Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

12th Edition

ISBN: 9781259144387

Author: Richard A Brealey, Stewart C Myers, Franklin Allen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 1SQ

(PRICE) In February 2009, Treasury 8.5s of 2020 yielded 3.2976%. What was their price? If the yield rose to 4%, what would happen to the price?

Expert Solution

Summary Introduction

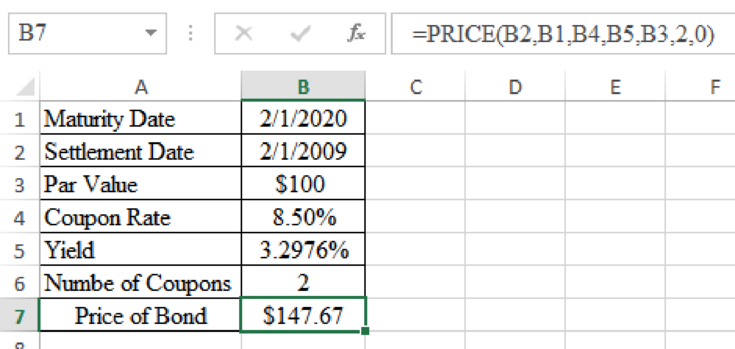

To determine: The price of bond at a yield of 3.2976%.

Answer to Problem 1SQ

The price of bond at a yield of 3.2976% is $147.67.

Explanation of Solution

Determine the price of bond at a yield of 3.2976%

Excel Spreadsheet:

Therefore the price of bond at a yield of 3.2976% is $147.67.

Expert Solution

Summary Introduction

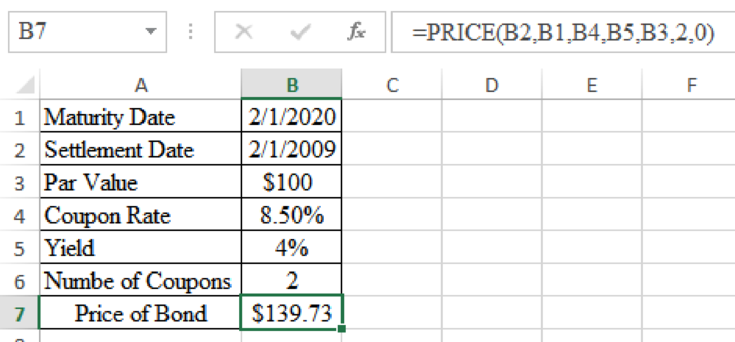

To determine: The price of bond at a yield of 4%.

Answer to Problem 1SQ

The price of bond at a yield of 4% is $139.73.

Explanation of Solution

Determine the price of bond at a yield of 4%

Excel Spreadsheet:

Therefore the price of bond at a yield of 4% is $139.73.

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Chapter 3 Solutions

Principles of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Ch. 3 - (PRICE) In February 2009, Treasury 8.5s of 2020...Ch. 3 - (YLD) On the same day, Treasury 3.5s of 2018 were...Ch. 3 - (DURATION) What was the duration of the Treasury...Ch. 3 - (MDURATION) What was the modified duration of the...Ch. 3 - Prob. 1PSCh. 3 - Bond prices and yields The following statements...Ch. 3 - Prob. 3PSCh. 3 - Bond prices and yields A 10-year German government...Ch. 3 - Bond prices and yields Construct some simple...Ch. 3 - Spot interest rates and yields Which comes first...

Ch. 3 - Prob. 7PSCh. 3 - Spot interest rates and yields Assume annual...Ch. 3 - Prob. 9PSCh. 3 - Prob. 10PSCh. 3 - Duration True or false? Explain. a....Ch. 3 - Duration Calculate the durations and volatilities...Ch. 3 - Term-structure theories The one-year spot interest...Ch. 3 - Real interest rates The two-year interest rate is...Ch. 3 - Duration Here are the prices of three bonds with...Ch. 3 - Prob. 16PSCh. 3 - Prob. 17PSCh. 3 - Spot interest rates and yields A 6% six-year bond...Ch. 3 - Spot interest rates and yields Is the yield on...Ch. 3 - Prob. 20PSCh. 3 - Prob. 21PSCh. 3 - Duration Find the spreadsheet for Table 3.4 in...Ch. 3 - Prob. 23PSCh. 3 - Prob. 25PSCh. 3 - Prob. 26PSCh. 3 - Prob. 27PSCh. 3 - Prob. 28PSCh. 3 - Prob. 29PSCh. 3 - Prices and yields If a bonds yield to maturity...Ch. 3 - Prob. 31PSCh. 3 - Price and spot interest rates Find the arbitrage...Ch. 3 - Prob. 33PSCh. 3 - Prices and spot interest rates What spot interest...Ch. 3 - Prices and spot interest rates Look one more time...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.The U.S. Treasury Markets Explained | Office Hours with Gary Gensler; Author: U.S. Securities and Exchange Commission;https://www.youtube.com/watch?v=uKXZSzY2ZbA;License: Standard Youtube License