Concept explainers

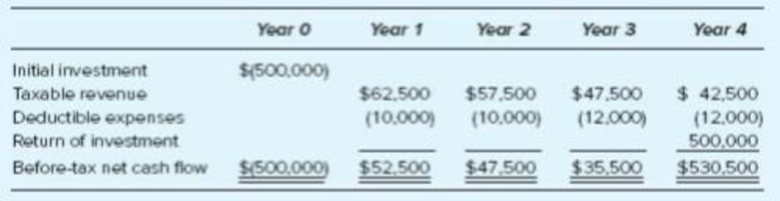

Investor W has the opportunity to invest $500,000 in a new venture. The projected

Investor W uses a 7 percent discount rate to compute

- a. Her marginal tax rate over the life of the investment is 15 percent.

- b. Her marginal tax rate over the life of the investment is 20 percent.

- c. Her marginal tax rate in years 1 and 2 is 10 percent and in years 3 and 4 is 25 percent.

a.

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Explanation of Solution

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Step 1: Calculate present value.

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

| Before-tax cash flow | $(500,000) | $52,500 | $47,500 | $35,500 | $530,500 |

| Less: Tax cost | - | $(7,875) | $(7,125) | $(5,325) | $(4,575) |

| After-tax cash flow | - | $44,625 | $40,375 | $30,175 | $525,925 |

| Multiply: Discount factor at 7% | - | ||||

| Present value | $(500,000) | $41,724 | $35,247 | $24,623 | $401,281 |

Working note:

Calculate tax cost.

| Year 1 | Year 2 | Year 3 | Year 4 | |

| Taxable income | $52,500 | $47,500 | $35,500 | $30,500 |

| Multiply: Marginal tax rate | ||||

| Tax cost | $7,875 | $7,125 | $5,325 | $4,575 |

Step 2: Calculate NPV.

The value of net present value (NPV) is positive. Hence, Investor W should make the investment.

b.

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Explanation of Solution

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Step 1: Calculate present value.

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

| Before-tax cash flow | $(500,000) | $52,500 | $47,500 | $35,500 | $530,500 |

| Less: Tax cost | - | $(10,500) | $(9,500) | $(7,100) | $(6,100) |

| After-tax cash flow | - | $42,000 | $38,000 | $28,400 | $524,400 |

| Multiply: Discount factor at 7% | - | ||||

| Present value | $(500,000) | $39,270 | $33,174 | $23,174 | $400,117 |

Working note:

Calculate tax cost.

| Year 1 | Year 2 | Year 3 | Year 4 | |

| Taxable income | $52,500 | $47,500 | $35,500 | $30,500 |

| Multiply: Marginal tax rate | ||||

| Tax cost | $10,500 | $9,500 | $7,100 | $6,100 |

Step 2: Calculate NPV.

The value of net present value (NPV) is negative. Hence, Investor W should not make the investment.

c.

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Explanation of Solution

Calculate net present value (NPV) and identify whether Investor W should make the investment or not.

Step 1: Calculate present value.

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | |

| Before-tax cash flow | $(500,000) | $52,500 | $47,500 | $35,500 | $530,500 |

| Less: Tax cost | - | $(5,250) | $(4,750) | $(8,875) | $(7,625) |

| After-tax cash flow | - | $47,250 | $42,750 | $26,625 | $522,875 |

| Multiply: Discount factor at 7% | - | ||||

| Present value | $(500,000) | $44,179 | $37,321 | $21,726 | $398,954 |

Working note:

Calculate tax cost.

| Year 1 | Year 2 | Year 3 | Year 4 | |

| Taxable income | $52,500 | $47,500 | $35,500 | $30,500 |

| Multiply: Marginal tax rate | ||||

| Tax cost | $5,250 | $4,750 | $8,875 | $7,625 |

Step 2: Calculate NPV.

The value of net present value (NPV) is positive. Hence, Investor W should make the investment.

Want to see more full solutions like this?

Chapter 3 Solutions

Principles Of Taxation For Business And Investment Planning 2020 Edition