Concept explainers

Recording and Posting Accrual Basis

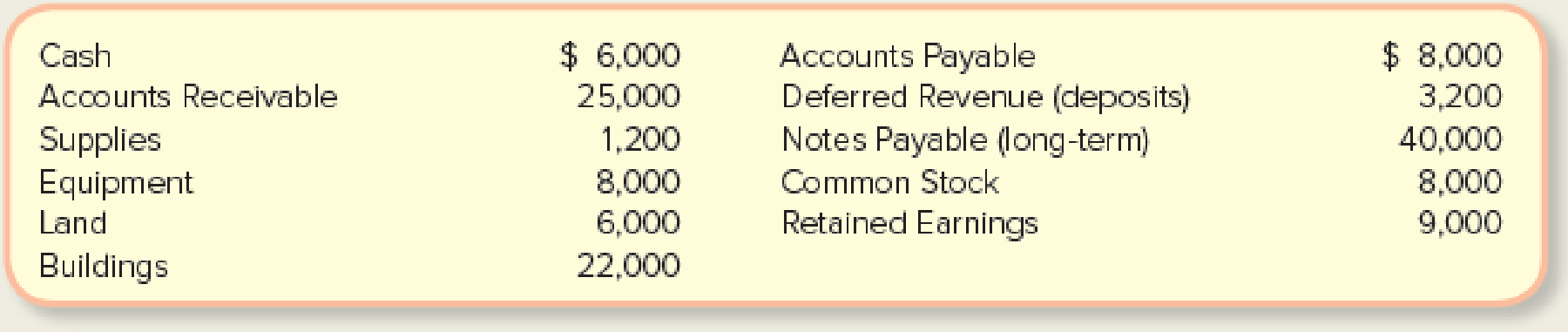

Ricky’s Piano Rebuilding Company has been operating for one year. On January 1, at the start of its second year, its income statement accounts had zero balances and its

Required:

- 1. Create T-accounts for the balance sheet accounts and for these additional accounts: Service Revenue, Rent Revenue, Salaries and Wages Expense, and Utilities Expense. Enter the beginning balances. (If you are using the general ledger tool in Connect, this requirement will be completed for you.)

- 2. Prepare journal entries for the following January transactions, using the letter of each transaction as a reference:

- a. Received a $500 deposit from a customer who wanted her piano rebuilt in February.

- b. Rented a part of the building to a bicycle repair shop; $300 rent received for January.

- c. Delivered five rebuilt pianos to customers who paid $14,500 in cash.

- d. Delivered two rebuilt pianos to customers for $7,000 charged on account.

- e. Received $6,000 from customers as payment on their accounts.

- f. Received an electric and gas utility bill for $350 for January services to be paid in February.

- g. Ordered $800 in supplies.

- h. Paid $1,700 on account in January.

- i. Paid $10,000 in wages to employees in January for work done this month.

- j. Received and paid cash for the supplies in (g).

- 3.

Post the journal entries to the T-accounts. Show the unadjusted ending balances in the T-accounts. (If you are using the general ledger tool, this requirement will be completed for you.) - 4. Use the balances in the completed T-accounts to prepare an unadjusted trial balance at January 31. (If you are using the general ledger tool, this requirement will be completed for you.)

- 5. Using the unadjusted balances, prepare a preliminary income statement and classified balance sheet for the month ended and at January 31

2.

Prepare journal entries for the given transaction.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Accrual basis of accounting:

In accrual Basis of accounting, the company records all the transaction that brings changes in the financial statement of the company. In accrual basis of accounting, the revenue is recognized for the accounting period, in which the goods are sold, or the service performed even if cash is not exchanged. Similarly the expenses are recognized for the accounting period, in which the business incurred expenses even if cash is not exchanged.

Prepare journal entries for the given transaction as follows:

|

Date | Account Title and Explanation | Debit ($) | Credit ($) | |

| a. | Cash (A+) | 500 | ||

| Deferred Revenue (L+) | 500 | |||

| (To record the cash receipt for the service yet to provide) | ||||

| b. | Cash (A+) | 300 | ||

| Rent Revenue (R+, SE+) | 300 | |||

| (To record the cash receipt from rental area) | ||||

| c. | Cash (A+) | 14,500 | ||

| Service Revenue (R+, SE+) | 14,500 | |||

| (To record the cash received for the service rendered) | ||||

| d. | Accounts Receivable (A+) | 7,000 | ||

| Service Revenue (R+, SE+) | 7,000 | |||

| (To record the service provided to customers on account) | ||||

| e. | Cash (A+) | 6,000 | ||

| Accounts Receivable (A–) | 6,000 | |||

| (To record the cash receipt from customer ) | ||||

| f. | Utilities expense (E+, SE–) | 350 | ||

| Accounts Payable (L+) | 350 | |||

| (To record the payment incurred for utilities expense which are to be paid later) | ||||

| g. | No transaction required | - | ||

| h. | Accounts Payable (L–) | 1,700 | ||

| Cash (A–) | 1,700 | |||

| (To record the payment of cash for the purchases made already) | ||||

| i. | Salaries and Wages Expense (E+, SE–) | 10,000 | ||

| Cash (A–) | 10,000 | |||

| (To record the payment of wages expenses to employees) | ||||

| j. | Supplies (A+) | 800 | ||

| Cash (A–) | 800 | |||

| (To record the purchase of supplies) | ||||

Table (1)

Note:

Item g is not a transaction because there is no cash exchange. Hence it is not recorded in the books of journal.

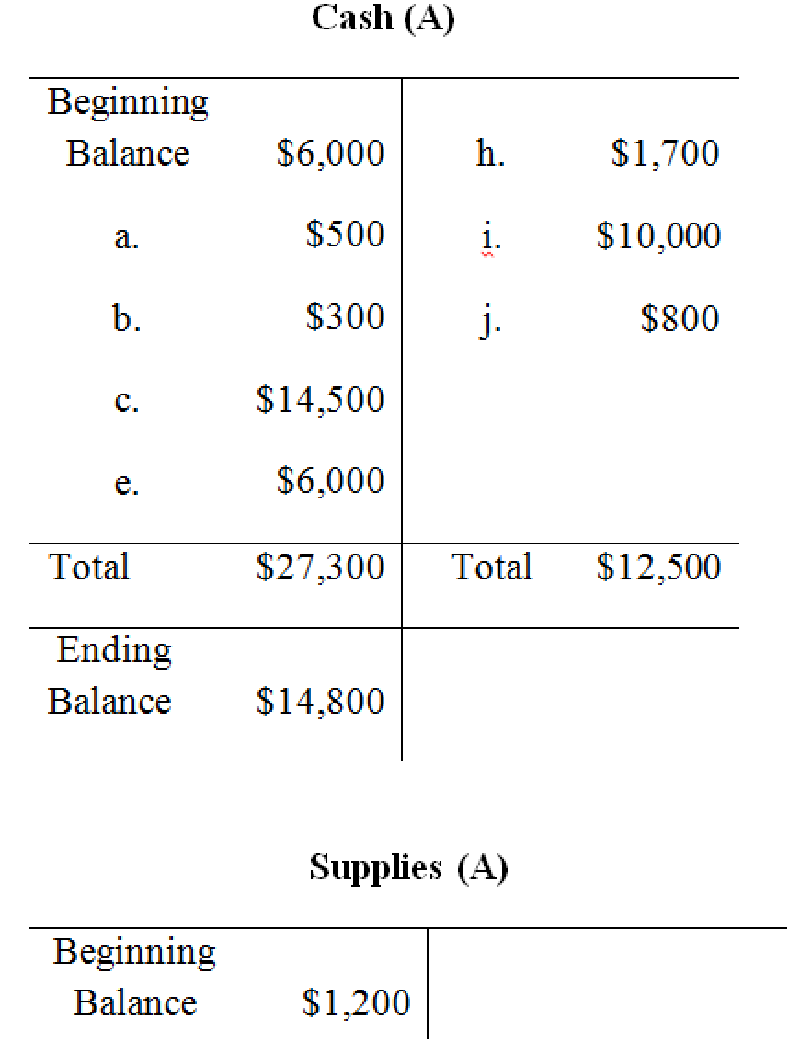

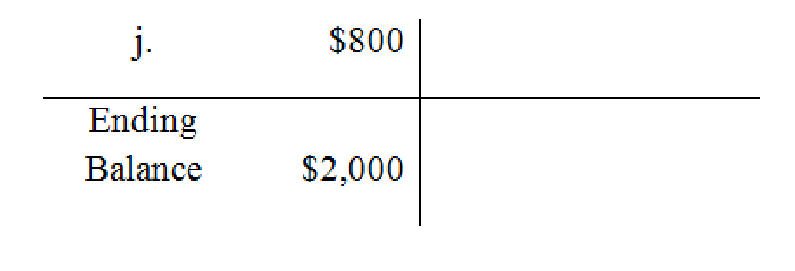

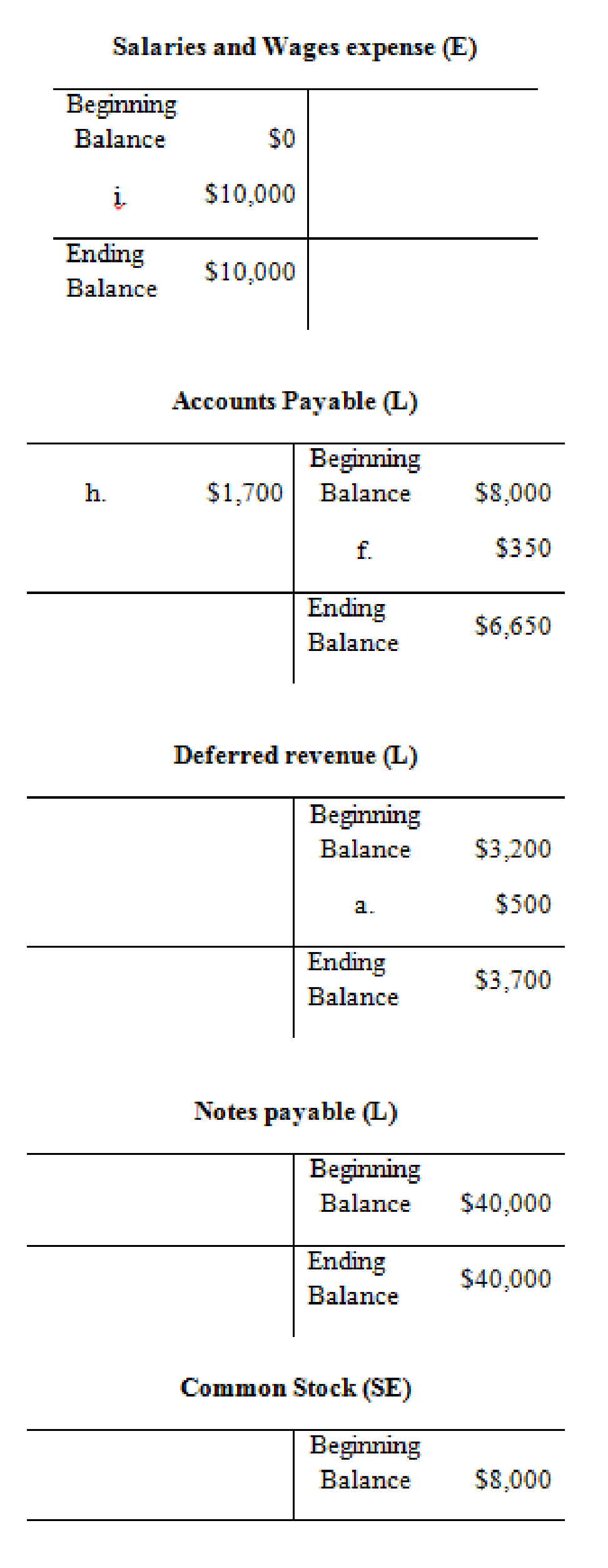

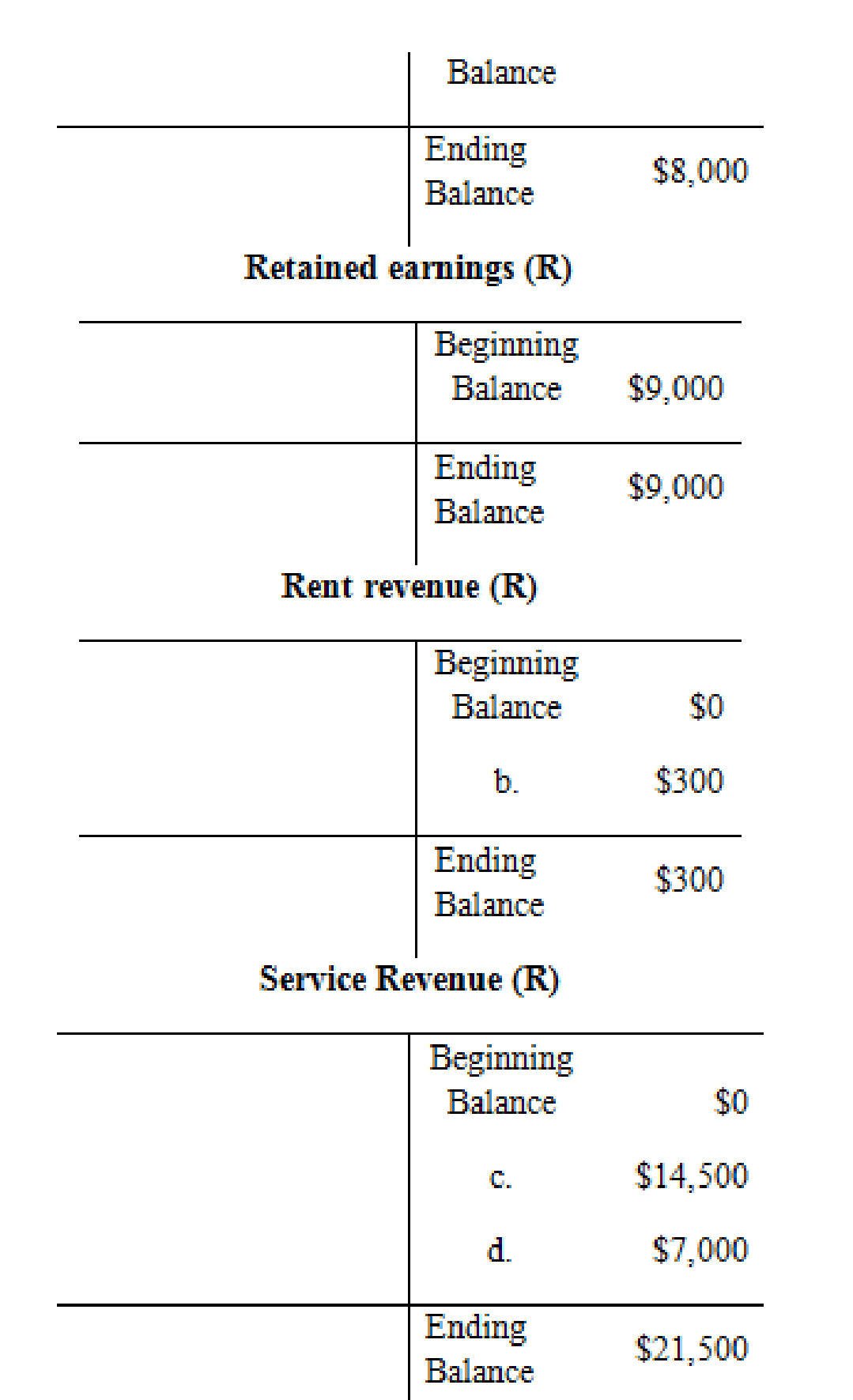

1. and 3.

Prepare the T accounts for the balance sheet accounts and post the journal entries to the T-account, also show the unadjusted ending balance in the T- accounts.

Explanation of Solution

T-account:

An account is referred to as a T-account, because the alignment of the components of the account resembles the capital letter ‘T’. An account consists of the three main components which are as follows:

- The title of the account.

- The left or debit side.

- The right or credit side.

The posting of the journal entries to the T accounts are as follows:

4.

Prepare an unadjusted trial balance at January 31 using the balances in the completed T-accounts.

Explanation of Solution

Unadjusted trial balance:

Unadjusted trial balance is that statement which contains complete list of accounts with their unadjusted balances. This statement is prepared at the end of every financial period.

Prepare an unadjusted trial balance at January 31 as follows:

| Company R | ||

| Unadjusted Trial Balance | ||

| At January 31 | ||

| Particulars | Debit | Credit |

| Cash | $14,800 | |

| Accounts Receivable | 26,000 | |

| Supplies | 2,000 | |

| Equipment | 8,000 | |

| Land | 6,000 | |

| Building | 22,000 | |

| Accounts Payable | $6,650 | |

| Deferred Revenue | 3,700 | |

| Notes Payable | 40,000 | |

| Common Stock | 8,000 | |

| Retained Earnings | 9,000 | |

| Service Revenue | 21,500 | |

| Rent Revenue | 300 | |

| Salaries and Wages Expense | 10,000 | |

| Utilities Expense | 350 | |

| Total | $89,150 | $89,150 |

Table (2)

5.

Prepare a preliminary income statement and classified balance sheet for the month ended January 31.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections, and sub-sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

- Prepare a preliminary income statement for the month ended January 31 as follows:

| Company R | |

| Income Statement | |

| For the Month Ended January 31 | |

| Particulars | $ |

| Revenues: | |

| Service Revenue | $21,500 |

| Rent Revenue | 300 |

| Total Revenues (a) | 21,800 |

| Less: Expenses | |

| Salaries and Wages Expense | 10,000 |

| Utilities Expense | 350 |

| Total Expenses (b) | 10,350 |

| Net Income | $11,450 |

Table (3)

- Prepare the Statement of retained earnings for the month ended January 31 as follows:

| Company R | |

| Statement of Retained Earnings | |

| For the Month Ended January 31 | |

| Particulars | $ |

| Retained Earnings, January 1 | $9,000 |

| Add: Net Income | 11,450 |

| Less: Dividends | 0 |

| Retained Earnings, January 31 | $20,450 |

Table (4)

- Prepare the classified balance at January 31 as follows:

| Company R | |

| Statement of Retained Earnings | |

| For the Month Ended January 31 | |

| Particulars | $ |

| Assets: | |

| Current Assets: | |

| Cash | $14,800 |

| Accounts Receivable | 26,000 |

| Supplies | 2,000 |

| Total Current Assets | 42,800 |

| Equipment | 8,000 |

| Land | 6,000 |

| Building | 22,000 |

| Total Assets | $78,800 |

| Liabilities: | |

| Current Liabilities | |

| Accounts Payable | $6,650 |

| Deferred Revenue | 3,700 |

| Total Current Liabilities | 10,350 |

| Notes Payable (long-term) | 40,000 |

| Total Liabilities (a) | 50,350 |

| Stockholders’ Equity: | |

| Common Stock | 8,000 |

| Retained Earnings | 20,450 |

| Total Stockholders’ Equity (b) | 28,450 |

| Total Liabilities and Stockholders’ Equity | $78,800 |

Table (5)

Want to see more full solutions like this?

Chapter 3 Solutions

GEN COMBO LL FUNDAMENTALS OF FINANCIAL ACCOUNTING; CONNECT ACCESS CARD

- Please answer the following requirements a and b on these general accounting questionarrow_forwardGeneral Accountingarrow_forwardHarper, Incorporated, acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2023, for $210,000 in cash. The book value of Kinman's net assets on that date was $400,000, although one of the company's buildings, with a $60,000 carrying amount, was actually worth $100,000. This building had a 10-year remaining life. Kinman owned a royalty agreement with a 20-year remaining life that was undervalued by $85,000. Kinman sold Inventory with an original cost of $60,000 to Harper during 2023 at a price of $90,000. Harper still held $15,000 (transfer price) of this amount in Inventory as of December 31, 2023. These goods are to be sold to outside parties during 2024. Kinman reported a $40,000 net loss and a $20,000 other comprehensive loss for 2023. The company still manages to declare and pay a $10,000 cash dividend during the year. During 2024, Kinman reported a $40,000 net income and declared and paid a cash dividend of $12,000. It made additional inventory sales…arrow_forward

- Solve this general accounting question not use aiarrow_forwardPlease provide solution this general accounting questionarrow_forwardMichael McDowell Co. establishes a $108 million liability at the end of 2025 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2026. Also, at the end of 2025, the company has $54 million of temporary differences due to excess depreciation for tax purposes, $7.56 million of which will reverse in 2026. The enacted tax rate for all years is 20%, and the company pays taxes of $34.56 million on $172.80 million of taxable income in 2025. McDowell expects to have taxable income in 2026. Assuming that the only deferred tax account at the beginning of 2025 was a deferred tax liability of $5,400,000, draft the income tax expense portion of the income statement for 2025, beginning with the line "Income before income taxes." (Hint: You must first compute (1) the amount of temporary difference underlying the beginning $5,400,000 deferred tax liability, then (2) the amount of temporary differences…arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub - Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning