Financial And Managerial Accounting

15th Edition

ISBN: 9781337912143

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 28, Problem 1MAD

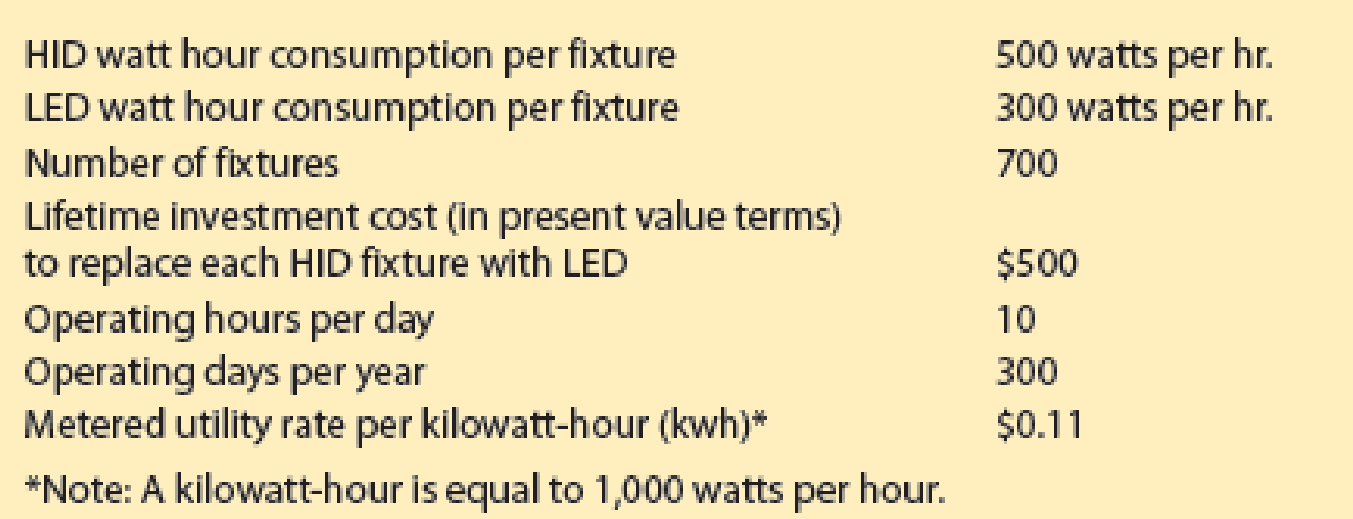

Den-Tex Company is evaluating a proposal to replace its HID (high intensity discharge) lighting with LED (light emitting diode) lighting throughout its warehouse. LED lighting consumes less power and lasts longer than HID lighting for similar performance. The following information was developed:

a. Determine the investment cost for replacing the 700 fixtures.

b. Determine the annual utility cost savings from employing the new energy solution.

c. Should the proposal be accepted? Evaluate the proposal using

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What are the total assets of the company on these financial accounting question?

Subject: accounting

Need help with this accounting questions

Chapter 28 Solutions

Financial And Managerial Accounting

Ch. 28 - How does a strategic performance measurement...Ch. 28 - What is the difference between a leading indicator...Ch. 28 - Prob. 3DQCh. 28 - How are strategic objectives and strategic...Ch. 28 - What do strategy maps show, and how do they add...Ch. 28 - Prob. 6DQCh. 28 - Prob. 7DQCh. 28 - Prob. 8DQCh. 28 - Prob. 9DQCh. 28 - Prob. 10DQ

Ch. 28 - 72 Inc. has developed a balanced scorecard with...Ch. 28 - Bluetiful Inc. has the following strategic...Ch. 28 - Moses Moonrocks Inc. has developed a balanced...Ch. 28 - Prob. 4BECh. 28 - Lonnies Shipping Co. is considering switching to...Ch. 28 - Henrys Cafe is a local restaurant that is growing...Ch. 28 - American Express Company is a major financial...Ch. 28 - Eat-n-Run Inc. owns and operates 10 food trucks...Ch. 28 - Prob. 4ECh. 28 - Apples Oranges Inc. is trying to become more...Ch. 28 - The following is the balanced scorecard for Smith...Ch. 28 - Prob. 7ECh. 28 - Coulson and Company is a large retail business...Ch. 28 - Rizzo Goal Inc. produces and sells hockey...Ch. 28 - Silver Lining Inc. has a balanced scorecard with a...Ch. 28 - Two departments within Cougar Gear Inc. are...Ch. 28 - Sunny Nights Inc. is completely powered by the...Ch. 28 - Instructions 1.Label each element of the balanced...Ch. 28 - Strategic initiatives and CSR Obj. 2, 4 Get...Ch. 28 - Hyperflash Inc. has a balanced scorecard that...Ch. 28 - Instructions 1.Based on the balanced scorecard and...Ch. 28 - Strategic initiatives and CSR Blue Skies Inc. is a...Ch. 28 - Eye Swear Inc. has a balanced scorecard that...Ch. 28 - Den-Tex Company is evaluating a proposal to...Ch. 28 - Prob. 2MADCh. 28 - Analyze CSR initiatives at Green Manufacturing...Ch. 28 - Prob. 1TIFCh. 28 - Blake McKenzie Tax Services is a company serving...Ch. 28 - Young Manufacturing Company is a startup...Ch. 28 - The fundamental concept behind strategic...Ch. 28 - Which of the following statements regarding the...Ch. 28 - The balanced scorecard provides an action plan for...Ch. 28 - Which of the following statements best describes...Ch. 28 - A sign of the successful implementation of a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vihat Tech is considering a project that will produce incremental annual sales of $250,000 and increase cash expenses by $160,000. If the project is implemented, taxes will increase from $29,000 to $33,000. The company is debt-free. What is the amount of the operating cash flow using the top-down approach? I want Answerarrow_forwardAt the end of last year, Harvey, a 25% partner in the four-person HRT partnership, had an outside basis of $28,000, which included his $12,000 share of HRT's debt. On January 1 of the current year, Harvey sells his partnership interest to Samuel for a cash payment of $20,000 and the assumption of his share of HRT's debt. HRT has no hot assets. What is the amount and character of Harvey’s recognized gain or loss on the sale? A. $4,000 capital loss B. $4,000 ordinary loss C. $4,000 capital gain D. $8,000 ordinary income answerarrow_forwardKindly help me with accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License