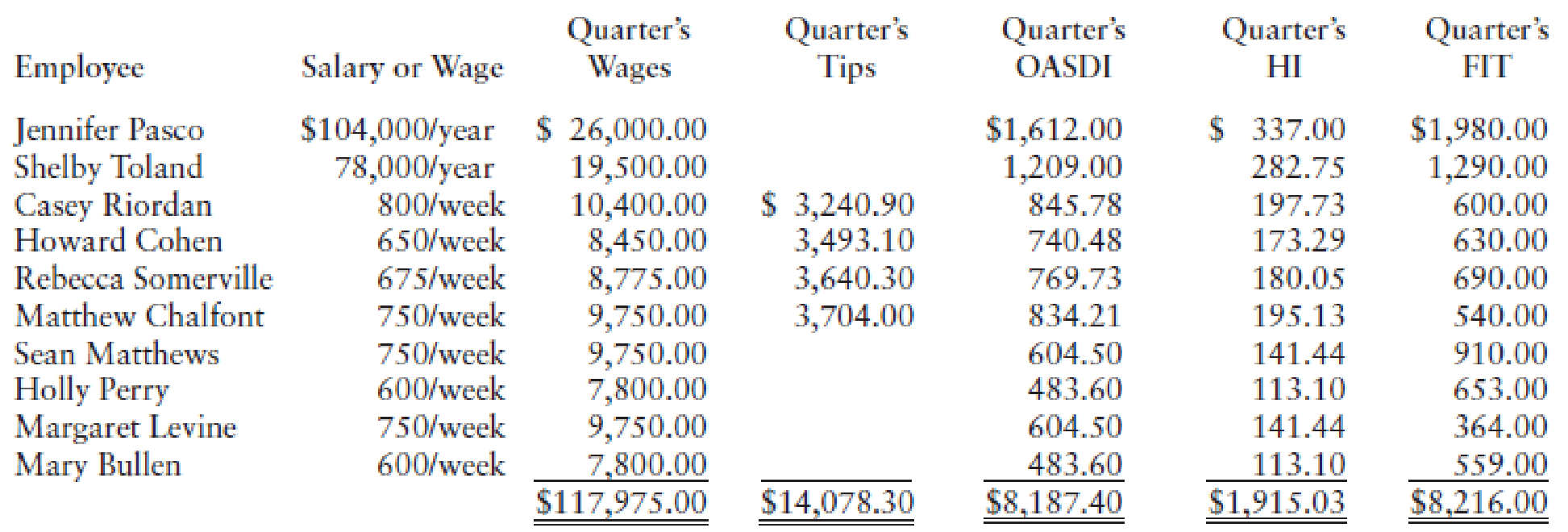

During the third calendar quarter of 20--, the Beechtree Inn, owned by Dawn Smedley, employed the persons listed below. Also given are the employees’ salaries or wages and the amount of tips reported to the owner. The tips were reported by the 10th of each month. The federal income tax and FICA tax to be withheld from the tips were estimated by the owner and withheld equally over the 13 weekly pay periods. The employer’s portion of FICA tax on the tips was estimated as the same amount.

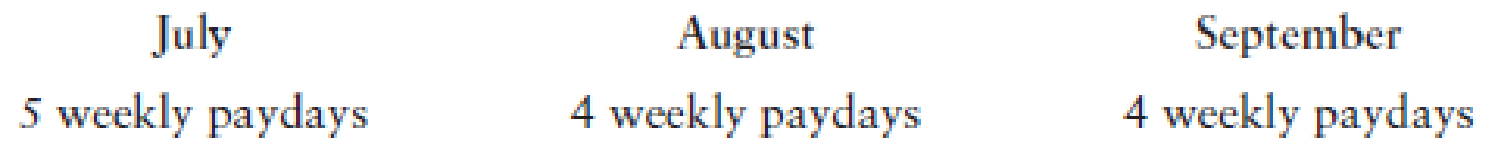

Employees are paid weekly on Friday. The following paydays occurred during this quarter:

Taxes withheld for the 13 paydays in the third quarter follow:

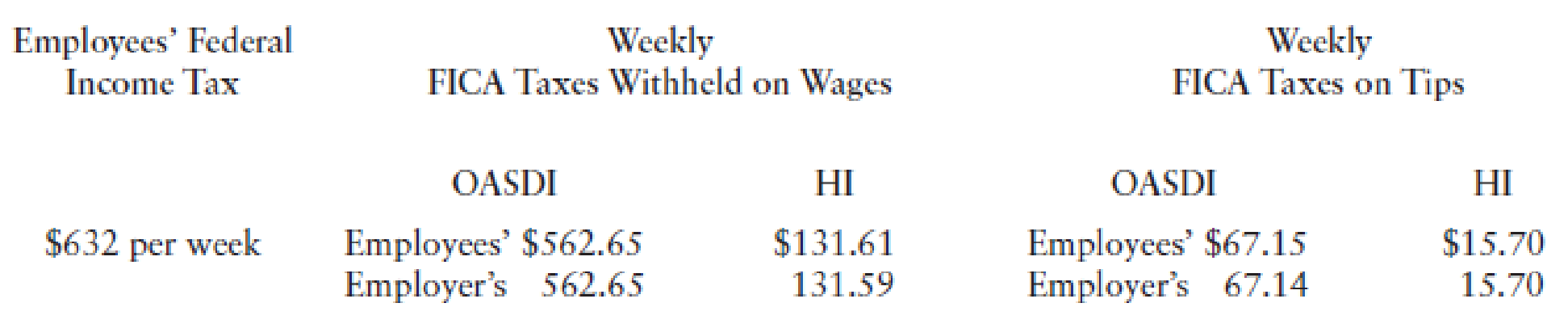

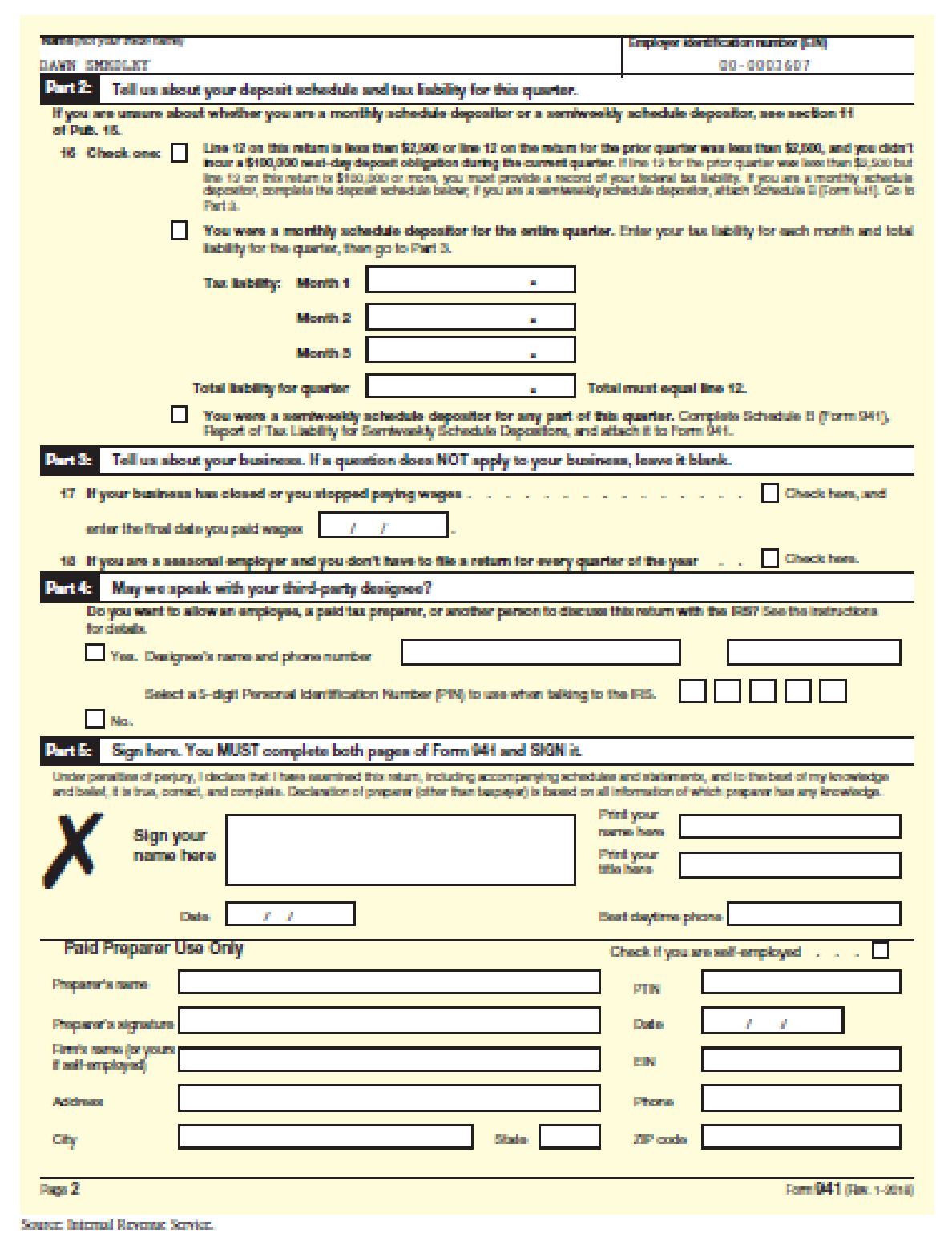

Based on the information given, complete Form 941 on the following pages for Dawn Smedley.

Phone number: (901) 555-7959

Date filed: October 31, 20--

Trending nowThis is a popular solution!

Chapter 3 Solutions

Payroll Accounting

- I need assistance with this general accounting question using appropriate principles.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardAn accrued expense:A. Has been paid but not incurredB. Has been incurred but not yet paidC. Is recorded when paidD. Is a non-cash transaction I need soluarrow_forward

- An accrued expense:A. Has been paid but not incurredB. Has been incurred but not yet paidC. Is recorded when paidD. Is a non-cash transaction need helparrow_forwardAn accrued expense:A. Has been paid but not incurredB. Has been incurred but not yet paidC. Is recorded when paidD. Is a non-cash transactionarrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- Can you help me solve this general accounting problem with the correct methodology?arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardNo Ai 7. Which account is not closed at the end of the accounting period?A. SalesB. Rent ExpenseC. DividendsD. Retained Earningsarrow_forward

- 7. Which account is not closed at the end of the accounting period?A. SalesB. Rent ExpenseC. DividendsD. Retained Earnings need helparrow_forwardWhich account is not closed at the end of the accounting period?A. SalesB. Rent ExpenseC. DividendsD. Retained Earningsarrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning