Concept explainers

a and b.

Record the journal

a and b.

Explanation of Solution

Record the journal entries and post the transactions in general ledger.

| Date | Account title and explanation | Debit | Credit |

| June 1 | Cash | 7,500 | |

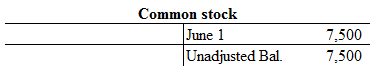

| Common stock | 7,500 | ||

| (To record the issuance of common stock in exchange of cash) | |||

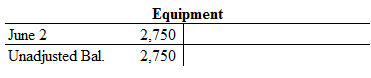

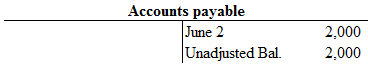

| June 2 | Equipment | 2,750 | |

| Cash | 750 | ||

| Accounts payable | 2,000 | ||

| (To record the purchase of equipment) | |||

| June 3 | Prepaid rent | 3,450 | |

| Cash | 3,450 | ||

| (To record the payment of 6 month rent) | |||

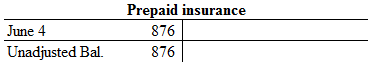

| June 4 | Prepaid insurance | 876 | |

| Cash | 876 | ||

| (To record the payment of 1 year insurance policy) | |||

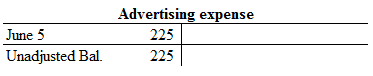

| June 5 | Advertising expense | 225 | |

| Cash | 225 | ||

| (To record the payment for advertising expense) | |||

| June 6 | Accounts receivable | 2,200 | |

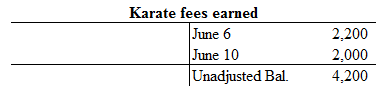

| Karate fees earned | 2,200 | ||

| (To record the fees earned on account) | |||

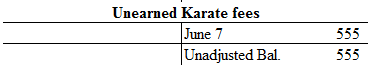

| June 7 | Cash | 555 | |

| Unearned Karate fees | 555 | ||

| (To record the receipt of advance) | |||

| June 8 | Cash | 1,800 | |

| Accounts receivable | 1,800 | ||

| (To record the collection of cash on account) | |||

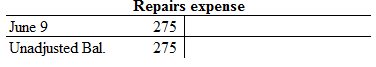

| June 9 | Repairs expense | 275 | |

| Cash | 275 | ||

| (To record the repairs expense) | |||

| June 10 | Accounts receivable | 2,000 | |

| Karate fees earned | 2,000 | ||

| (To record the fees earned on account) | |||

| June 11 | Wages expense | 650 | |

| Cash | 650 | ||

| (To record the wages expense) |

Table (1)

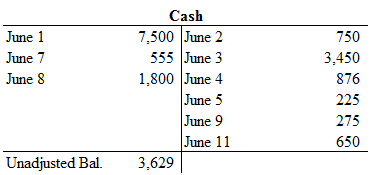

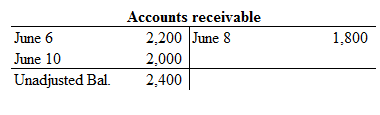

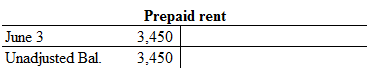

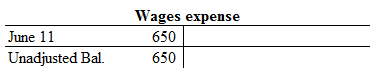

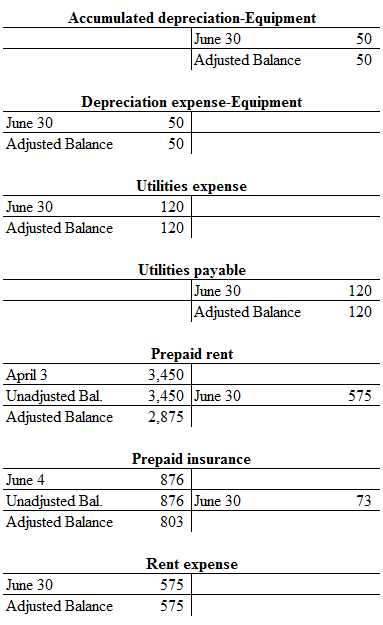

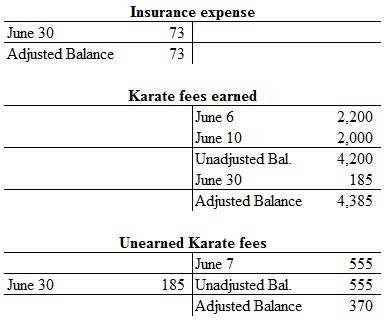

General ledger:

General ledger is a ledger which is used to summarize all the entries of the subsidiary ledger. The general ledger is used to record the correcting, adjusting and closing entries.

Post the transactions in general ledger.

c.

Prepare an unadjusted

c.

Explanation of Solution

Unadjusted trial balance:

Unadjusted trial balance is a statement which contains complete list of accounts with their unadjusted balances, after journal entries are made but before all relevant adjustments have been made. This statement is prepared at the end of every financial period.

Prepare an unadjusted trial balance as of June 30.

| Unadjusted Trial Balance | ||

| Cash | 3,629 | |

| Accounts receivable | 2,400 | |

| Prepaid rent | 3,450 | |

| Prepaid insurance | 876 | |

| Equipment | 2,750 | |

| Accounts payable | 2,000 | |

| Unearned Karate fees | 555 | |

| Common stock | 7,500 | |

| Karate fees earned | 4,200 | |

| Repairs expense | 275 | |

| Advertising expense | 225 | |

| Wages expense | 650 | |

| Totals | 14,255 | 14,255 |

Table (2)

d.

Record the

d.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and

Record the adjusting entries.

| Date | Account title and explanation | Debit | Credit |

| June 30 | 50 | ||

| Accumulated Depreciation -Equipment | 50 | ||

| (To record the depreciation on Equipment) | |||

| June 30 | Utilities expense | 120 | |

| Utilities payable | 120 | ||

| (To record the estimated utilities expense) | |||

| June 30 | Rent expense (3,450/6) | 575 | |

| Prepaid rent | 575 | ||

| (To record the rent expense of the month) | |||

| June 30 | Insurance expense (876/12) | 73 | |

| Prepaid insurance | 73 | ||

| (To record the insurance expense of the month) | |||

| June 30 | Unearned Karate fees | 185 | |

| Karate fees earned | 185 | ||

| (To record the unearned fees earned) |

Table (3)

Post the adjusting entries to the respective accounts.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting for Undergraduates

- Please explain the correct approach for solving this general accounting question.arrow_forwardWhat does the "matching principle" in accounting state? A. Revenues should be matched with expenses incurred to generate those revenuesB. Assets should equal liabilitiesC. All accounts must be balanced at year-endD. Revenue is recognized only when cash is received need helparrow_forwardThe direct manufacturing labor efficiency variance during July is?arrow_forward

- I need help with this general accounting question using standard accounting techniques.arrow_forwardFinancial Accounting Question please answerarrow_forwardShoreham Industries sells its product for $98 per unit. During 2023, it produced 85,000 units and sold 74,000 units (there was no beginning inventory). Costs per unit are: direct materials $24, direct labor $18, and variable overhead $7. Fixed costs are: $1,275,000 manufacturing overhead, and $142,000 selling and administrative expenses. The per-unit manufacturing cost under absorption costing is__.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education