Concept explainers

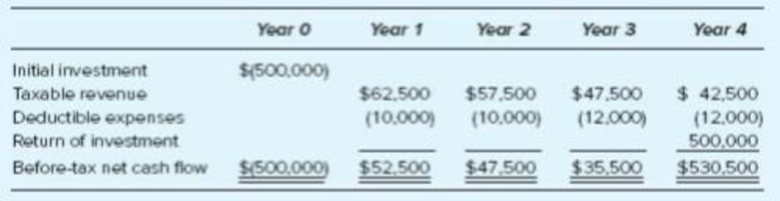

Investor W has the opportunity to invest $500,000 in a new venture. The projected

Investor W uses a 7 percent discount rate to compute

- a. Her marginal tax rate over the life of the investment is 15 percent.

- b. Her marginal tax rate over the life of the investment is 20 percent.

- c. Her marginal tax rate in years 1 and 2 is 10 percent and in years 3 and 4 is 25 percent.

a.

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Explanation of Solution

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Step 1: Calculate present value.

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

| Before-tax cash flow | $(500,000) | $52,500 | $47,500 | $35,500 | $530,500 |

| Less: Tax cost | - | $(7,875) | $(7,125) | $(5,325) | $(4,575) |

| After-tax cash flow | - | $44,625 | $40,375 | $30,175 | $525,925 |

| Multiply: Discount factor at 7% | - | ||||

| Present value | $(500,000) | $41,724 | $35,247 | $24,623 | $401,281 |

Working note:

Calculate tax cost.

| Year 1 | Year 2 | Year 3 | Year 4 | |

| Taxable income | $52,500 | $47,500 | $35,500 | $30,500 |

| Multiply: Marginal tax rate | ||||

| Tax cost | $7,875 | $7,125 | $5,325 | $4,575 |

Step 2: Calculate NPV.

The value of net present value (NPV) is positive. Hence, Investor W should make the investment.

b.

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Explanation of Solution

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Step 1: Calculate present value.

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

| Before-tax cash flow | $(500,000) | $52,500 | $47,500 | $35,500 | $530,500 |

| Less: Tax cost | - | $(10,500) | $(9,500) | $(7,100) | $(6,100) |

| After-tax cash flow | - | $42,000 | $38,000 | $28,400 | $524,400 |

| Multiply: Discount factor at 7% | - | ||||

| Present value | $(500,000) | $39,270 | $33,174 | $23,174 | $400,117 |

Working note:

Calculate tax cost.

| Year 1 | Year 2 | Year 3 | Year 4 | |

| Taxable income | $52,500 | $47,500 | $35,500 | $30,500 |

| Multiply: Marginal tax rate | ||||

| Tax cost | $10,500 | $9,500 | $7,100 | $6,100 |

Step 2: Calculate NPV.

The value of net present value (NPV) is negative. Hence, Investor W should not make the investment.

c.

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Explanation of Solution

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Step 1: Calculate present value.

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

| Before-tax cash flow | $(500,000) | $52,500 | $47,500 | $35,500 | $530,500 |

| Less: Tax cost | - | $(5,250) | $(4,750) | $(8,875) | $(7,625) |

| After-tax cash flow | - | $47,250 | $42,750 | $26,625 | $522,875 |

| Multiply: Discount factor at 7% | - | ||||

| Present value | $(500,000) | $44,179 | $37,321 | $21,726 | $398,954 |

Working note:

Calculate tax cost.

| Year 1 | Year 2 | Year 3 | Year 4 | |

| Taxable income | $52,500 | $47,500 | $35,500 | $30,500 |

| Multiply: Marginal tax rate | ||||

| Tax cost | $5,250 | $4,750 | $8,875 | $7,625 |

Step 2: Calculate NPV.

The value of net present value (NPV) is positive. Hence, Investor W should make the investment.

Want to see more full solutions like this?

Chapter 3 Solutions

PRINCIPLES OF TAXATION F/BUS...(LL)

- ?? Financial accountingarrow_forwardA firm has a market value equal to its book value. Currently, the firm has excess cash of $1,000, other assets of $5,500, and equity of $6,500. The firm has 650 shares of stock outstanding and a net income of $600. The firm has decided to spend half of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed? a. 625 shares b. 640 shares c. 600 shares d. 630 shares e. 615 sharesarrow_forwardProvide correct answer general accounting questionarrow_forward

- answer plzarrow_forwardThe controller of Afton Manufacturing has collected the following monthly expense data for use in analyzing the cost behavior of maintenance costs: ⚫ January: $2,800 and 3,500 machine hours • February: $3,200 and 4,200 machine hours ⚫ March: $3,800 and 6,000 machine hours ⚫ April: $4,500 and 7,500 machine hours • May: $3,600 and 5,200 machine hours • June: $5,200 and 7,000 machine hours Using the high-low method, determine the estimated fixed cost element and the variable cost per unit of machine hour.arrow_forwardSubject general accountingarrow_forward

- Financial accountingarrow_forwardDelta Corp. had the following data last year: • Net income = $1,200 • Net operating profit after taxes (NOPAT) = $1,100 • Total assets = $4,500 Total operating capital = $3,500 For the just-completed year, Delta Corp. reported: • Net income = $1,500 • NOPAT = $1,375 • Total assets = $3,800 Total operating capital = $3,900 How much free cash flow (FCF) did Delta generate during the just-completed year?arrow_forwardSlotnick Chemical received $380,000 from customers as deposits on returnable containers during 2024. Fifteen percent of the containers were not returned. The deposits are based on the container cost marked up 25%. How much profit did Slotnick realize on the forfeited deposits? Note: Do not round intermediate calculations. Multiple Choice $11,400 $0 $14,250 $57,000arrow_forward