Concept explainers

The city manager of University City is finalizing the budget proposal that must be submitted to the city council 60 days prior to the July 1 start of the next fiscal year, FY 20X2. An economic recession has significantly reduced the city’s revenues over the past two years, particularly sales taxes and building permit fees. Despite strong political pressures on city council members to sustain current city services, the legal requirement to balance the budget has forced the council to cut certain services and staffing levels over the past two years. Federal financial assistance has prevented even deeper cuts, but will be sharply reduced at the end of FY 20X1. Even though the economy has gradually improved, reduced federal support will make achieving a balanced budget even more difficult in FY 20X2.

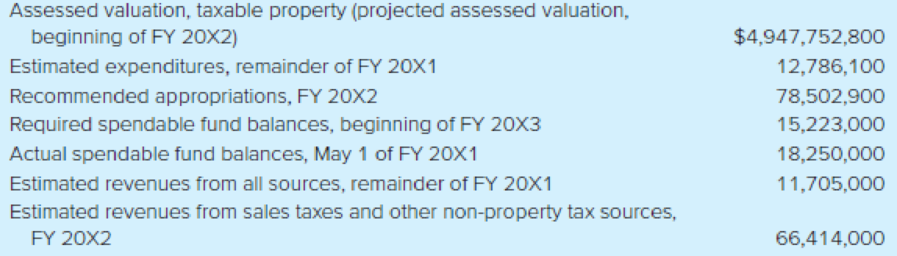

Constraints and planning factors: The city council has mandated that there be no increase in fees and taxes in FY 20X2. Although retail sales and housing starts are projected to increase modestly in FY 20X2, the assessed valuation of taxable property is projected to decrease an additional 5 percent in FY 20X2, reflecting the continuing decline in property values. Moreover, General Fund operating costs, particularly employee health insurance and energy, are expected to outpace revenue growth. Consequently, the city manager is recommending a third consecutive year of no salary and wage increases for city employees. The following financial information is provided as of May 1 of FY 20X1.

General Fund

Analysis and estimation of required property tax rate for FY 20X2: After analyzing the preceding information, constraints, and planning factors, respond to the following questions. (Keep in mind, however, that the city council may impose further changes to the budget as a result of the several budget hearings that will be held over the next two months.)

- a. What amount of estimated revenues is required from property taxes for FY 20X2? (Hint: Make your calculation using the format shown in Illustration 3–6.)

- b. What tax rate will be required in FY 20X2 to generate the amount of revenues from property taxes calculated in question a?

- c. Assuming the property tax rate for FY 20X1 was $0.20 per $100 of assessed valuation of taxable property, will the tax rate calculated in question b violate the city council mandate of no increase in taxes? If so, how would you justify the rate calculated in question b, since the city council will likely be sensitive to adverse public reaction to an increased tax rate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Accounting For Governmental & Nonprofit Entities

- The town council of Riverside estimated revenues for 2020 to be $685,000 from property taxes and $165,000 from business licenses. The appropriations budget from the council was as follows: General government $ 395,000 Parks and recreation 110,000 Sanitation 90,000 Streets and sidewalks 160,000 In April, heavy spring rains caused some flooding near the river. As a result, a picnic area at River’s Edge Park was ruined and several damaged shops had to shut down. The council adopted an upward revision of $50,000 for the parks and recreation budget and reduced the estimated revenues from business licenses by $30,000.The General Fund began the year with a balance of $49,000. During the year, tax collections totaled $687,500 and revenues from business licenses were $124,000. Expenditures were $365,000 for general government, $160,500 for parks and recreation, $91,600 for sanitation, and $157,333 for streets and sidewalks. There are no outstanding encumbrances at…arrow_forwardsarrow_forwardDuring lunch, the director of the Streets and Parkways Department of the city Torrance made the following comment: “For the past 10 years, I have deliberately overstated my labor and equipment needs by 20 percent when preparing my budget request. I figure that the city council will cut it by 10 percent, and I can use the other 10 percent as slack. If there is money left over, I can always find a way to spend it.” Do you consider this behavior to be ethical? If not, what steps might you, as budget director, take to cut down on this “padding”?arrow_forward

- "The City of Lakeview adopts its budget on a basis of accounting that permits outstanding purchase commitments to be charged against the budget in the year that the goods are ordered instead of in the year they are received. During the year the city ordered and received $4,000 of supplies (of which $3,000 had been paid and $1,000 was unpaid) and had $500 of outstanding purchase commitments for supplies at year-end. In the budget-to-actual comparison, the expenditures for supplies would be: ""$3,000" "$3,500" "$4,000 " "$4,500"arrow_forwardShepherd City's original budget included a credit to fund balance of $20,000. During the year, the City recorded an additional entry that debited budgetary fund balance and credited estimated revenues. Which of the following accurately describes what happened? The estimated revenues decreased, reducing the City's projected surplus for the year. The estimated revenues decreased, improving the City's projected surplus for the year. The estimated revenues increased, reducing the City's projected surplus for the year. The estimated revenues increased, improving the City's projected surplus for the year.arrow_forwardDon't give solution in image format..arrow_forward

- The City of Troy collects its annual property taxes late in its fiscal year. Consequently, each year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, the city estimated that it will require $2,500,000 to finance governmental activities for the remainder of the fiscal year. On that date, it had $770,000 of cash on hand and $830,000 of current liabilities. Collections for the remainder of the year from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at $1,100,000. Required a. Calculate the estimated amount of tax anticipation financing that will be required for the remainder of the current fiscal year. b. Assume that on April 2, the City of Troy borrowed the amount calculated in part a by signing tax anticipation notes bearing 6 percent per annum to a local bank. Record the issuance of the tax anticipation notes in…arrow_forwardThe following transactions relate to Newport City’s special revenue fund. In 2020, Newport City created a special revenue fund to help fund the 911 emergency call center. The center is to be funded through a legally restricted tax on cellular phones. No budget is recorded. During the first year of operations, revenues from the newly imposed tax totaled $495,000. Of this amount, $445,500 has been received in cash and the remainder will be received within 60 days of the end of the fiscal year. Expenditures (salaries) incurred through the operation of the 911 emergency call center totaled $441,000. Of this amount, $412,335 was paid before year-end. During the year the state government awarded Newport City a grant to reimburse the City’s costs (not to exceed $159,000) for the purpose of training new 911 operators. During the year, the City paid $151,050 (not reflected in the expenditures above) to train new operators for the 911 emergency call center and billed the state government.…arrow_forwardThe following transactions relate to Newport City’s special revenue fund. In 2020, Newport City created a special revenue fund to help fund the 911 emergency call center. The center is to be funded through a legally restricted tax on cellular phones. No budget is recorded. During the first year of operations, revenues from the newly imposed tax totaled $530,000. Of this amount, $477,000 has been received in cash and the remainder will be received within 60 days of the end of the fiscal year. Expenditures (salaries) incurred through the operation of the 911 emergency call center totaled $469,000. Of this amount, $438,515 was paid before year-end. During the year the state government awarded Newport City a grant to reimburse the City’s costs (not to exceed $180,000) for the purpose of training new 911 operators. During the year, the City paid $171,000 (not reflected in the expenditures above) to train new operators for the 911 emergency call center and billed the state government.…arrow_forward

- The City of Iroy collects its annual property taxes late in its fiscal year. Consequently, each year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, the city estimated that it will require $1,800,000 to finance governmental activities for the remainder of the fiscal year. On that date, it had $700,000 of cash on hand and $760,000 of current liabilities. Collections for the remainder of the year from revenues other than current property taxes and from delinquent property taxes, including interest and penalties, were estimated at $750,000. Required a. Calculate the estimated amount of tax anticipation financing that will be required for the remainder of the current fiscal year. b. Assume that on April 2, the City of Troy borrowed the amount calculated in part a by signing tax anticipation notes bearing 7 percent per annum to a local bank. Record the issuance of the tax anticipation notes in the…arrow_forwardLilly County, faced with the prospect of declining revenues, decides it can save money by doingall printing in-house. The county creates the Lilly Printing Fund (an Internal Service Fund),directs departments to fulfill their bulk printing needs through that Fund, and directs departmentsto pay the Fund promptly to minimize its operating cash flow needs.The Fund had the following transactions and events during 2021:1. Received a $12,000 loan on January 2 from the county’s General Fund to be repaid in fourequal annual installments of $3,000, starting December 31, 2021, with interest at the rateof 1 percent per annum on the outstanding balance. The specified purpose of the loan is toallow the Lilly Printing Fund to purchase equipment for $9,600 and to use the balance of $2,400to meet operating cash flow needs.2. Purchased reproduction equipment for $9,600 on January 2, using cash provided.The equipment has an estimated useful life of 4 years.3. Purchased paper and supplies for $9,000 on…arrow_forwardThe Franklin Management Association held its annual public relations luncheon in April Year 2. Based on the previous year’s results, the organization allocated $24,818 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, Molly Hubbard, the treasurer, prepared the following budget for the Year 2 luncheon. The budget for the luncheon was based on the following expectations: The meal cost per person was expected to be $12.50. The cost driver for meals was attendance, which was expected to be 1,470 individuals. Postage was based on $0.58 per invitation and 3,350 invitations were expected to be mailed. The cost driver for postage was number of invitations mailed. The facility charge is $1,700 for a room that will accommodate up to 1,600 people; the charge for one to hold more than 1,600 people is $2,200. A fixed amount was designated for printing, decorations, the speaker’s gift, and publicity. FRANKLIN MANAGEMENT…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education