College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 13SPB

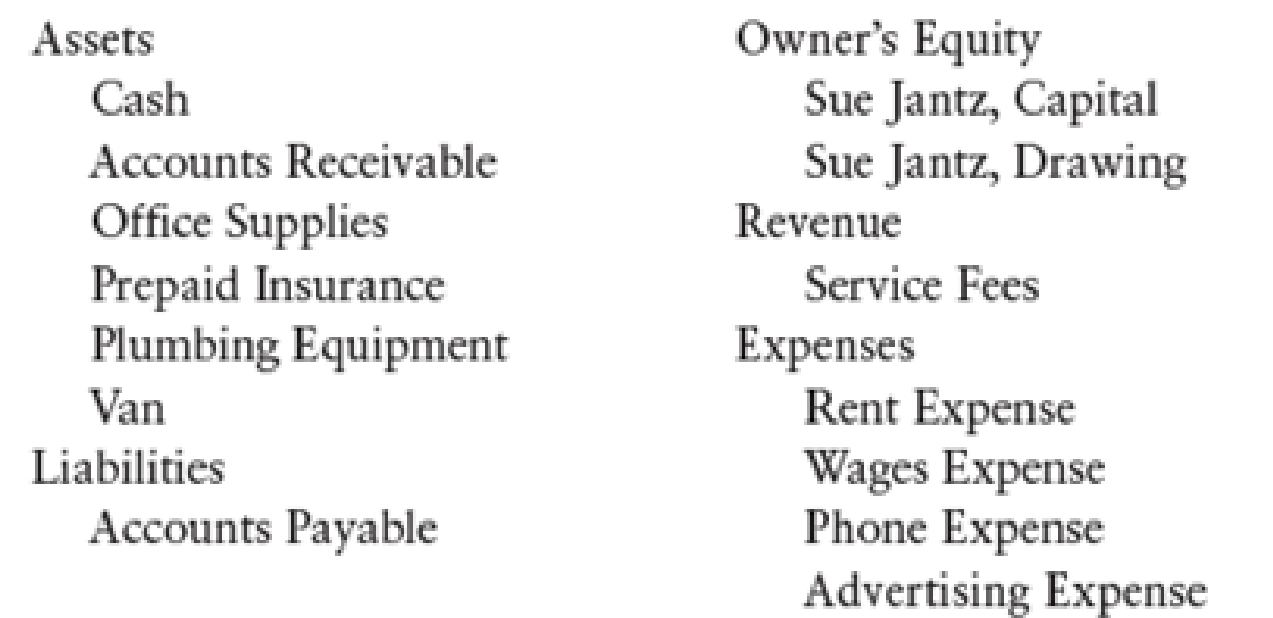

T ACCOUNTS AND

The following transacrions occurred during August:

- (a) Invested cash in the business, $30,000.

- (b) Purchased a used van for cash, $8,000.

- (c) Purchased plumbing equipment on account, $4,000.

- (d) Received cash for services rendered, $3,000.

- (e) Paid cash on account owed from transaction (c), $1,000.

- (f) Paid rent for the month, $700.

- (g) Paid phone bill, $100.

- (h) Earned revenue on account, $4,000.

- (i) Purchased office supplies for cash, $300.

- (j) Paid wages to student, $500.

- (k) Purchased a one-year insurance policy, $800.

- (l) Received cash from services performed in transaction (h), $3,000.

- (m) Paid cash for advertising expense, $2,000.

- (n) Purchased additional plumbing equipment for $2,000, paying $500 cash and spreading the remaining payments over the next six months.

- (o) Earned revenue from services for the remainder of the month of $2,800: $1,100 in cash and $1,700 on account.

- (p) Withdrew cash at the end of the month, $3,000.

REQUIRED

- 1. Enter the transactions in T accounts, identifying each transaction with its responding letter.

- 2. Foot and balance the accounts where necessary.

- 3. Prepare a trial balance as of August 31, 20--.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General accounting question

provide correct answer

Hi expert please give me answer general accounting question

Chapter 3 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 3 - LO3 To debit an account is to enter an amount on...Ch. 3 - Liability accounts normally have debit balances.Ch. 3 - LO3 Increases in owners equity are entered as...Ch. 3 - Prob. 4TFCh. 3 - LO3 To credit an account is to enter an amount on...Ch. 3 - LO3 A debit to an asset account will decrease it.Ch. 3 - A common example of an asset is (a) Professional...Ch. 3 - The accounting equation may be expressed as (a)...Ch. 3 - LO3 Liability, owners equity, and revenue accounts...Ch. 3 - LO4 To record the payment of rent expense, an...

Ch. 3 - Prob. 5MCCh. 3 - Foot and balance the accounts receivable T account...Ch. 3 - LO3 Complete the following questions using either...Ch. 3 - Analyze the following transaction using the T...Ch. 3 - The following accounts have normal balances....Ch. 3 - What are the three major parts of a T account?Ch. 3 - Prob. 2RQCh. 3 - What is a footing?Ch. 3 - What is the relationship between the revenue and...Ch. 3 - What is the function of the trial balance?Ch. 3 - Prob. 1SEACh. 3 - DEBIT AND CREDIT ANALYSIS Complete the following...Ch. 3 - ANALYSIS OF T ACCOUNTS Richard Gibbs began a...Ch. 3 - NORMAL BALANCE OF ACCOUNT Indicate the normal...Ch. 3 - TRANSACTION ANALYSIS Linda Kipp started a business...Ch. 3 - TRANSACTION ANALYSIS Linda Kipp starred a business...Ch. 3 - ANALYSIS OF TRANSACTIONS Charles Chadwick opened a...Ch. 3 - ANALYSIS OF TRANSACTIONS Charles Chadwick opened a...Ch. 3 - TRIAL BALANCE The following accounts have normal...Ch. 3 - Provided below is a trial balance for Juanitas...Ch. 3 - Provided below is a trial balance for Juanitas...Ch. 3 - Provided below is a trial balance for Juanitas...Ch. 3 - T ACCOUNTS AND TRIAL BALANCE Wilhelm Kohl started...Ch. 3 - NET INCOME AND CHANGE IN OWNERS EQUITY Refer to...Ch. 3 - FINANCIAL STATEMENTS Refer to the trial balance in...Ch. 3 - FOOT AND BALANCE A T ACCOUNT Foot and balance the...Ch. 3 - DEBIT AND CREDIT ANALYSIS Complete the following...Ch. 3 - ANALYSIS OF T ACCOUNTS Roberto Alvarez began a...Ch. 3 - NORMAL BALANCE OF ACCOUNT Indicate the normal...Ch. 3 - TRANSACTION ANALYSIS George Atlas started a...Ch. 3 - TRANSACTION ANALYSIS George Atlas started a...Ch. 3 - ANALYSIS OF TRANSACTIONS Nicole Lawrence opened a...Ch. 3 - ANALYSIS OF TRANSACTIONS Nicole Lawrence opened a...Ch. 3 - TRIAL BALANCE The following accounts have normal...Ch. 3 - Provided below is a trial balance for Bills...Ch. 3 - Provided below is a trial balance for Bills...Ch. 3 - Provided below is a trial balance for Bills...Ch. 3 - T ACCOUNTS AND TRIAL BALANCE Sue Jantz started a...Ch. 3 - NET INCOME AND CHANGE IN OWNERS EQUITY Refer to...Ch. 3 - FINANCIAL STATEMENTS Refer to the trial balance in...Ch. 3 - Craig Fisher started a lawn service called Craigs...Ch. 3 - Your friend Chris Stevick started a part-time...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY