Concept explainers

NET INCOME AND CHANGE IN OWNER’S EQUITY Refer to the

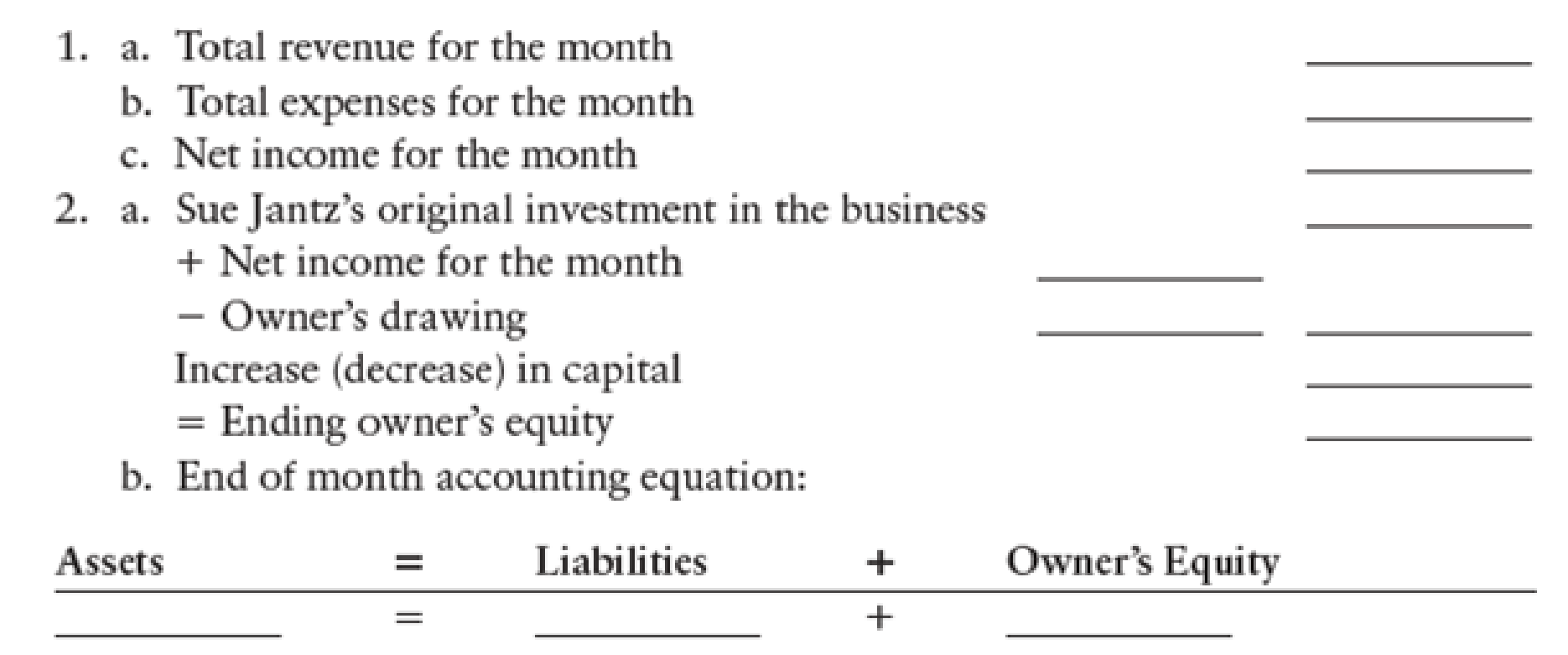

1. a

Determine the total revenue for the month of August.

Explanation of Solution

Revenue is known as “Top line” because it appears very top on the income statement of the company. It is used to imply profits or net income (bottom line) of the company by subtracting the total expenses from total revenues.

Determine the total revenue for the month of August:

Hence, the total revenue for the month of August is $9,800.

1.b

Determine the total expenses for the month of August.

Explanation of Solution

Expense is the cost borne by a company to produce and sell the goods and services to the customers. This involves outflow of cash by making a payment for an individual or company for a particular item and service.

Determine the total expenses for the month of August:

Hence, the total expense for the month of August is $3,300.

1.c

Determine the net income for the month of August.

Explanation of Solution

Net income: The bottom line of income statement which is the result of excess of earnings from operations (revenues) over the costs incurred for earning revenues (expenses) is referred to as net income.

Determine the net income for the month of August:

Hence, the net income for the month of August is $6,500.

2.a

Determine the amount of ending owner’s equity.

Explanation of Solution

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and a drawing is deducted from beginning owner’s equity to arrive at the result, ending owner’s equity.

Determine the amount of ending owner’s equity:

| J Plumbing Repair | ||

| Statement of Owner’s Equity | ||

| For Month Ended August 31, 20-- | ||

| Particulars | Amount ($) | Amount ($) |

| Invested cash in the business | 30,000 | |

| Add: Net income for August | 6,500 | |

| Less: Withdrawals for August | (3,000) | |

| Increase in capital | 3,500 | |

| Ending owner’s equity | $33,500 | |

Table (1)

2.b

Show the accounting equation for the end of month.

Explanation of Solution

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relation between resources or assets of a company and claims of resources to creditors and owners. Accounting equation is expressed as shown below:

Show the accounting equation for the end of month:

Working note:

Calculate the amount of assets:

Want to see more full solutions like this?

Chapter 3 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 23rd + Cengagenowv2, 2 Terms Printed Access Card

- Need help with this general accounting questionarrow_forwardPLEASE HELP ME WITH THISarrow_forwardThis is an individual assignment. You are required to create a formal topic-to-sentence outline and a full five-paragraph essay [containing an introductory paragraph, 3 body paragraphs and a concluding paragraph], followed by an appropriate Works Cited list, and an annotated bibliography of one source used in the essay. Your essay must be based on ONE of the following prompts. EITHER A. What are the qualities of a socially responsible individual? OR B. Discuss three main groupings of life skills required by Twenty-first Century employers. Additionally, you will state which one of the expository methods [Analysis by Division OR Classification] you chose to guide development of your response to the question selected, and then provide a two or three sentence justification of that chosen method. Your essay SHOULD NOT BE LESS THAN 500 words and SHOULD NOT EXCEED 700 words. You are required to use three or four scholarly / reliable sources of evidence to support the claims made in your…arrow_forward

- FILL ALL CELLS PLEASE HELParrow_forwardLuctor Actual overhead costs Actual qty of the allocation base used Estimated overhead costs Estimated qty of the allocation base Predetermined OH allocation rate Data table Activity Allocation Base Supplies Number of square feet Travel Number of customer sites Allocation Rate $0.07 per square foot $23.00 per site Print Done Clear all Check answer 12:58 PMarrow_forwardWere the overheads over applied or under applied and by how much for this general accounting question?arrow_forward

- The Trainer Tire Company provided the following partial trial balance for the current year ended December 31. The company is subject to a 45% income tax rate.arrow_forwardProvide correct answer this general accounting questionarrow_forwardNeedam Company has analyzed its production process and identified two primary activities. These activities, their allocation bases, and their estimated costs are listed below. BEE (Click on the icon to view the estimated costs data.) The company manufactures two products: Regular and Super. The products use the following resources in March: BEE (Click on the icon to view the actual data for March.) Read the requirements. Requirement 5. Compute the predetermined overhead allocation rates using activity-based costing. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the all Actual overhead costs Actual qty of the allocation base used Estimated overhead costs Estimated qty of the allocation base Predetermined OH allocation rate Data table Data table Regular Super Number of purchase orders 10 purchase orders Number of parts 600 parts 13 purchase orders 800 parts Activity Purchasing Materials handling - X…arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning