1.

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

1.

Explanation of Solution

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

Step 1: Calculate the annual salary of Employee LR, Employee RB and Employee GL.

| Employee | Monthly salary (A) | Annual salary (A×12months) |

| Employee LR | $6,240 per month | $74,880.00 |

| Employee RB | $4,680 per month | $56,160.00 |

| Employee GL | $4,900 per month | $58,800.00 |

Table (1)

Step 2: Calculate the regular earnings of each employees.

| Employee | Annual salary (A) | Regular Weekly earnings |

| Employee MA | $97,240 | $1,870.00 |

| Employee BC | $91,000 | $1,750.00 |

| Employee LR | $74,880 | $1,440.00 |

| Employee RB | $56,160 | $1,080.00 |

| Employee GL | $58,800 | $1,130.77 |

| Total | $378,080 | $7,270.77 |

Table (2)

Thus, the total regular earnings for the weekly payroll ended December 13, 2019 is $7,270.77

2.

Calculate the overtime earnings if any applicable to any employee.

2.

Explanation of Solution

Calculate the overtime earnings for Employee GL.

| Employee | Weekly earnings (A) | Regular hourly rate (B) |

Overtime hourly rate (C) |

Overtime earnings (D) |

| Employee GL | $1,130.77 | $28.27 | $42.40 | $339.23 |

Table (3)

Thus, the overtime earnings for Employee GL is $339.23.

3.

Calculate the total regular, overtime earnings and bonus.

3.

Explanation of Solution

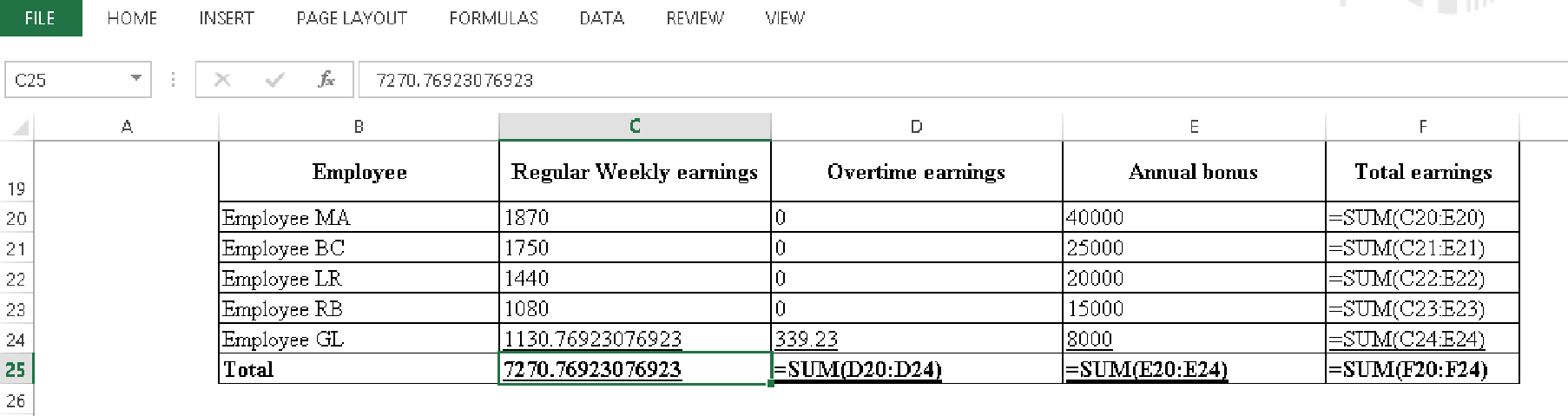

Calculate the total regular, overtime earnings and bonus.

| Employee | Regular Weekly earnings | Overtime earnings | Annual bonus | Total earnings |

| Employee MA | $1,870.00 | $0.00 | $40,000 | $41,870.00 |

| Employee BC | $1,750.00 | $0.00 | $25,000 | $26,750.00 |

| Employee LR | $1,440.00 | $0.00 | $20,000 | $21,440.00 |

| Employee RB | $1,080.00 | $0.00 | $15,000 | $16,080.00 |

| Employee GL | $1,130.77 | $339.23 | $8,000 | $9,470.00 |

| Total | $7,270.77 | $339.23 | $108,000 | $115,610.00 |

Table (4)

Calculation for total regular, overtime earnings and bonus is as follows.

Table (5)

4 and 5.

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

4 and 5.

Explanation of Solution

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

| Cumulative earnings as of Last Pay Period | FICA Taxable Wages This Pay Period | FICA Taxes to be Withheld | Employees | ||

| OASDI (A) | HI (B) | OASDI | HI | ||

| $91,630 | $36,770.00 | $41,870 | $2,279.74 | $607.12 | Employee MA |

| $85,750 | $26,750.00 | $26,750 | $1,658.50 | $387.88 | Employee BC |

| $70,560 | $21,440.00 | $21,440 | $1,329.28 | $310.88 | Employee LR |

| $52,920 | $16,080.00 | $16,080 | $996.96 | $233.16 | Employee RB |

| $34,890 | $9,470.00 | $9,470 | $587.14 | $137.32 | Employee GL |

| $110,510.00 | $115,610.00 | $6,851.62 | $1,676.35 | Totals | |

Table (6)

Note: Employee MA’s earnings is exceeding the taxable wage limit of $128,400. Thus, the $5,100

Step 3: Calculate the employer’s portion of the FICA taxes for the week ended.

Calculate the OASDI taxes.

Calculate the HI taxes.

Calculate the total FICA taxes.

Want to see more full solutions like this?

Chapter 3 Solutions

Payroll Accounting

- I need assistance with this general accounting question using appropriate principles.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardPlease show me how to solve this financial accounting problem using valid calculation techniques.arrow_forward

- What was the cost of goods sold for Year 1arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardDuring June, the production department of a process operations system completed and transferred to finished goods a total of 82,000 units of product. At the end of May, 18,000 additional units were in process in the production department and were 70% complete with respect to materials. The beginning inventory included a materials cost of $92,400 and the production department incurred a direct materials cost of $276,800 during June. Compute the direct materials cost per equivalent unit for the department using the weighted-average method.arrow_forward

- Mistral Inc. reported $85,000 in net profit for the year using absorption costing. The company had no units in beginning inventory, planned and actual production was24,000 units and sales were 20,500 units during the year. Variable manufacturing costs were $25 per unit and total budgeted fixed manufacturing overhead was $120,000. There was no underapplied or overapplied overhead reported during the year. Determine the net profit under variable costing.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardHow much would profit increase if 14 more platters were sold?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning