Principles of Taxation for Business and Investment Planning 2020 Edition

23rd Edition

ISBN: 9781260433210

Author: Jones, Sally

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 14AP

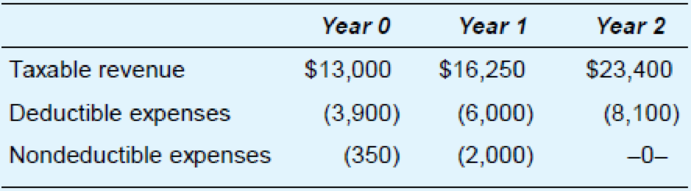

Firm Q is about to engage in a transaction with the following

If the firm’s marginal tax rate over the three-year period is 30 percent and its discount rate is 6 percent, compute the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hi expert please give me answer general accounting question

provide (P/E ratio)?

What was xyz corporation's stockholders' equity at the of march

Chapter 3 Solutions

Principles of Taxation for Business and Investment Planning 2020 Edition

Ch. 3 - Does the NPV of future cash flows increase or...Ch. 3 - Explain the relationship between the degree of...Ch. 3 - Does the after-tax cost of a deductible expense...Ch. 3 - Prob. 4QPDCh. 3 - Prob. 5QPDCh. 3 - Prob. 6QPDCh. 3 - Prob. 7QPDCh. 3 - Which type of tax law provision should be more...Ch. 3 - In the U.S. system of criminal justice, a person...Ch. 3 - Identify two reasons why a firms actual marginal...

Ch. 3 - Prob. 11QPDCh. 3 - Prob. 12QPDCh. 3 - Prob. 1APCh. 3 - Prob. 2APCh. 3 - Prob. 3APCh. 3 - Use a 5 percent discount rate to compute the NPV...Ch. 3 - Consider the following opportunities: Opportunity...Ch. 3 - Prob. 6APCh. 3 - Refer to the income tax rate structure in the...Ch. 3 - Prob. 8APCh. 3 - Company N will receive 100,000 of taxable revenue...Ch. 3 - Prob. 10APCh. 3 - Investor B has 100,000 in an investment paying 9...Ch. 3 - Firm E must choose between two alternative...Ch. 3 - Company J must choose between two alternate...Ch. 3 - Firm Q is about to engage in a transaction with...Ch. 3 - Corporation ABC invested in a project that will...Ch. 3 - Prob. 16APCh. 3 - Investor W has the opportunity to invest 500,000...Ch. 3 - Prob. 18APCh. 3 - Prob. 19APCh. 3 - Prob. 20APCh. 3 - Prob. 21APCh. 3 - Prob. 1IRPCh. 3 - Firm V must choose between two alternative...Ch. 3 - Prob. 3IRPCh. 3 - Refer to the facts in problem 3. Company WB is...Ch. 3 - Prob. 5IRPCh. 3 - Prob. 6IRPCh. 3 - Prob. 7IRPCh. 3 - Prob. 8IRPCh. 3 - Prob. 9IRPCh. 3 - Prob. 1TPCCh. 3 - Firm D is considering investing 400,000 cash in a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ???arrow_forwardHorizon Consulting started the year with total assets of $80,000 and total liabilities of $30,000. During the year, the business recorded $65,000 in service revenues and $40,000 in expenses. Additionally, Horizon issued $12,000 in stock and paid $18,000 in dividends. By how much did stockholders' equity change from the beginning of the year to the end of the year?arrow_forwardх chat gpt - Sea Content Content × CengageNOW × Wallet X takesssignment/takeAssignmentMax.co?muckers&takeAssignment Session Loca agenow.com Instructions Labels and Amount Descriptions Income Statement Instructions A-One Travel Service is owned and operated by Kate Duffner. The revenues and expenses of A-One Travel Service Accounts (revenue and expense items) < Fees earned Office expense Miscellaneous expense Wages expense Required! $1,480,000 350,000 36,000 875,000 Prepare an income statement for the year ended August 31, 2016 Labels and Amount Descriptions Labels Expenses For the Year Ended August 31, 20Y6 Check My Work All work saved.arrow_forward

- Evergreen Corp. began the year with stockholders' equity of $350,000. During the year, the company recorded revenues of $500,000 and expenses of $320,000. The company also paid dividends of $30,000. What was Evergreen Corp.'s stockholders' equity at the end of the year?arrow_forwardEvergreen corp.'s stockholders' equity at the end of the yeararrow_forwardHarrison Corp. reported earnings per share (EPS) of $15 in 2022 and paid dividends of $4 per share. The current market price per share is $90, and the book value per share is $65. What is Harrison Corp.'s price- earnings ratio (P/E ratio)?arrow_forward

- Everest Manufacturing produces and sells a single product. The company has provided its contribution format income statement for March: • Sales (4,500 units): $135,000 • Variable expenses: $58,500 • Contribution margin: $76,500 • Fixed expenses: $50,000 • Net operating income: $26,500 If the company sells 5,200 units, what is the total contribution margin?arrow_forwardProvide solution with step by step calculationarrow_forwardWhat was the amount of net income for the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License