![MindTap Business Statistics for Ragsdale's Spreadsheet Modeling & Decision Analysis, 8th Edition, [Instant Access], 2 terms (12 months)](https://s3.amazonaws.com/compass-isbn-assets/textbook_empty_images/large_textbook_empty.svg)

Concept explainers

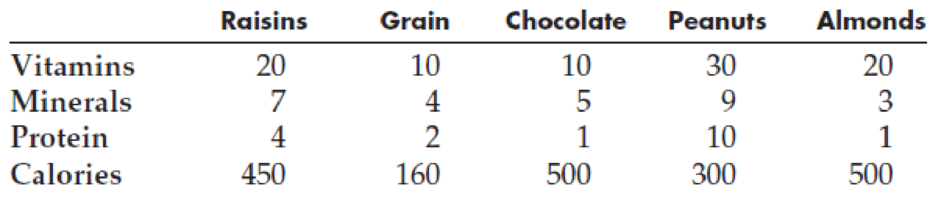

Tuckered Outfitters plans to market a custom brand of packaged trail mix. The ingredients for the trail mix will include Raisins, Grain, Chocolate Chips, Peanuts, and Almonds costing, respectively, $2.50, $1.50, $2.00, $3.50, and $3.00 per pound. The vitamin, mineral, and protein content of each of the ingredients (in grams per pound) is summarized in the following table along with the calories per pound of ingredient:

The company would like to identify the least costly mix of these ingredients that provides at least 40 grams of vitamins, 15 grams of minerals, 10 grams of protein, and 600 calories per two pound package. Additionally, they want each ingredient to account for at least 5% and no more than 50% of the weight of the package.

- a. Formulate a LP model for this problem.

- b. Implement your model in a spreadsheet and solve it.

- c. What is the optimal mix and how much is the total ingredient cost per package?

Trending nowThis is a popular solution!

Chapter 3 Solutions

MindTap Business Statistics for Ragsdale's Spreadsheet Modeling & Decision Analysis, 8th Edition, [Instant Access], 2 terms (12 months)

- Similar to insurance companies, financial institutions such as banks view risk management as critical to the success and viability of their business and have therefore adopted strategies to manage the risks they are exposed to. Explain 5 operational risks and give two examples of such risks faced by management at financial institutions. Discuss the importance of establishing an effective risk management policy at financial institutions to manage operational risks, giving one example of a risk management strategy used by financial institutions to mitigate such risks. What is the role of the Core Principles of Effective Bank Supervision as it relates to operational risks, in the effective management of financial institutions? Give explanationarrow_forwardBased on your Course Project (Organizing a diversity, equity, and inclusion (DEI) awareness month celebration) Explain what contingency planning Based on Organizing a diversity, equity, and inclusion (DEI) awareness month celebration including its broader conversation of risk management?arrow_forwardBias Vulnerability- On which biases were you the most vulnerable? On which ones were you least vulnerable? Did the ambiguity, or pressure to make quick decisions have an impact on the process?arrow_forward

- In each of the four scenarios of OB Simulation, you will be faced with making a key decision. Each scenario also poses a potential decision-making bias. As you navigate the simulation scenarios, consider which decision-making bias may be an issue for each scenario.identify which bias you thought it was as compared to the bias that actually was placed in the simulation. Did you accurately predict the bias?arrow_forwardEvaluate the arguement of Meredith in this case. Are her claims valid? Was she treated fairly ? Evaluate the arguement of the supervisor and manager in this case . Are there claims valid ? Was firing Meredith fair in this case ?arrow_forwardWhat benefits are executive officers entitled and give two references with your answer. What are the advantages and disadvantages of being an executive officer. Give two references with your answer.arrow_forward

- %ro .. ٥٠٢:٤٧ ره < Notes ← 28 December 2024 at 10:54 شاب يتحدث ما تمنيت شئ الا وحصل لي بهذا الدعاء . اللهم يا اكرم الاكرمين ويا ارحم الراحمين بـ من تسجد له الجبال وتسبح بحمده الافواه اسألك بأسمائك الحسنى وبصفاتك العظمى الذي اذا سألت بها اجبت اذكر حاجتك). ١٥ ألف + ... متابعة mokrane_hamza A ng Humming Nasheed . + من الاكسبلور فولو ( يتابعه 18_les_jijeliensarrow_forwardBased on your Course Project (Organizing a diversity, equity, and inclusion (DEI) awareness month celebration) Explain what uncertainty outcome would be best suited to manage risks effectively for the project you chose. Remember, choosing an outcome as it relates to uncertainty is dependent on different variables, such as the industry, environment, culture, and so forth. (Use Table 2-10. Checking Outcomes - Uncertainty Performance Domain to review the different outcomes.)arrow_forwardWhy is Program management more involved than project management as it requires oversee multiple related projects to achieve strategic objectives?arrow_forward

- why not? What did you learn this semester? Anything you think should be added or changed as far as the curriculumarrow_forwardDefine what is an Executive officer and give reference with your answer. What are the roles and responsibilities of an Executive Officer and give one reference with your answer. Describe the qualifications needed to become an Executive officer and give one reference with your answer.arrow_forwardIdentify and explain the legal and regulatory frameworks governing companies in your jurisdiction. Provide examples of compliance and non-compliance cases, assessing their outcomes. Suggest best practices for ensuring compliance.arrow_forward

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,- MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning