1.

Identify the amounts for assets, liabilities, and

1.

Explanation of Solution

Identify the amount:

| Assets | = | Liabilities | + | Stockholders’ Equity |

| 3,200 | 2,400 | 800 | ||

| 8,000 | 5,600 | 4,000 | ||

| 6,400 | 1,600 | 3,200 | ||

| $17,600 | = | $9,600 | + | $8,000 |

Table (1)

Note:

- Assets include cash,

accounts receivable , and long-term investments. - Liabilities include accounts payable, unearned revenue, and long-term note payable.

- Stockholders’ equity includes common stock, additional paid-in capital, and

retained earnings .

2.

Prepare the T- account and enter the amount for the given transaction in their respective accounts.

2.

Explanation of Solution

Prepare the T-accounts:

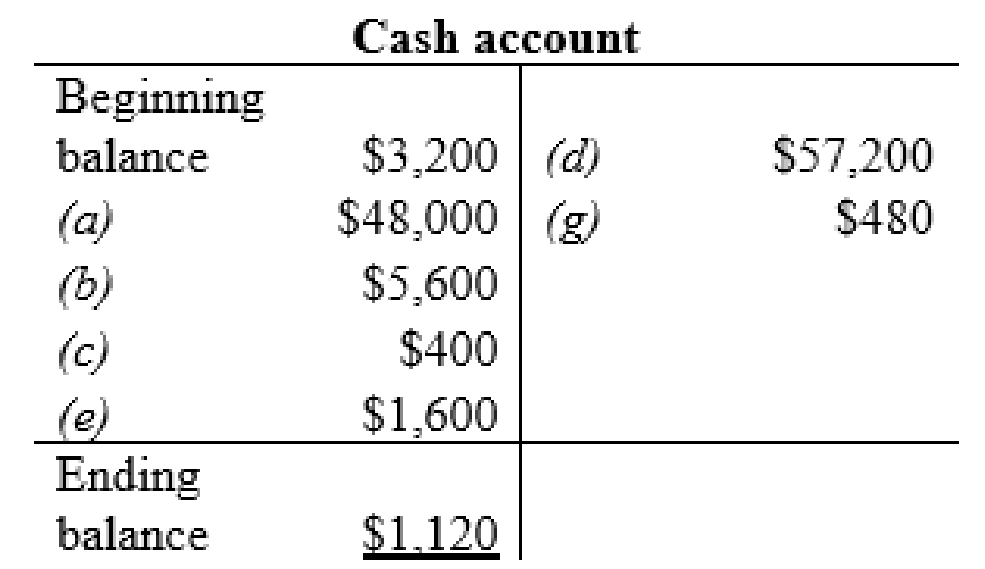

Cash account:

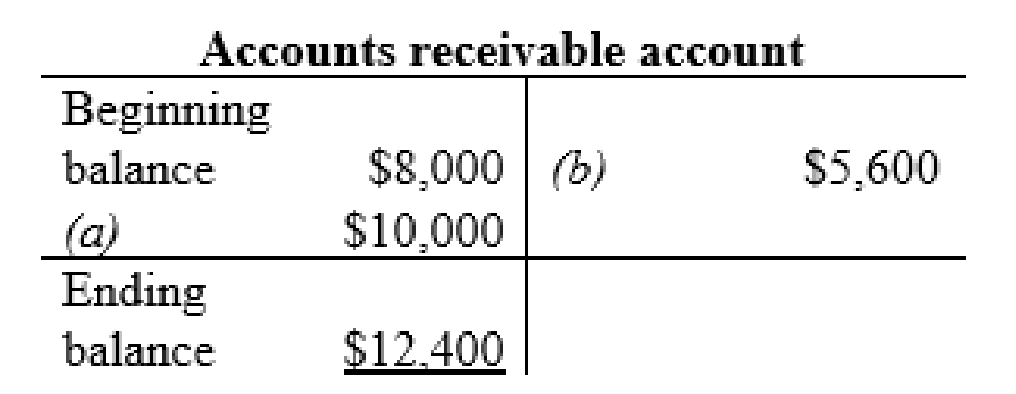

Accounts receivable account:

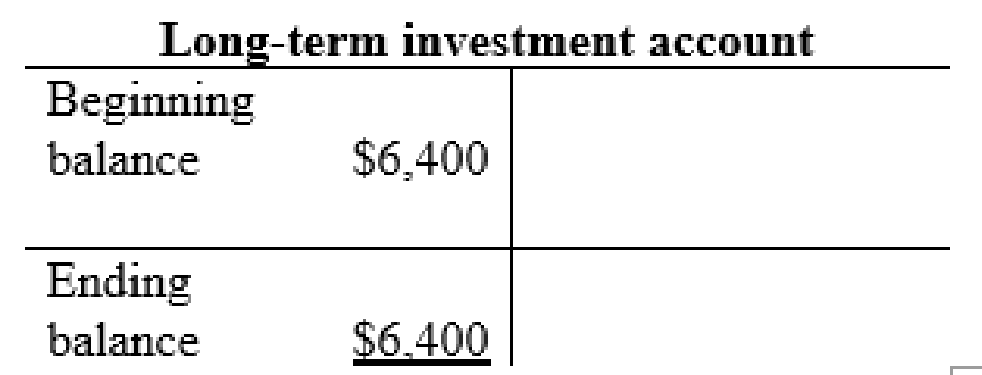

Long-term investment account:

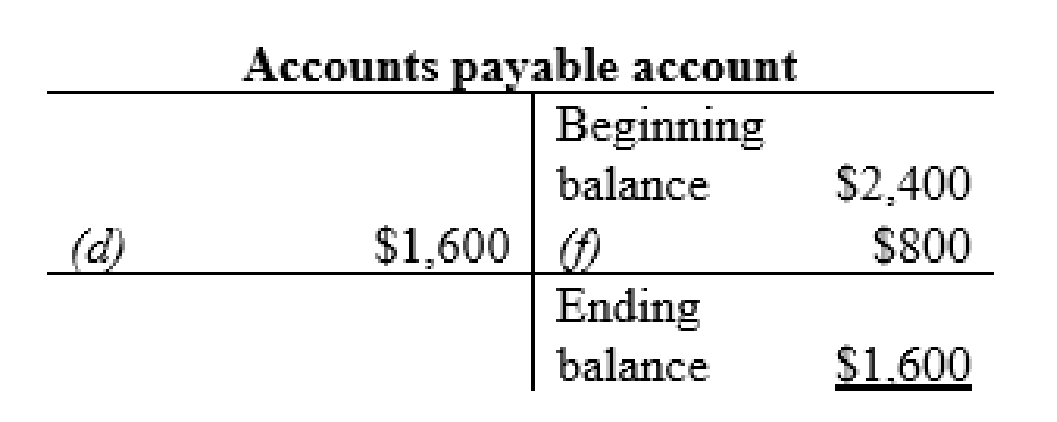

Accounts payable account:

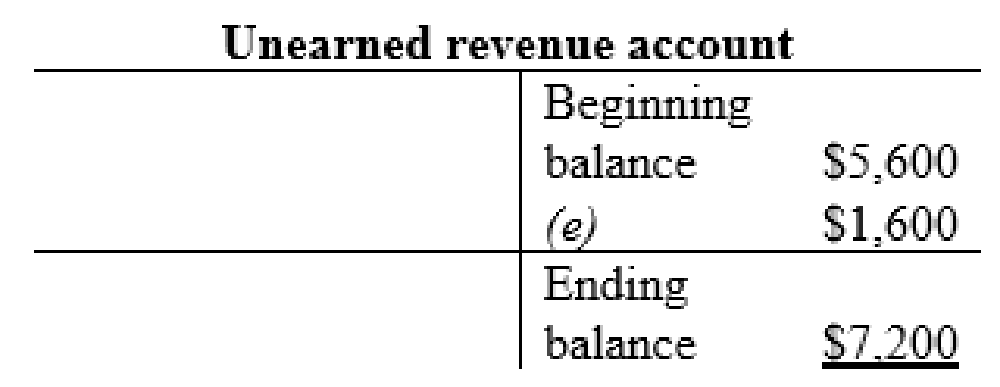

Unearned revenue account:

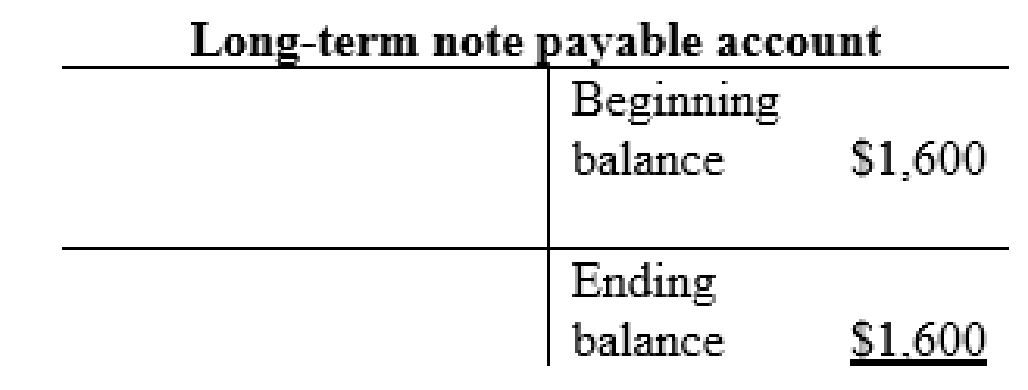

Long-term note payable account:

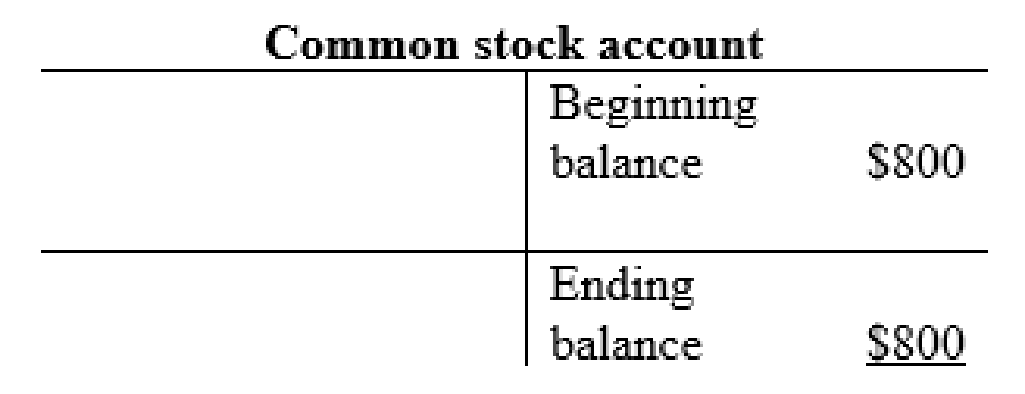

Common stock account:

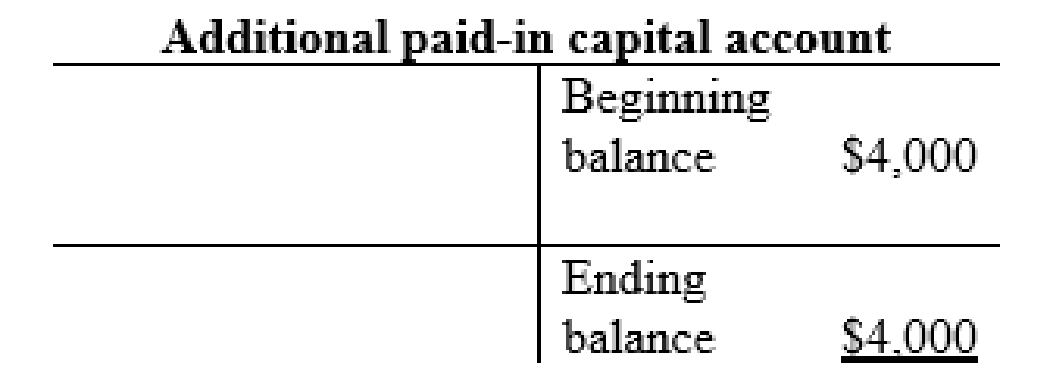

Additional paid-in capital account:

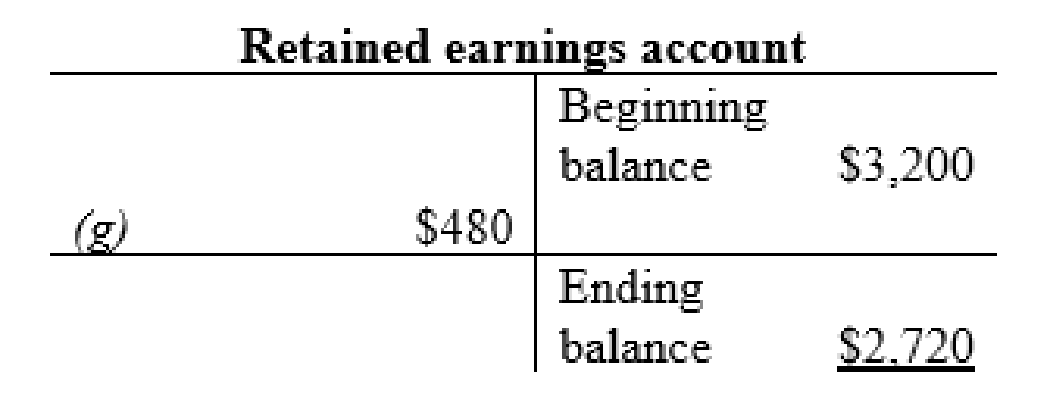

Retained earnings account:

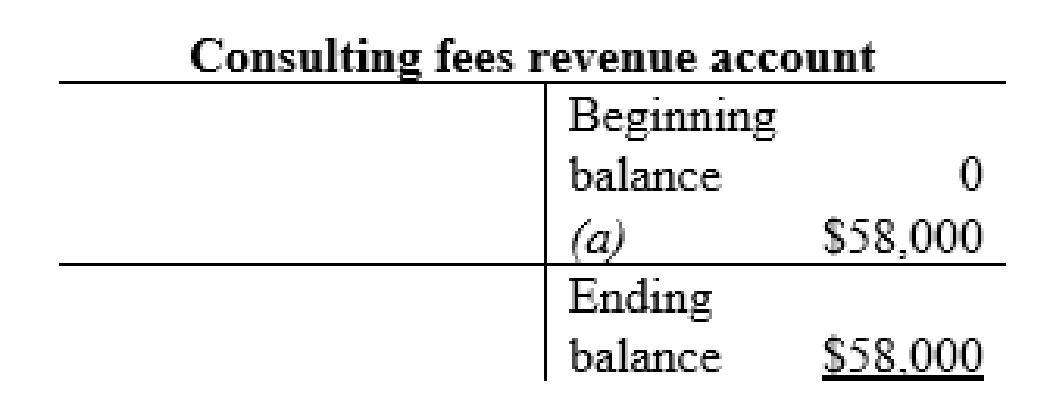

Consulting fees revenue account:

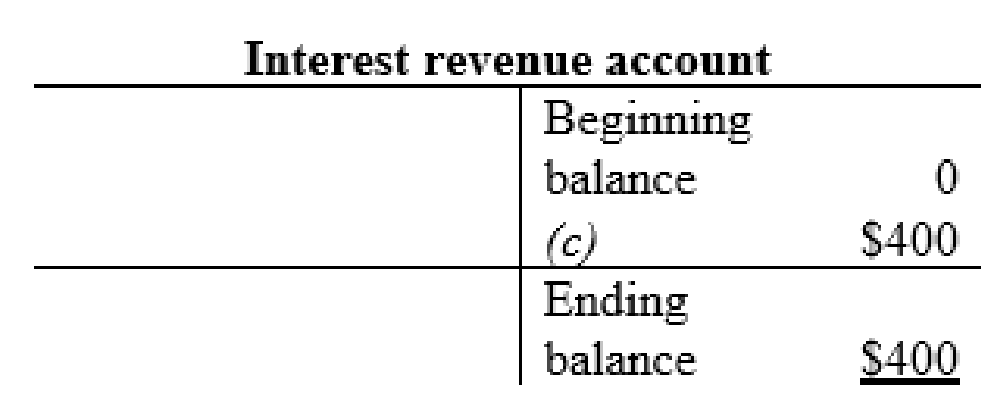

Interest revenue account:

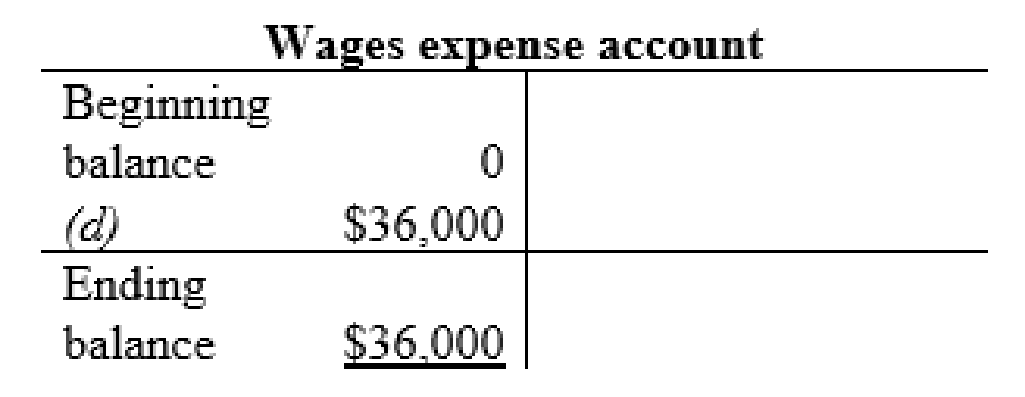

Wages expense account:

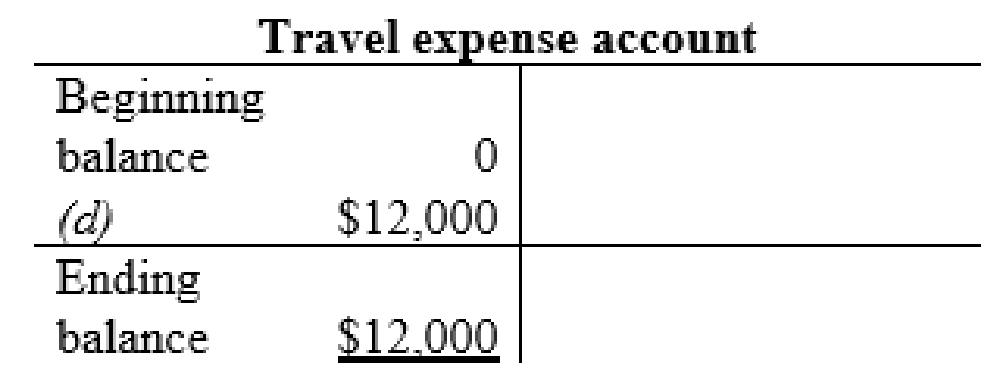

Travel expense account:

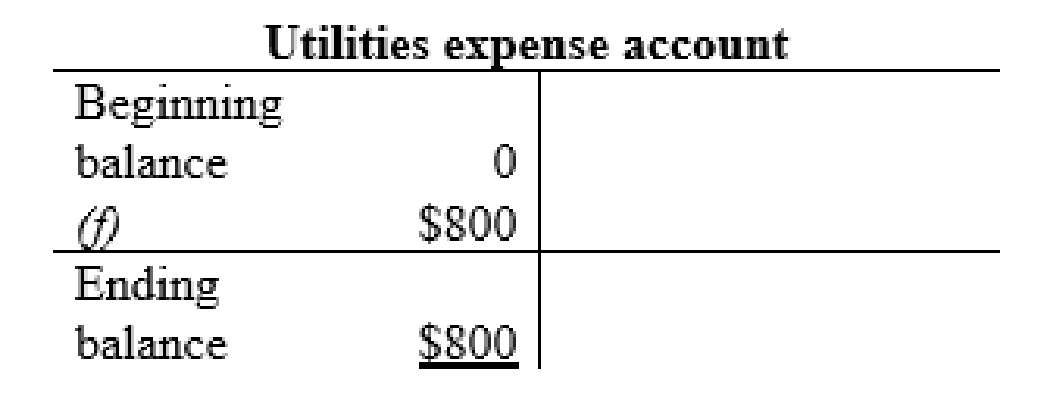

Utilities expense account:

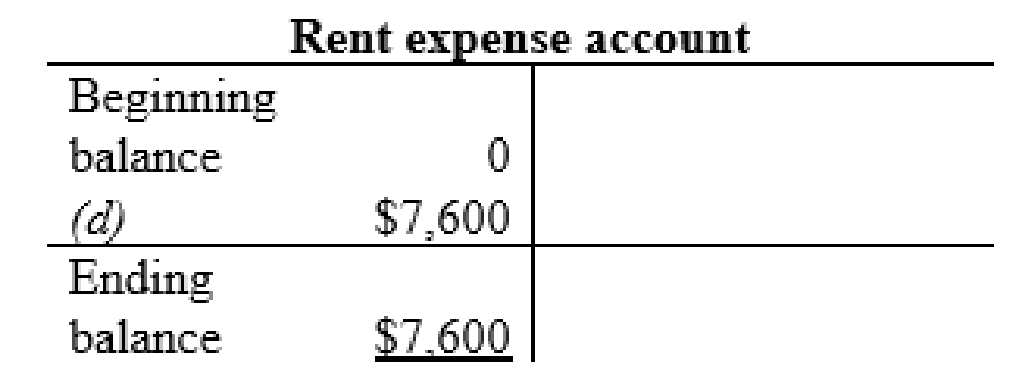

Rent expense account:

Thus, the t-accounts are prepared and the ending balances are calculated.

3.

Ascertain the amount for the given equations at the end of the December.

3.

Explanation of Solution

For the equation

For the equation

Working note (1):

Calculate the revenues:

Working note (2):

Calculate the expenses:

Calculate the net income:

| Particulars | Amount ($) | Amount ($) |

| Revenues |

| |

| Less: Expenses |

| |

| Net income | $2,00 |

Table (2)

Calculate the amount for the accounting equation:

| Assets | = | Liabilities | + | Stockholders’ Equity |

| $1,120 | $1,600 | $800 | ||

| $12,400 | $7,200 | $4,000 | ||

| $6,400 | $1,600 | $2,720 | ||

| $2,000 | ||||

| $19,920 | = | $10,400 | + | $9,250 |

Table (3)

4.

Calculate the net profit margin ratio for 2019.

4.

Explanation of Solution

Net profit margin ratio can be calculated by using the following formula:

Calculate the net profit margin ratio for 2019:

Hence, the net profit margin ratio for the year 2019 is 3.45%.

- By computing the net profit margin ratio, Company KK net profit margin ratio is 3.45%. This indicates that there is an increase in the net profit margin ratio.

- Company KK has become effective in managing its sales and the expenses.

Want to see more full solutions like this?

Chapter 3 Solutions

INTRO TO FIN ACCT (LL W/ ACCESS-1 SMSTR

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education