EP CENGAGENOWV2 FOR HEINTZ/PARRY'S COLL

23rd Edition

ISBN: 9780357421123

Author: HEINTZ

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

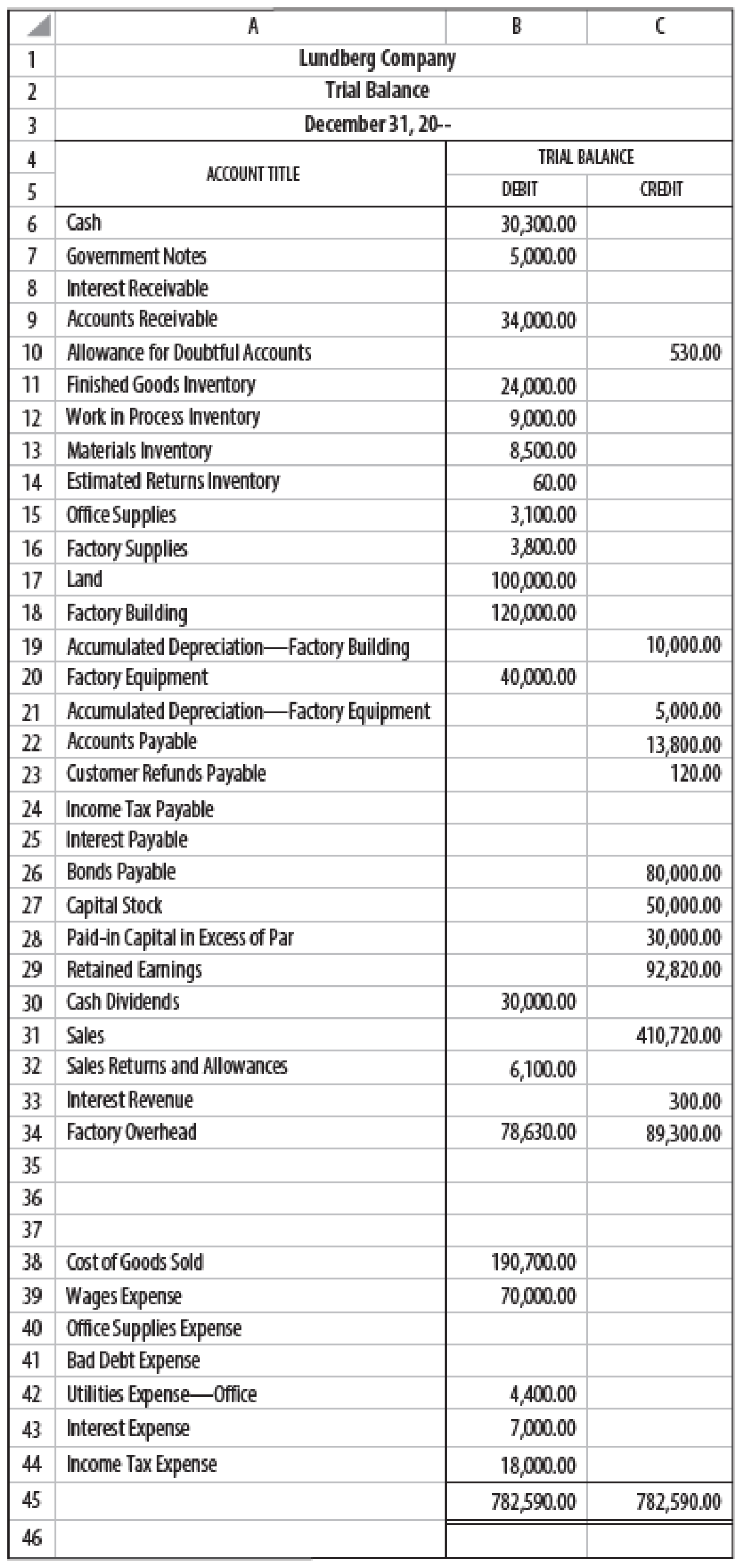

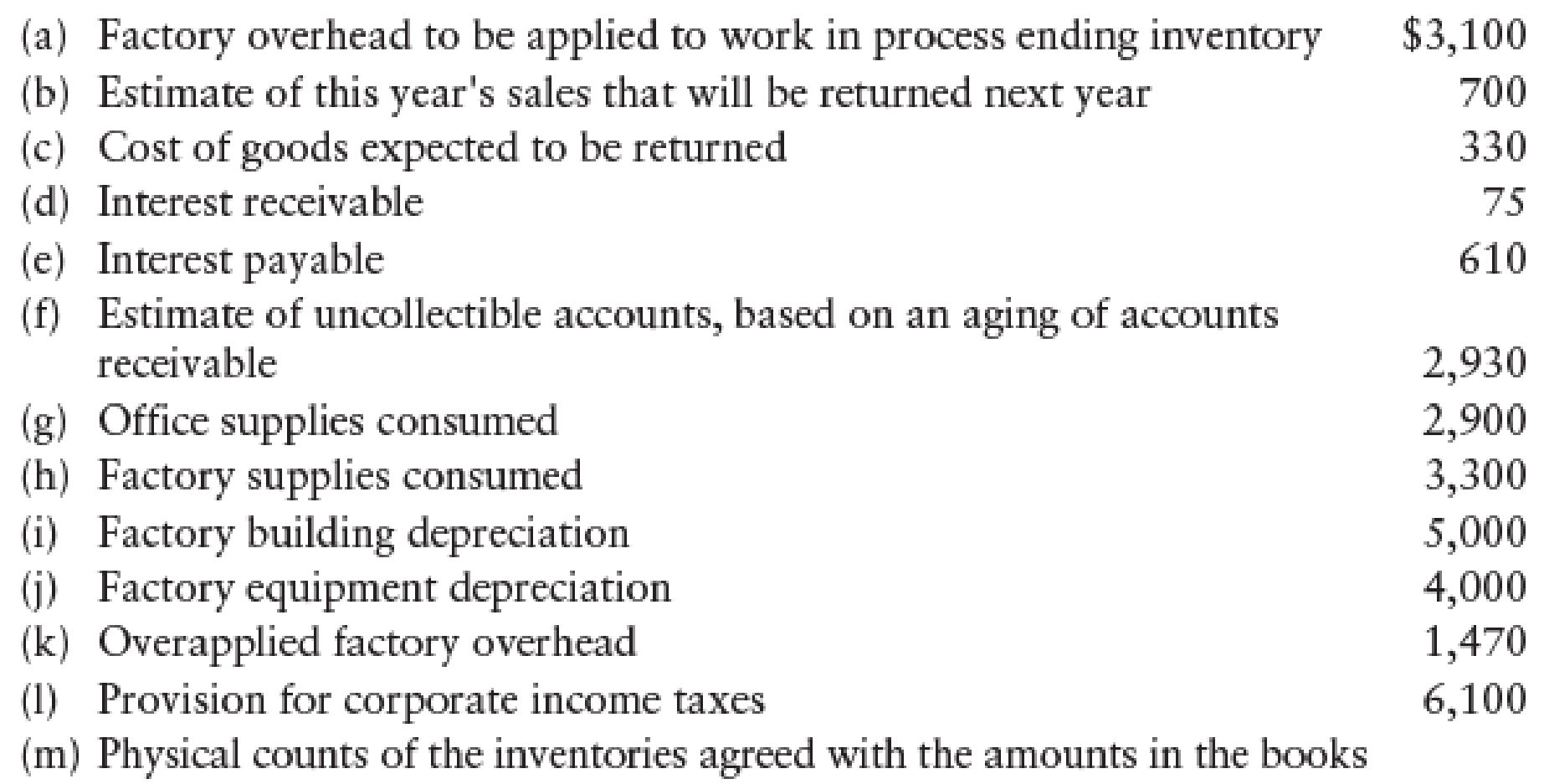

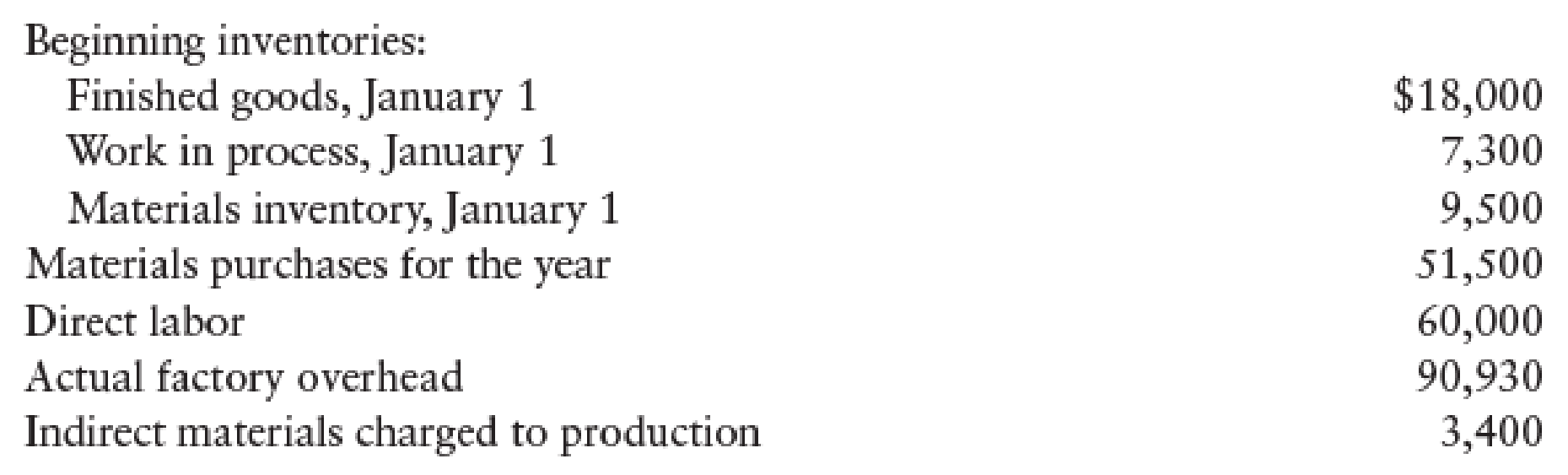

Chapter 27, Problem 6SPA

SPRE ADSHEET,

Data for adjusting the accounts are as follows:

Additional information needed to prepare the financial statements is as follows:

Required

- 1. Prepare a 6-column spreadsheet.

- 2. Prepare the following financial statements and schedule:

- (a) income statement

- (b) schedule of cost of goods manufactured

- (c) statement of

retained earnings - (d)

balance sheet

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

provide correct answer is

Given below for smith Enterprises

What is the payback period for the production line on these financial accounting question?

Chapter 27 Solutions

EP CENGAGENOWV2 FOR HEINTZ/PARRY'S COLL

Ch. 27 - Under the perpetual inventory system, Cost of...Ch. 27 - Prob. 2TFCh. 27 - On the spreadsheet, the factory overhead account...Ch. 27 - Prob. 4TFCh. 27 - The adjustment for factory overhead applied to...Ch. 27 - LO2 The adjustment for the amount of factory...Ch. 27 - The adjustment for depreciation expense for the...Ch. 27 - At the end of the accounting period, a credit...Ch. 27 - Prob. 4MCCh. 27 - Prob. 5MC

Ch. 27 - LO2 Prepare adjusting entries at December 31 for J...Ch. 27 - Prob. 2CECh. 27 - Prob. 3CECh. 27 - Prob. 1RQCh. 27 - Prob. 2RQCh. 27 - Prob. 3RQCh. 27 - Prob. 4RQCh. 27 - Prob. 5RQCh. 27 - What are the distinctive features of ToyJoys...Ch. 27 - Prob. 7RQCh. 27 - Prob. 8RQCh. 27 - Prob. 9RQCh. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEACh. 27 - Prob. 3SEACh. 27 - CLOSING JOURNAL ENTRIES Prepare closing journal...Ch. 27 - REVERSING JOURNAL ENTRIES Prepare reversing...Ch. 27 - SPRE ADSHEET, ADJUSTING ENTRIES, AND FIN ANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - ADJUSTING. CLOSING. AND REVERSING ENTRIES A...Ch. 27 - ADJUSTING ENTRIES INCLUDING ADJUSTMENT FOR...Ch. 27 - Prob. 2SEBCh. 27 - ADJUSTING JOURNAL ENTRIES FOR A MANUFACTURING...Ch. 27 - Prob. 4SEBCh. 27 - REVERSING ENTRIES Prepare reversing journal...Ch. 27 - SPREADSHEET, ADJUSTING ENTRIES, AND FINANCIAL...Ch. 27 - FINANCIAL STATEMENTS The adjusted trial balance...Ch. 27 - Prob. 8SPBCh. 27 - Prob. 1MYWCh. 27 - Reese Manufacturing Company manufactures and sells...Ch. 27 - Drafts of the condensed income statement and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute the gross profitarrow_forwardDaisy Inc., wants to make a profit of $25,000. It has variable costs of $80 per unit and fixed costs of $15,000. How much must it charge per unit if 4,000 units are sold? Ansarrow_forwardWhat is the payback period of this financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY