FINANCIAL MANAGEMENT: THEORY AND PRACTIC

16th Edition

ISBN: 9780357691977

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 13P

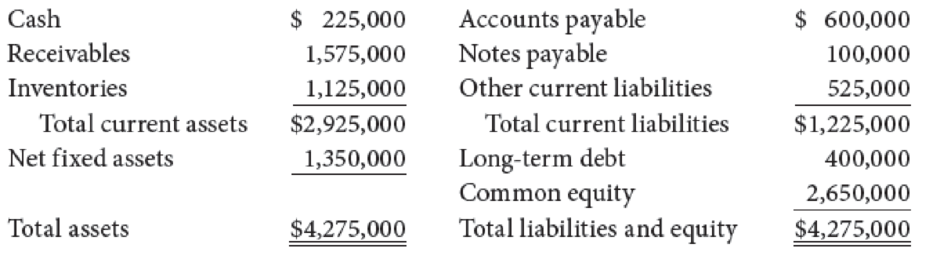

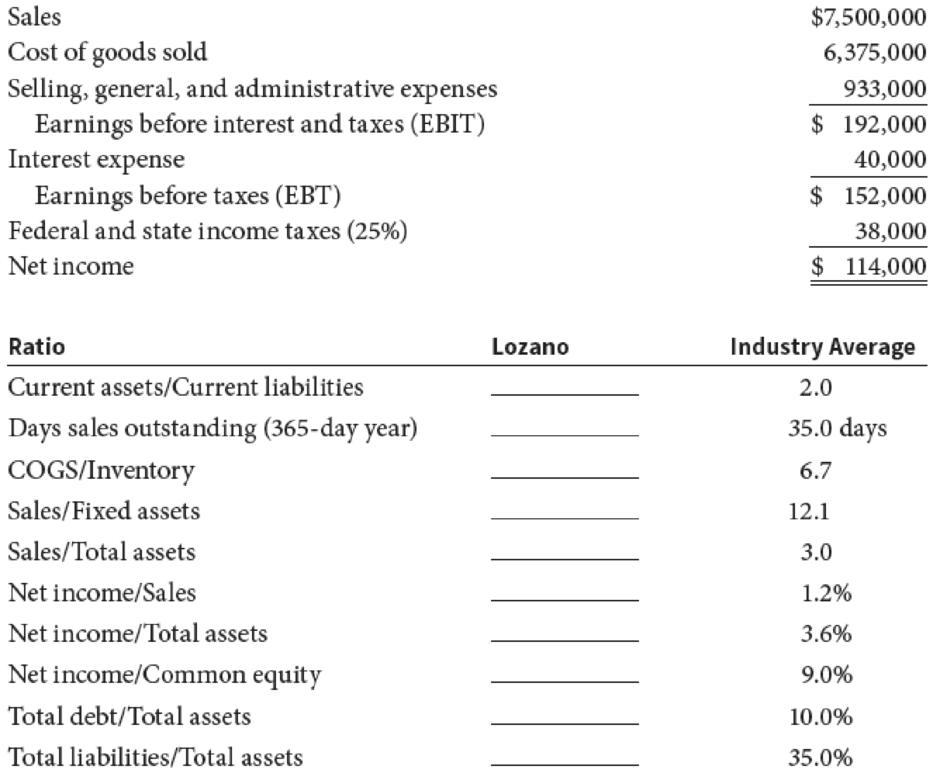

Data for Lozano Chip Company and its industry averages follow.

- a. Calculate the indicated ratios for Lozano.

- b. Construct the extended DuPont equation for both Lozano and the industry.

- c. Outline Lozano’s strengths and weaknesses as revealed by your analysis.

Lozano Chip Company:

Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

For fiscal year 2018, Walmart Inc. (WMT) had total revenues of $500.34 billion, net income of $9.86 billion, total

assets of $204.52 billion, and total shareholders' equity of $77.87 billion.

a. Calculate Walmart's ROE directly, and using the DuPont Identity.

b. Comparing with the data for Costco, use the DuPont Identity to understand the difference between the

two firms' ROES.

Data table

For fiscal year 2018, Costco Wholesale Corporation (COST) had a net profit margin of 2.08%, asset

turnover of 3.55, and a book equity multiplier of 3.37. Costco's ROE (DuPont) is 24.88%.

Meagley Company presents the following condensed income statement and balance sheet information for 2020 and 2019: Next Level Prepare Meagley’s common-size income statements and balance sheets for 2020 and 2019. What trends do you analyses reveal in Meagley's operations and financial position?

Byers Company presents the following condensed income statement for 2019 and condensed December 31, 2019, balance sheet: Compute the following ratios for Byers ( round all computations to two decimals): ( 1) earnings per share, ( 2) gross profit margin, ( 3) operating profit margin, ( 4) net profit margin, ( 5) total asset turnover, ( 6) return on assets, (7) return on common equity, (8) receivables turnover (in days), and (9 ) interest coverage.

Chapter 3 Solutions

FINANCIAL MANAGEMENT: THEORY AND PRACTIC

Ch. 3 - Define each of the following terms:

Liquidity...Ch. 3 - Financial ratio analysis is conducted by managers,...Ch. 3 - Over the past year, M. D. Ryngaert Co. has...Ch. 3 - Profit margins and turnover ratios vary from one...Ch. 3 - How might (a) seasonal factors and (b) different...Ch. 3 - Why is it sometimes misleading to compare a...Ch. 3 - Greene Sisters has a DSO of 20 days. The company’s...Ch. 3 - Vigo Vacations has $200 million in total assets,...Ch. 3 - Winston Watchs stock price is 75 per share....Ch. 3 - Reno Revolvers has an EPS of $1.50, a free cash...

Ch. 3 - Needham Pharmaceuticals has a profit margin of 3%...Ch. 3 - Gardial Son has an ROA of 12%, a 5% profit...Ch. 3 - Ace Industries has current assets equal to 3...Ch. 3 - Assume you are given the following relationships...Ch. 3 - Prob. 9PCh. 3 - The Morrit Corporation has $600,000 of debt...Ch. 3 - Complete the balance sheet and sales information...Ch. 3 - The Kretovich Company had a quick ratio of 1.4, a...Ch. 3 - Data for Lozano Chip Company and its industry...Ch. 3 - The Jimenez Corporation’s forecasted 2020...Ch. 3 - Why are ratios useful? What three groups use ratio...Ch. 3 - Calculate the projected profit margin, operating...Ch. 3 - Calculate the projected inventory turnover, days...Ch. 3 - Prob. 4MCCh. 3 - Calculate the projected debt ratio, debt-to-equity...Ch. 3 - Calculate the projected price/earnings ratio and...Ch. 3 - Prob. 7MCCh. 3 - Use the extended DuPont equation to provide a...Ch. 3 - What are some potential problems and limitations...Ch. 3 - What are some qualitative factors that analysts...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following select account data is taken from the records of Reese Industries for 2019. A. Use the data provided to compute net sales for 2019. B. Prepare a simple income statement for the year ended December 31, 2019. C. Compute the gross margin for 2019. D. Prepare a multi-step income statement for the year ended December 31, 2019.arrow_forwardData for Lozano Chip Company and its industry averages follow. Calculate the indicated ratios for Lozano. Construct the extended DuPont equation for both Lozano and the industry. Outline Lozano’s strengths and weaknesses as revealed by your analysis.arrow_forwardPrepare the common-size financial statement for the entities below and provide a reasoned explanation of the benefits relative to ratios when used to compare performance and establish trends. Income statements for year ending 31 December 2020 Energy Plus Co. ltd V8 Splash Ltd. $’000 $’000 Net revenue 35,119 30,990 Cost of goods sold 12,693 11,088 Gross profit 22,426 19,902 Selling & administrative expenses 13,158 11,358 Other operating expenses 819…arrow_forward

- Using the financial statements provided below for ABC Manufacturing Company, calculate all the ratios listed below for both 2020 and2021. Assume that all sales are credit sales. (a) Calculate the ratios forABC Manufacturing Company for2020 and 2021. (b)Put an“I/D” beside the Year 2021 ratio calculation if the ratio has Improved/Deteriorated. Putan“S”/“W” beside the Year 2021 ratio if ABC Manufacturing Company’s ratio is Stronger/Weake rthan its competitorsarrow_forwardObtain Target Corporation's annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com a. What was Target's gross margin percentage for the fiscal year ended February 2, 2019 (2018) and 2017? Use "Sales" for these computations b. What was Target's Return on Sales percentage for 2018 and 2017? Use "Total Revenue" for these computations. c. Target's return on ales percentage for 2017 was higher than it was in 2018. Ignoring taxes, how much higher would Target's 2018 net income have been if it's return on sales percentage in 2018 had been the same as for 2017?arrow_forwardLiverton Co.’s income statement for the year ended 31 March 2019 and statements of financial position at 31 March 2019 and 2018 were as follows in the images. Calculate for the financial year ended 31 March 2019 and, where possible, for 31 March 2018, the following ratios: i) Gross profit marginii) Assets usageiii) Current ratioiv) Acid testv) Inventories holding periodvi) Debt to Equity ratioarrow_forward

- Forecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forwardForecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forwardCAN SOMEONE HELP ME WITH THE RATIOS? The comparative statements of Wahlberg Company are presented here. Wahlberg CompanyIncome StatementFor the Years Ended December 31 2020 2019 Net sales $1,813,600 $1,750,700 Cost of goods sold 1,007,100 978,000 Gross profit 806,500 772,700 Selling and administrative expenses 519,800 472,000 Income from operations 286,700 300,700 Other expenses and losses Interest expense 17,100 14,200 Income before income taxes 269,600 286,500 Income tax expense 80,015 77,500 Net income $ 189,585 $ 209,000 Wahlberg CompanyBalance SheetsDecember 31 Assets 2020 2019 Current assets Cash $60,600 $64,600 Debt investments (short-term) 69,100 50,300 Accounts receivable 117,500 102,800 Inventory 123,600 115,600…arrow_forward

- CAN SOMEONE HELP ME WITH THE RATIOS? The comparative statements of Wahlberg Company are presented here. Wahlberg CompanyIncome StatementFor the Years Ended December 31 2020 2019 Net sales $1,813,600 $1,750,700 Cost of goods sold 1,007,100 978,000 Gross profit 806,500 772,700 Selling and administrative expenses 519,800 472,000 Income from operations 286,700 300,700 Other expenses and losses Interest expense 17,100 14,200 Income before income taxes 269,600 286,500 Income tax expense 80,015 77,500 Net income $ 189,585 $ 209,000 Wahlberg CompanyBalance SheetsDecember 31 Assets 2020 2019 Current assets Cash $60,600 $64,600 Debt investments (short-term) 69,100 50,300 Accounts receivable 117,500 102,800 Inventory 123,600 115,600 Total…arrow_forwardUsing the financiaql statements of Top Glove Corporation Berhad for the year 2020, provide and comment on the following: Calculate the profitability, liquidity and effiency ratios of the Top Glove Corporation Berhad company (use the following ratios: gross profit margin, net profit margin, return on capital employed, quick ratio, current ratio, accounts receivable turnover, accounts payables turnover, inventory turnover) for the year 2019 and 2020.arrow_forwardUse this data to compute the following ratios: 1.Current ratio (Dec 2020 )2.Acid-test Ratio (Dec 2020) 3.Accounts Receivable Turnover 4.Inventory Turnover 5.Return on Assets 6.Profit Margin on Sales 7.Return on Equity 8.Times Interest Earned b.Discuss the financial condition of ABC Company, Inc. based on what you learn from computing the ratios.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License