Bundle: Intermediate Accounting: Reporting and Analysis, 2017 Update, Loose-Leaf Version, 2nd + CengageNOWv2, 2 terms Printed Access Card

2nd Edition

ISBN: 9781337358552

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 13P

During 2016, Thomas Company entered into two transactions involving promissory notes and properly recorded each transaction.

- 1. On November 1, 2016, it purchased land at a cost of $8,000. It made a $2,000 down payment and signed a note payable agreeing to pay the $6,000 balance in 6 months plus interest at an annual rate of 10%.

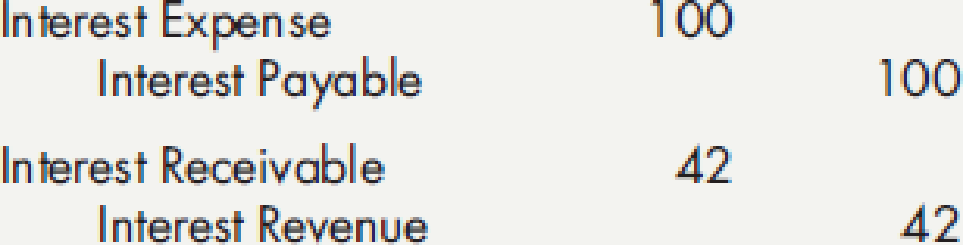

- 2. On December 1, 2016, it accepted a $4,200, 3-month, 12% (annual interest rate) note receivable from a customer for the sale of merchandise. On December 31, 2016, Thomas made the following related adjustments:

Required:

- 1. Assuming that Thomas uses reversing

entries, prepare journal entries to record:- a. the January 1, 2017, reversing entries

- b. the March 1, 2017, $4,326 collection of the note receivable

- c. the May 1, 2017, $6,300 payment of the note payable

- 2. Assuming instead that Thomas does not use reversing entries, prepare journal entries to record the collection of the note receivable and the payment of the note payable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the days sales collected for kavya enterprises?

General Account

Hello expert give me solution this question

Chapter 3 Solutions

Bundle: Intermediate Accounting: Reporting and Analysis, 2017 Update, Loose-Leaf Version, 2nd + CengageNOWv2, 2 terms Printed Access Card

Ch. 3 - What is the primary purpose of an accounting...Ch. 3 - What is the relationship between the accounting...Ch. 3 - Show the expanded accounting equation using the 10...Ch. 3 - Explain and distinguish between a transaction; an...Ch. 3 - Explain how the accounting equation organizes...Ch. 3 - What is the difference between a permanent and a...Ch. 3 - Prob. 7GICh. 3 - Why is it advantageous to a company to initially...Ch. 3 - What is a perpetual inventory accounting system?...Ch. 3 - Give examples of transactions that: a. Increase an...

Ch. 3 - Give examples of transactions that: a. Increase...Ch. 3 - Prob. 12GICh. 3 - Prob. 13GICh. 3 - Prob. 14GICh. 3 - Prob. 15GICh. 3 - Explain and provide examples of deferrals,...Ch. 3 - Prob. 17GICh. 3 - Prob. 18GICh. 3 - Prob. 19GICh. 3 - Prob. 20GICh. 3 - Prob. 21GICh. 3 - What are the major financial statements of a...Ch. 3 - Prob. 23GICh. 3 - Prob. 24GICh. 3 - Prob. 25GICh. 3 - Prob. 26GICh. 3 - Prob. 27GICh. 3 - Prob. 28GICh. 3 - Prob. 29GICh. 3 - What is cash-basis accounting? What must a company...Ch. 3 - On May 1, Johnson Corporation purchased inventory...Ch. 3 - On January 1, Tolson Company purchased a building...Ch. 3 - On July 1, Friler Company purchased a 1-year...Ch. 3 - Prob. 4RECh. 3 - Prob. 5RECh. 3 - Prob. 6RECh. 3 - Goldfinger Corporation had account balances at the...Ch. 3 - Prob. 8RECh. 3 - For the current year, Vidalia Company reported...Ch. 3 - Prob. 10RECh. 3 - (Appendix 3.1) Vickelly Company uses cash-basis...Ch. 3 - Financial Statement Interrelationship Draw a...Ch. 3 - Journal Entries Mead Company uses a perpetual...Ch. 3 - Journal Entries The following are selected...Ch. 3 - Adjusting Entries Your examination of Sullivan...Ch. 3 - Adjusting Entries The following are several...Ch. 3 - Adjusting Entries The following partial list of...Ch. 3 - Prob. 7ECh. 3 - Prob. 8ECh. 3 - Closing Entries Lloyd Bookstore shows the...Ch. 3 - Prob. 10ECh. 3 - Prob. 11ECh. 3 - Prob. 12ECh. 3 - Prob. 13ECh. 3 - Special Journals The following are several...Ch. 3 - Prob. 15ECh. 3 - Prob. 1PCh. 3 - Prob. 2PCh. 3 - Prob. 3PCh. 3 - Prob. 4PCh. 3 - Errors in Financial Statements At the end of the...Ch. 3 - Journal Entries, Posting, and Trial Balance Luke...Ch. 3 - Effects of Errors: During the current accounting...Ch. 3 - Prob. 8PCh. 3 - Carolyn Company has prepared the following...Ch. 3 - Prob. 10PCh. 3 - Prob. 11PCh. 3 - Comprehensive On November 30, 2016, Davis Company...Ch. 3 - During 2016, Thomas Company entered into two...Ch. 3 - Prob. 14PCh. 3 - Adjusting Entries At the end of 2016, Richards...Ch. 3 - Prob. 16PCh. 3 - Prob. 17P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E9.19B (LO 3) (Nonmonetary Exchange) Mathews Company exchanged equipment used in its manufacturing operations plus $6,000 in cash for similar equipment used in the operations of Biggio Company. The following information pertains to the exchange: Mathews Co. Equipment (cost) Accumulated depreciation Fair value of equipment Cash given up Instructions $56,000 38,000 25,000 6,000 Biggio Co. $56,000 20,000 31,000 a. Prepare the journal entries to record the exchange on the books of both companies. Assume that the exchange lacks commercial substance. b. Prepare the journal entries to record the exchange on the books of both companies. Assume that the exchange has commercial substance.arrow_forwardCorrect Answerarrow_forwardSophia sold land to Brian. The sales price was $250,000. Sophia paid a commission to a real estate broker of $15,000 and paid other selling expenses of $3,200. Sophia's basis in the land was $135,500. What was Sophia's gain realized on the sale of the land?arrow_forward

- 4 POINTSarrow_forwardYami Enterprises began the accounting period with $75,000 of merchandise, and the net cost of purchases was $265,000. A physical inventory showed $85,000 of merchandise unsold at the end of the period. The cost of goods sold by York Enterprises for the period is ____. Answerarrow_forwardYami Enterprises began the accounting period with $75,000 of merchandise, and the net cost of purchases was $265,000. A physical inventory showed $85,000 of merchandise unsold at the end of the period. The cost of goods sold by York Enterprises for the period is ____.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License