Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 1R

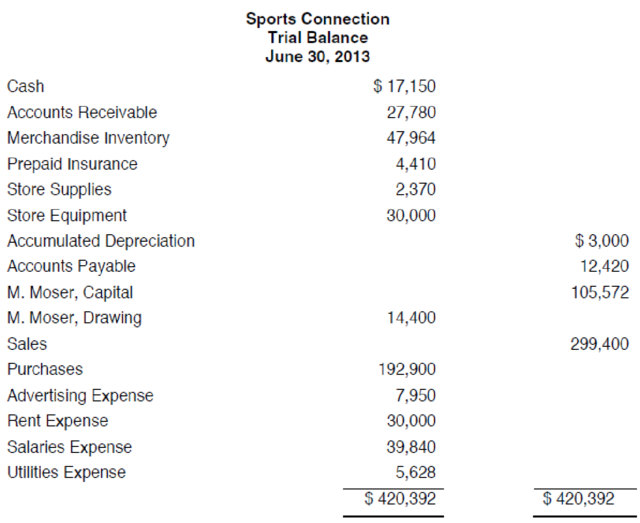

The

Adjustment information is as follows:

- a. Supplies on hand as of June 30, 2013, $450.

- b. Insurance premiums that expired during the year, $2,420.

- c.

Depreciation on equipment during the year, $1,500. - d. Included in the rent expense of $30,000 is $1,200 that is prepaid for July 2013.

- e. Salaries accrued but not paid at June 30, 2013, $1,440.

- f. Merchandise inventory on June 30, 2013, $68,864.

As the accountant for Sports Connection, you have been asked to prepare

Expert Solution & Answer

To determine

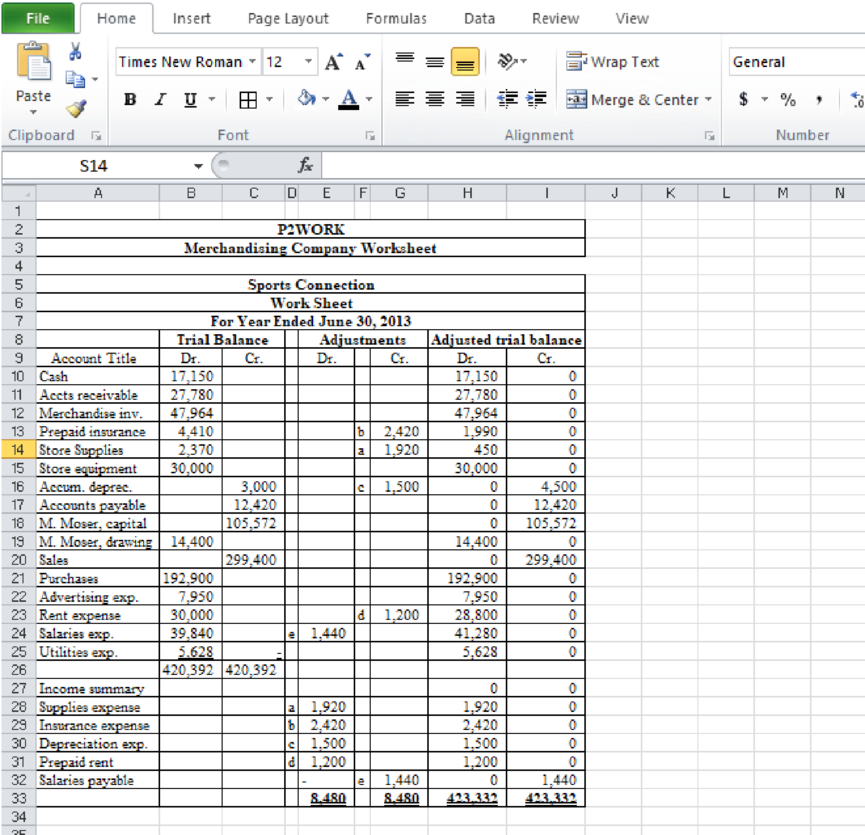

Prepare adjusting entries and financial statement by making entries in worksheet.

Explanation of Solution

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

What markup percentage is the company using

An asset owned by Crescent Manufacturing has a book value of $36,000 on June 30, Year 5. The asset has been depreciated at an annual rate of $8,000 using the straight-line method. Assuming the asset is sold on June 30, Year 5 for $39,500, how should the company record the transaction? a. Neither a gain nor a loss is recognized on this type of transaction. b. A gain on sale of $3,500. c. A gain on sale of $5,000. d. A loss on sale of $3,500. e. A loss on sale of $5,000.

Can you solve this financial accounting question with the appropriate financial analysis techniques?

Chapter 3 Solutions

Excel Applications for Accounting Principles

Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - The trial balance of Sports Connection at June 30,...Ch. 3 - Open P2WORK4 and click the Chart sheet tab. On the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCornell Manufacturing has stockholders' equity of $420,000 and total liabilities of $380,000. What is the value of total assets?arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardIf a business buys supplies on credit, which of the following accounts will be affected?a) Supplies and Accounts Payableb) Cash and Suppliesc) Accounts Receivable and Suppliesd) Supplies and Cashno aiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY