ch. 3 - Prob. 27EPCh. 3 - Greenville has provided the following information...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tracy Company, a manufacturer of air conditioners, sold 100 units to Thomas Company on November 17, 2024. The units have a list price of $750 each, but Thomas was given a 20% trade discount. The terms of the sale were 3/10 , n/30 . 3-a. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on November 26, 2024, assuming that the net method of accounting for cash discounts is used. 3-b. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on December 15, 2024, assuming that the net method of accounting for cash discounts is used.arrow_forwardTracy Company, a manufacturer of air conditioners, sold 100 units to Thomas Company on November 17, 2024. The units have a list price of $750 each, but Thomas was given a 20% trade discount. The terms of the sale were 3/10 , n/30 . 3-a. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on November 26, 2024, assuming that the net method of accounting for cash discounts is used. 3-b. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on December 15, 2024, assuming that the net method of accounting for cash discounts is used.arrow_forwardBurlington manufacturing complete solution general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

- Business Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:9781305224414

Author:JENNINGS

Publisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License