Worksheet, Including Inventory Surian Motors Company prepared a

Additional information: (a) The equipment is being

Required:

- 1. Complete the worksheet.

- 2. Prepare financial statements for 2019.

- 3. Prepare closing entries in the general journal.

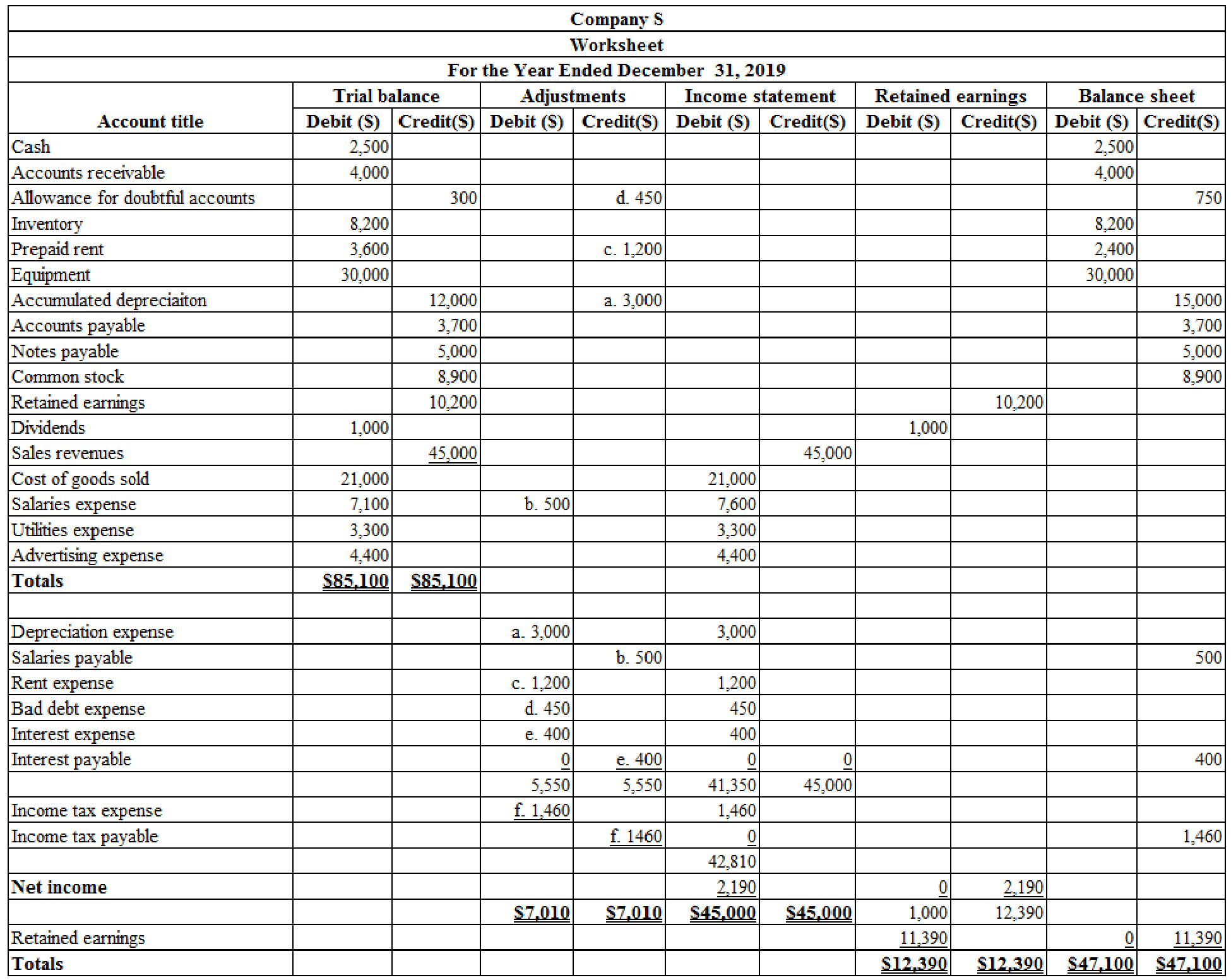

1.

Prepare the worksheet for the year ended December 31, 2019.

Explanation of Solution

Worksheet: A worksheet is a tool that is used while preparing a financial statement. It is a type of form, having multiple columns and it is used in the adjustment process.

Prepare the worksheet for the year ended December 31, 2019:

Table (1)

2.

Prepare the financial statements of Company S for the year ended December 31, 2019.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare income statement of Company S for the year ended December 31, 2019:

| Company S | ||

| Income statement | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount($) | Amount($) |

| Sales revenue | 45,000 | |

| Less: Cost of goods sold | (21,000) | |

| Gross profit | 24,000 | |

| Less: Operating expenses: | ||

| Salaries expense | 7,600 | |

| Utilities expense | 3,300 | |

| Advertising expense | 4,400 | |

| Depreciation expense | 3,000 | |

| Rent expense | 1,200 | |

| Bad debt expense | 450 | |

| Total operating expense | (19,950) | |

| Income from operations | 4,050 | |

| Other items: | ||

| Interest expense | (400) | |

| Income before income taxes | 3,650 | |

| Less: Income tax expense | (1,460) | |

| Net income | $2,190 | |

| Earnings per share (1,000 shares) | $2.19 | |

Table (2)

Working notes 1: Calculate the amount of salaries expense.

Working note 2: Calculate the amount of rent expense.

Working note 3: Calculate the amount of depreciation expense.

Working note 4: Calculate the amount of income tax expense.

Working note 5: Calculate the amount of bad debt expense.

Working note 6: Calculate earnings per share.

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare statement of retained earnings of Company S for the year ended December 31, 2019:

| Company S | ||

| Statement of Retained Earnings | ||

| For the Year Ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, January 1, 2019 | 10,200 | |

| Add: Net income | 2,190 | |

| Subtotal | 12,390 | |

| Less: Dividends | (1,000) | |

| Retained earnings at December 31, 2019 | $11,390 | |

Table (3)

Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet of Company S for the year ended December 31, 2019:

| Company S | ||

| Balance Sheet | ||

| As on December 31, 2019 | ||

| Assets | ||

| Current assets: | Amount ($) | Amount ($) |

| Cash | 2,500 | |

| Accounts receivable | 4,000 | |

| Less: Allowance for doubt accounts | (750) | 3,250 |

| Inventory | 8,200 | |

| Prepaid rent | 2,400 | |

| Total current assets | ||

| Property, plant and equipment: | ||

| Equipment | 30,000 | |

| Less: Accumulated depreciation | (15,000) | |

| Net property, plant and equipment | 15,000 | |

| Total assets | $31,350 | |

| Liabilities and Equity | ||

| Liabilities: | ||

| Current liabilities: | ||

| Accounts payable | 3,700 | |

| Notes payable | 5,000 | |

| Salaries payable | 500 | |

| Interest payable | 400 | |

| Income taxes payable | 1,460 | |

| Total liabilities | 11,060 | |

| Shareholders’ Equity | ||

| Contributed Capital: | ||

| Common stock | 8,900 | |

| Retained earnings | 11,390 | |

| Total shareholders’ equity | 20,290 | |

| Total liabilities and shareholders’ equity | $31,350 | |

Table (4)

3.

Prepare the closing entries for the year ended December 31, 2019 in the general journal.

Explanation of Solution

Prepare the closing entries:

| Date | Accounts title and explanation | Post Ref. | Debit | Credit |

| ($) | ($) | |||

| December 31, 2019 | Sales Revenue | 45,000 | ||

| Income Summary | 45,000 | |||

| (To close the revenue accounts) | ||||

| December 31, 2019 | Income Summary | 42,810 | ||

| Cost of Goods Sold | 21,000 | |||

| Salaries Expense | 7,600 | |||

| Utilities Expense | 3,300 | |||

| Advertising Expense | 4,400 | |||

| Depreciation Expense | 3,000 | |||

| Rent Expense | 1,200 | |||

| Bad Debt Expense | 450 | |||

| Interest Expense | 400 | |||

| Income Tax Expense | 1,460 | |||

| (To close the expense accounts) | ||||

| December 31, 2019 | Income Summary | 2,190 | ||

| Retained Earnings | 2,190 | |||

| (To close the income summary account) | ||||

| December 31, 2019 | Retained Earnings | 1,000 | ||

| Dividends | 1,000 | |||

| (To close the dividends account) | ||||

Table (5)

Want to see more full solutions like this?

Chapter 3 Solutions

Interm.acct.:reporting.(ll)-w/access

- Compute the company's plantwide predetermined overhead rate for the yeararrow_forwardWhat is General Ledger? And how to implement it ? Give an example.arrow_forwardAt the beginning of 2020, Darwin Company issued 10% bonds with a face value of $600,000. These bonds mature in five years, and interest is paid semiannually on June 30 and December 31. The bonds were sold for $555,840 to yield 12%. Winston uses a calendar-year reporting period. Using the effective-interest method of amortization, what amount of interest expense should be reported for 2020? (Round your answer to the nearest dollar.).arrow_forward

- What is the total equity for Oliver Supplies at year end ?arrow_forwardTriton Manufacturing had a beginning finished goods inventory of $23,500 and an ending finished goods inventory of $21,000 during FY 2023. Beginning work-in-process was $19,500 and ending work-in-process was $18,000. Factory overhead was $28,600. The total manufacturing costs amounted to $298,000. Use this information to determine the FY 2023 Cost of Goods Sold. (Round enter as whole dollars only.)Helparrow_forwardTriton Manufacturing had a beginning finished goods inventory of $23,500 and an ending finished goods inventory of $21,000 during FY 2023. Beginning work-in-process was $19,500 and ending work-in-process was $18,000. Factory overhead was $28,600. The total manufacturing costs amounted to $298,000. Use this information to determine the FY 2023 Cost of Goods Sold. (Round enter as whole dollars only.)arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning