Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 20SEB

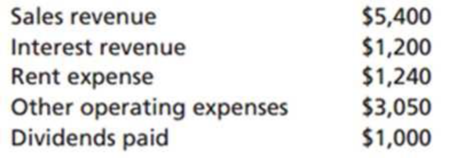

Calculate net income. (LO I, 4). Suppose a company had the following accounts and balances at year end:

Calculate net income by preparing the income statement for the year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

accounting question

SUBJECT =GENERAL ACCOUNTING

Classify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense? Need help

Chapter 3 Solutions

Financial Accounting

Ch. 3 - Prob. 1YTCh. 3 - Prob. 2YTCh. 3 - Prob. 3YTCh. 3 - Prob. 4YTCh. 3 - Prob. 5YTCh. 3 - Prob. 6YTCh. 3 - Prob. 7YTCh. 3 - How does accrual basis accounting differ from cash...Ch. 3 - Prob. 2QCh. 3 - Prob. 3Q

Ch. 3 - Prob. 4QCh. 3 - What are accrued expenses?Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Name two common deferred expenses.Ch. 3 - What does it mean to recognize revenue?Ch. 3 - How does matching relate to accruals and...Ch. 3 - What is depreciation?Ch. 3 - Why is depreciation necessary?Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Prob. 1MCQCh. 3 - Prob. 2MCQCh. 3 - Prob. 3MCQCh. 3 - Prob. 4MCQCh. 3 - Prob. 5MCQCh. 3 - Prob. 6MCQCh. 3 - Prob. 7MCQCh. 3 - Prob. 8MCQCh. 3 - When prepaid insurance has been used, the...Ch. 3 - Prob. 10MCQCh. 3 - Prob. 1SEACh. 3 - Prob. 2SEACh. 3 - Account for interest expense. (LO 1, 2). UMC...Ch. 3 - Prob. 4SEACh. 3 - Account for insurance expense. (LO 1, 3). Catrina...Ch. 3 - Prob. 6SEACh. 3 - Account for unearned revenue. (LO 1, 3). Able...Ch. 3 - Prob. 8SEACh. 3 - Prob. 9SEACh. 3 - Prob. 10SEACh. 3 - Calculate profit margin on sales ratio. (LO 5)....Ch. 3 - Prob. 12SEBCh. 3 - Prob. 13SEBCh. 3 - Prob. 14SEBCh. 3 - Prob. 15SEBCh. 3 - Prob. 16SEBCh. 3 - Prob. 17SEBCh. 3 - Prob. 18SEBCh. 3 - Prob. 19SEBCh. 3 - Calculate net income. (LO I, 4). Suppose a company...Ch. 3 - Prob. 21SEBCh. 3 - Prob. 22SEBCh. 3 - Prob. 23EACh. 3 - Prob. 24EACh. 3 - Prob. 25EACh. 3 - Prob. 26EACh. 3 - Prob. 27EACh. 3 - Prob. 28EACh. 3 - Account for insurance expense. (LO 1, 3). Yodel ...Ch. 3 - Prob. 30EACh. 3 - Prob. 31EACh. 3 - Prob. 32EACh. 3 - Prob. 33EACh. 3 - Prob. 34EACh. 3 - Southeast Pest Control, Inc., was started when its...Ch. 3 - Prob. 36EACh. 3 - Prob. 37EACh. 3 - Prob. 38EACh. 3 - Prob. 39EACh. 3 - Prob. 40EBCh. 3 - Prob. 41EBCh. 3 - Prob. 42EBCh. 3 - TJs Tavern paid 10,800 on February 1, 2010, for a...Ch. 3 - Prob. 44EBCh. 3 - Prob. 45EBCh. 3 - Account for insurance expense. (LO 1, 3). All...Ch. 3 - Prob. 47EBCh. 3 - Prob. 48EBCh. 3 - Prob. 49EBCh. 3 - Prob. 50EBCh. 3 - Prob. 51EBCh. 3 - Prob. 52EBCh. 3 - From the following list of accounts (1) identify...Ch. 3 - Prob. 54EBCh. 3 - Prob. 55EBCh. 3 - Prob. 56EBCh. 3 - Prob. 57PACh. 3 - Prob. 58PACh. 3 - Prob. 59PACh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 61PACh. 3 - Record adjustments. (LO 1, 2, 3). The Gladiator...Ch. 3 - Prob. 63PACh. 3 - Transactions for Pops Company for 2011 were as...Ch. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 66PACh. 3 - Prob. 67PACh. 3 - Record adjustments and prepare income statement....Ch. 3 - Prob. 69PBCh. 3 - Prob. 70PBCh. 3 - Following is a partial list of financial statement...Ch. 3 - Prob. 72PBCh. 3 - Record adjustments. (LO 1, 2, 3). Summit Climbing...Ch. 3 - Prob. 74PBCh. 3 - Prob. 75PBCh. 3 - Record adjustments and prepare financial...Ch. 3 - Prob. 77PBCh. 3 - Prob. 78PBCh. 3 - Identify and explain accruals and deferrals. (LO...Ch. 3 - Prob. 2FSACh. 3 - Prob. 3FSACh. 3 - Prob. 1CTPCh. 3 - Prob. 1IECh. 3 - Prob. 3IECh. 3 - Prob. 4IE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Classify the following account: Prepaid Insurance – Asset, Liability, Equity, Revenue, or Expense?arrow_forwardJournalize the following transaction: Purchased equipment worth $10,000, paying $4,000 in cash and the balance on credit.arrow_forwardExplain the difference between accrued expense and prepaid expense with examples. No aiarrow_forward

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardWhich financial statement shows financial position at a point in time?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License