Fundamentals of Financial Management, Concise Edition

9th Edition

ISBN: 9781337087544

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 16P

FINANCIAL STATEMENTS The Davidson Corporation's

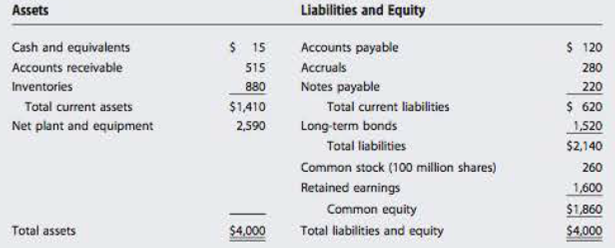

Davidson Corporation: Balance Sheet as of December 31, 2016 (Millions of Dollars)

Davidson Corporation: Income Statement for Year Ending December 31, 2016 (Millions of Dollare)

| Sales | $6.250 |

| Operating costs excluding |

5.230 |

| EBITDA | $1.000 |

| Depreciation & amortization | 2.20 |

| EBIT | $ 800 |

| Interest | 180 |

| EBT | $ 620 |

| Taxes (40%) | 248 |

| Net income | $ 372 |

| Common dividends paid | $ 146 |

| Earnings per share | $ 3,72 |

- a. Construct the statement of

stockholders equity for December 31, 2016. No common stock was issued during 2016. - b. How much money has been reinvested in the firm over the years?

- c. At the present time, how large a check could be written without it bouncing?

- d. How much money must be paid to current creditors within the next year?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the origin of Biblical ethics and how researchers can demonstrate Biblical ethics?

How researchers can demonstrate Biblical ethics when conducting a literaturereview?

How researchers can demonstrate Biblical ethics when communicating with aresearch team or university committee?

Equipment is worth $339,976. It is expected to produce regular cash flows of $50,424 per year for 18 years and a special cash flow of

$75,500 in 18 years. The cost of capital is X percent per year and the first regular cash flow will be produced today. What is X?

Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do

not enter 0986 or 9.86%). Round your answer to at least 2 decimal places.

percent

You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver

Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment

to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent

per month. Your first payment to Pond Leisure would be in 1 month. What is X?

Input instructions: Round your answer to at least 2 decimal places.

Chapter 3 Solutions

Fundamentals of Financial Management, Concise Edition

Ch. 3 - Prob. 1QCh. 3 - Who are some of the basic users of financial...Ch. 3 - If a typical firm reports 20 million of retained...Ch. 3 - Explain the following statement: Although the...Ch. 3 - Prob. 5QCh. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Prob. 8QCh. 3 - How are managements actions incorporated in EVA...Ch. 3 - Explain the following statement: Our tax rates are...

Ch. 3 - Prob. 11QCh. 3 - How does the deductibility of interest and...Ch. 3 - BALANCE SHEET The assets of Dallas Associates...Ch. 3 - INCOME STATEMENT Byron Books Inc recently reported...Ch. 3 - INCOME STATEMENT Patterson Brothers recently...Ch. 3 - STATEMENT OF STOCKHOLDERS EQUITY In its most...Ch. 3 - MVA Harper Industries has 900 million of common...Ch. 3 - Prob. 6PCh. 3 - EVA Barton Industries has operating income for the...Ch. 3 - PERSONAL TAXES Susan and Stan Britton are a...Ch. 3 - BALANCE SHEET Which of the following actions are...Ch. 3 - STATEMENT OF STOCKHOLDERS EQUITY Electronics World...Ch. 3 - EVA For 2016, Gourmet Kitchen Products reported 22...Ch. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - FREE CASH FLOW Arlington Corporations financial...Ch. 3 - INCOME STATEMENT Edmonds Industries is...Ch. 3 - FINANCIAL STATEMENTS The Davidson Corporation's...Ch. 3 - Prob. 17PCh. 3 - Prob. 18PCh. 3 - FINANCIAL STATEMENTS, CASH FLOW, AND TAXES Laiho...Ch. 3 - Prob. 20ICCh. 3 - Prob. 1DQCh. 3 - Prob. 2DQCh. 3 - Prob. 3DQCh. 3 - Prob. 4DQCh. 3 - Prob. 5DQ

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 4 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per month. Your first payment to River Media would be in 1 month. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forwardYou plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. SAarrow_forward

- 69 You plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forwardYou plan to retire in 7 years with $X. You plan to withdraw $54,100 per year for 15 years. The expected return is 13.19 percent per year and the first regular withdrawal is expected in 7 years. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Orange Furniture would let you make quarterly payments of $12,540 for 6 years at an interest rate of 1.26 percent per quarter. Your first payment to Orange Furniture would be in 3 months. River Furniture would let you make X monthly payments of $41,035 at an interest rate of 0.73 percent per month. Your first payment to River Furniture would be today. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

- Let y(t) represent your retirement account balance, in dollars, after t years. Each year the account earns 7% interest, and you deposit 8% of your annual income. Your current annual income is $34000, but it is growing at a continuous rate of 2% per year. Write the differential equation modeling this situation. dy dtarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Research would let you make quarterly payments of $9,130 for 3 years at an interest rate of 3.27 percent per quarter. Your first payment to Silver Research would be today. Island Research would let you make monthly payments of $3,068 for 3 years at an interest rate of X percent per month. Your first payment to Island Research would be in 1 month. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Orange Technology would let you make quarterly payments of $13,650 for 8 years at an interest rate of 1.93 percent per quarter. Your first payment to Orange Technology would be in 3 months. Island Technology would let you make monthly payments of $7,976 for 4 years at an interest rate of X percent per month. Your first payment to Island Technology would be today. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

- Says my answer is wrongarrow_forwardEquipment is worth $339,976. It is expected to produce regular cash flows of $50,424 per year for 18 years and a special cash flow of $75,500 in 18 years. The cost of capital is X percent per year and the first regular cash flow will be produced today. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. $ 523472 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License