Concept explainers

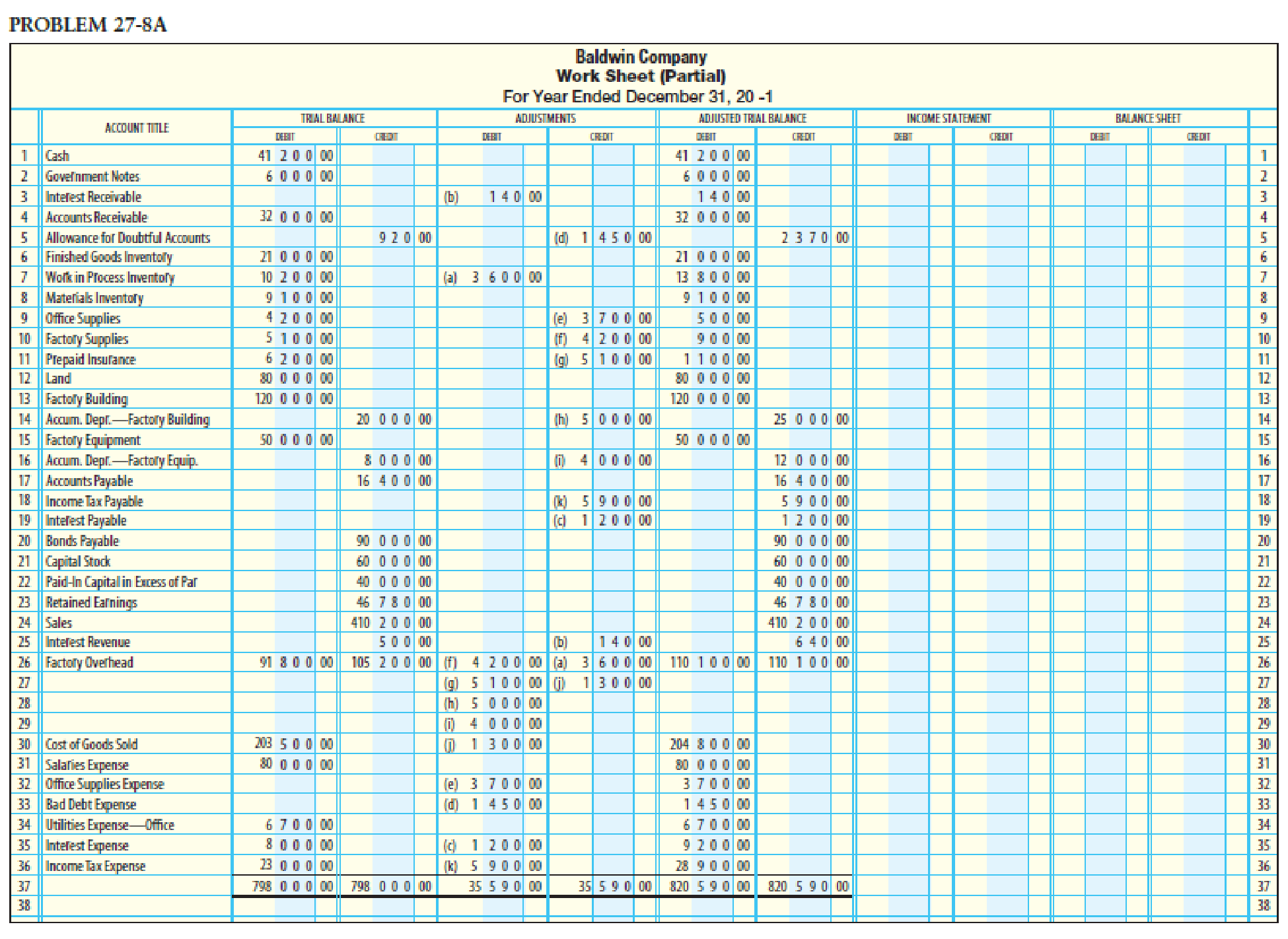

ADJUSTING, CLOSING, AND REVERSING ENTRIES A partial work sheet for Baldwin Company is shown on the next page.

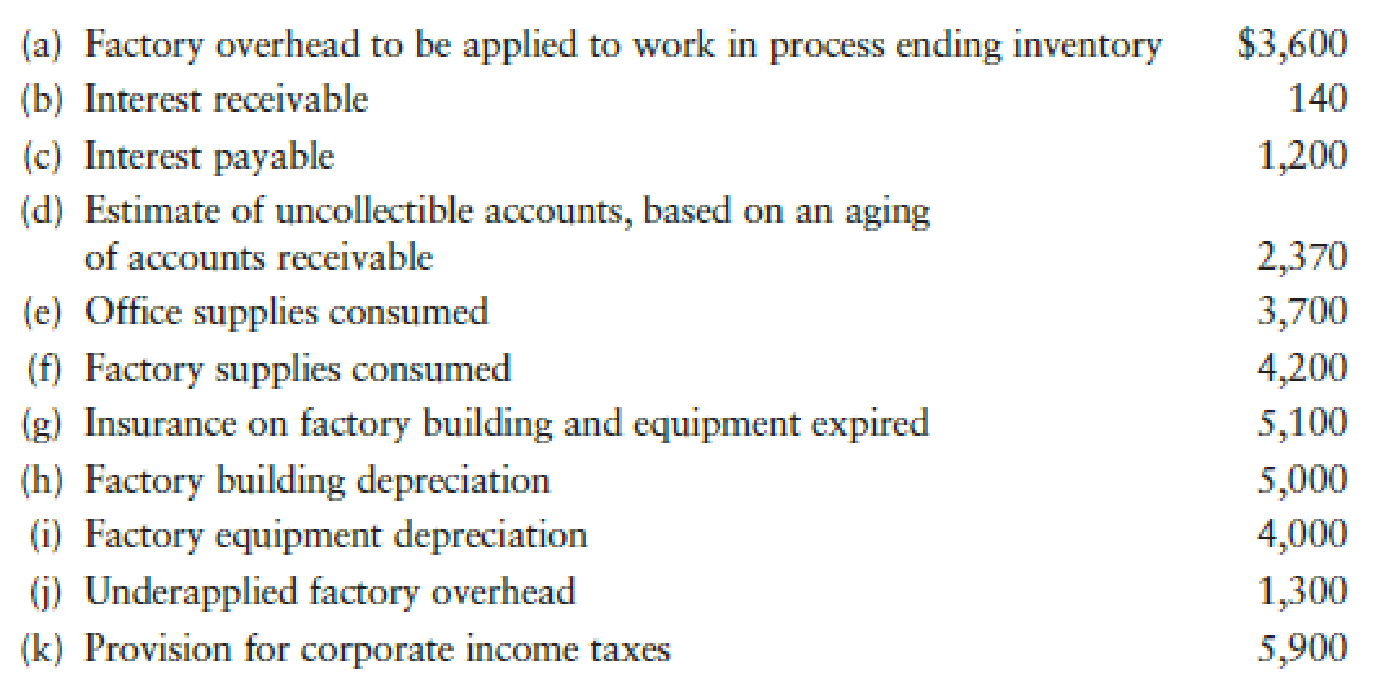

Data for adjusting the accounts are as follows:

REQUIRED

- 1. Prepare the December 31

adjusting journal entries for Baldwin Company. - 2. Prepare the December 31 closing journal entries for Baldwin Company.

- 3. Prepare the reversing journal entries as of January 1, 20-2, for Baldwin Company.

1.

Prepare adjusting entries of Company B for the year ended December 31.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries of Company B for the year ended December 31 as follows:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) | |

| December 31 | a. | Work in process inventory account | 3,600 | ||

| Factory overhead | 3,600 | ||||

| (To record the transfer of work in process inventory account to factory overhead) | |||||

| December 31 | b. | Interest receivable | 140 | ||

| Interest revenue | 140 | ||||

| (To record the interest revenue earned at the end of the accounting year) | |||||

| December 31 | c. | Interest Expense | 1,200 | ||

| Interest Payable | 1,200 | ||||

| (To record the interest expense incurred at the end of the accounting year) | |||||

| December 31 | d. | Bad Debt Expense | 1,450 | ||

| Allowance for Doubtful Accounts | 1,450 | ||||

| (To record the bad debt expense incurred at the end of the accounting year) | |||||

| December 31 | e. | Office Supplies Expense | 3,700 | ||

| Office Supplies | 3,700 | ||||

| (To record the office supplies expense incurred at the end of the accounting year) | |||||

| December 31 | f. | Factory Overhead (supplies expense) | 4,200 | ||

| Factory Supplies | 4,200 | ||||

| (To record the supplies expense incurred at the end of the accounting year) | |||||

| December 31 | g. | Factory Overhead (insurance expense) | 5,100 | ||

| Prepaid insurance | 5,100 | ||||

| (To record the insurance expense incurred at the end of the accounting year) | |||||

| December 31 | h. | Factory overhead-(depreciation expense for factory building) | 5,000 | ||

| Accumulated Depreciation-factory building | 5,000 | ||||

| (To record the depreciation expense incurred at the end of the accounting year) | |||||

| December 31 | i. | Factory Overhead (Depreciation expense-Factory Equipment) | 4,000 | ||

| Accumulated Depreciation-Factory Equipment | 4,000 | ||||

| (To record the depreciation expense incurred at the end of the accounting year) | |||||

| December 31 | j. | Cost of Goods Sold | 1,300 | ||

| Factory Overhead | 1,300 | ||||

| (To record the factory overhead transferred to the cost of goods sold) | |||||

| December 31 | k. | Income Tax Expense | 5,900 | ||

| Income Tax Payable | 5,900 | ||||

| (To record the income tax expense incurred at the end of the account) |

Table (1)

2.

Prepare closing entries of Company B for the year ended December 31.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries of Company B for the year ended December 31 as follows:

| Date | Account Title and Explanation | Post ref. | Debit ($) | Credit ($) |

| December 31 | Income Summary | 110,100 | ||

| Factory Overhead (Subsidiary ledger account) | 110,100 | |||

| (To close the subsidiary factory overheads account) | ||||

| December 31 | Factory Overhead | 110,100 | ||

| Income Summary | 110,100 | |||

| (To close the factory overhead account) | ||||

| December 31 | Sales | 410,200 | ||

| Interest revenue | 640 | |||

| Income Summary | 410,840 | |||

| (To close the sales and interest revenue account) | ||||

| December 31 | Income Summary | 334,750 | ||

| Cost of Goods Sold | 204,800 | |||

| Salaries expense | 80,000 | |||

| Office supplies expense | 3,700 | |||

| Bad debt expense | 1,450 | |||

| Utilities expense-office | 6,700 | |||

| Interest expense | 9,200 | |||

| Income tax expense | 28,900 | |||

| (To close all expenses account) | ||||

| December 31 | Income Summary | 76,090 | ||

| Retained Earnings (1) | 76,090 | |||

| (To close the income summary account) |

Table (2)

Closing entry for factory overhead:

The total debit balance of factory overhead account is transferred to the income summary account in order to bring the debit balance of factory overhead account to zero, and in the closing entry the income summary account is debited with $110,100, and the factory overhead account is credited (subsidiary ledger account) with $110,100.

The total credit balance of factory overhead account is transferred to the income summary account in order to bring the credit balance of factory overhead account to zero, and in the closing entry the factory overhead account is debited with $110,100, and the income summary account is credited with $110,100.

Closing entry for revenue account:

In this closing entry, the sales and interest revenue account is closed by transferring the amount of sales and interest revenue to the income summary account in order to bring the all revenue accounts balance to zero. Hence, debit the all revenue account for $410,840, and credit the income summary account for $410,840.

Closing entry for expenses account:

In this closing entry, all expenses are closed by transferring the amount of all expenses to the income summary account in order to bring all the expense accounts balance to zero. Hence, debit the income summary account for $334,750, and credit all the expenses account for $334,750.

Closing entry for income summary account:

In this closing entry, the income summary account is closed by transferring the amount of net income to the retained earnings account in order to bring the income summary balance to zero. Hence, debit the income summary account for $76,090, and credit the retained earnings for $76,090.

Working note (1):

Calculate the value of retained earnings.

3.

Prepare the reversing entries of Company B as of January 1, 20-2.

Explanation of Solution

Reversing entries: Reversing entries are made at the beginning of the accounting period when the accountant needs to cancel any entry made in the previous accounting period. It is done in order to eliminate any errors that might have occurred in the calculation of the revenue or expenses and henceforth increase the efficiency of the financial statements for an improved decision making.

Prepare the reversing entries of Company B as of January 1, 20-2 as follows:

Reversing entry for interest revenue:

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| January 1 | Interest revenue | 140 | ||

| Interest receivable | 140 | |||

| (To record the reversing entry for interest revenue) |

Table (3)

- Interest revenue is component of shareholders’ equity, and it decreases the value of shareholders equity. Hence, debit the interest revenue with $140.

- Interest receivable is an asset account, and it decreases the value of asset. Hence, credit the interest receivable account with $140.

Reversing entry for interest expense:

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| January 1 | Interest payable | 1,200 | ||

| Interest expense | 1,200 | |||

| (To record the reversing entry for interest expense) |

Table (4)

- Interest payable is a liability account and it decreases in the value of liabilities. Hence, debit the interest payable with $1,200.

- Interest expense is component of shareholders’ equity, and it increases the value of shareholders equity. Hence, credit the interest expense with $1,200.

Reversing entry for factory overheads:

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| January 1 | Factory Overhead | 3,600 | ||

| Work in Process Inventory | 3,600 | |||

| (To record the reversing entry for factory overhead) |

Table (5)

- Factory overhead (expense) is a component of owner’s equity, and there is an increase in the value of expense. Hence, debit the factory overhead account with $3,600.

- Work in process inventory is an asset account, and it decreases the value of asset. Hence, credit the work in process inventory account with $3,600.

Want to see more full solutions like this?

Chapter 27 Solutions

Bundle: College Accounting, Chapters 1-15, 22nd + Study Guide with Working Papers + CengageNOWv2™, 1 term Printed Access Card

- Repsola is a drilling company that operates an offshore Oilfield in Feeland. Five yearsago, Feeland had a major oil discovery and granted licenses to drill oil to reputable,experienced drilling companies. The licensing agreement requires the company toremove the oil rig at the end of production and restore the seabed. Ninety percent ofthe eventual costs of undertaking the work relate to the removal of the oil rig andrestoration of damage caused by building it and ten percent arise through theextraction of the oil. At the Statement of Financial Position (SOFP) date (December 312025), the rig has been constructed but no oil has been extractedOn January 1st 2023, Repsola obtained the license to construct an oil rig at a cost of$500 million. Two years later the oil rig was completed. The rig is expected to beremoved in 20 years from the date of acquisition. The estimated eventual cost is 100million. The company’s cost of capital is 10% and its year end is December 31st. Repsolauses…arrow_forwardMaharaj Garage & Car Supplies sells a variety of automobile cleaning gadgets including a variety of hand vacuums. The business began the first quarter (January to March) of 2024 with 20 (Mash up Dirt) deep clean, cordless vacuums at a total cost of $126,800. During the quarter, the business completed the following transactions relating to the "Mash up Dirt" brand. January 8 January 31 February 4 February 10 February 28 March 4 March 10 March 31 March 31 105 vacuums were purchased at a cost of $6,022 each. In addition, the business paid a freight charge of $518 cash on each vacuum to have the inventory shipped from the point of purchase to their warehouse. The sales for January were 85 vacuums which yielded total sales revenue of $768,400. (25 of these units were sold on account to Mandys Cleaning Supplies, a longstanding customer) A new batch of 65 vacuums was purchased at a total cost of $449,800 8 of the vacuums purchased on February 4 were returned to the supplier, as they were…arrow_forwardTutor give me ansarrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning