Concept explainers

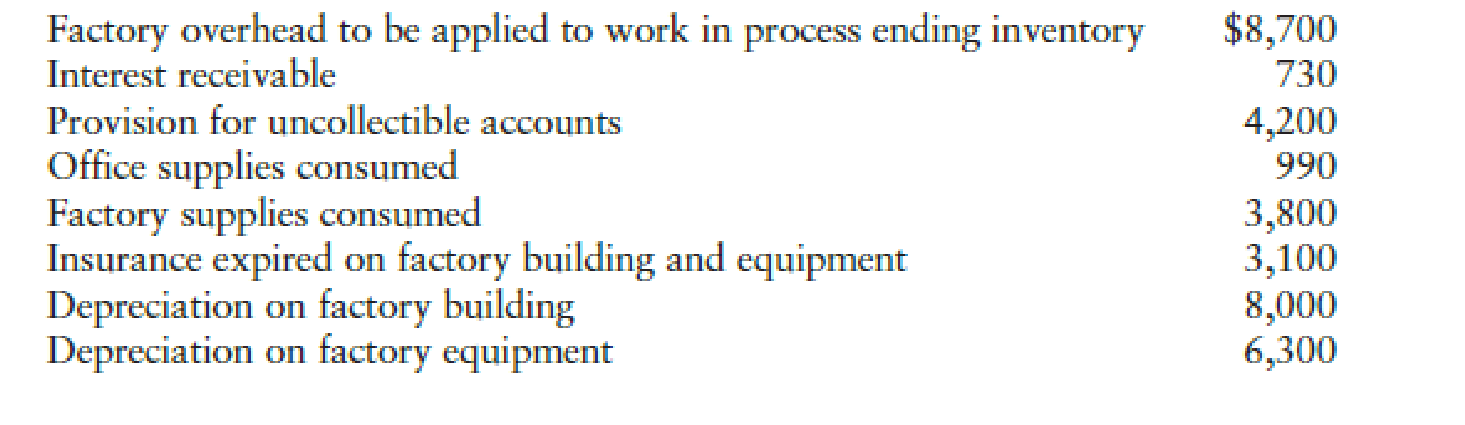

Prepare the necessary adjusting entries of Company D for the year ended December 31.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Factory Overhead Cost:

Factory overhead cost is the cost other than the direct material cost, and the direct labor cost which is not directly involved in the production of converting the raw materials to the finished products. If the direct material cost or direct labor cost does not constitute the major portion of the total cost of the finished product, then it may be classified as the factory overhead cost. For example: Cost of repairing, and maintaining factory equipment.

Prepare an adjusting entry to record the factory overhead applied to work in process ending inventory.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Work in process inventory | 8,700 | ||

| Factory overheads | 8,700 | |||

| (To record the transfer of factory overheads to work in process) |

Table (1)

- Work in process inventory is an asset account, and it increases the value of asset. Hence, debit the work in process inventory account with $8,700.

- Factory overhead (expense) is a component of owner’s equity, and there is a decrease in the value of expense. Hence, credit the factory overhead account with $8,700.

Prepare an adjusting entry to record the interest revenue earned during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Interest receivable | 730 | ||

| Interest revenue | 730 | |||

| (To record the interest revenue earned at the end of the year) |

Table (2)

- Interest receivable is an asset account, and it increases the value of asset. Hence, debit the interest receivable account with $730.

- Interest revenue is a component of owner’s equity, and it increases the value of owner’s equity. Hence, credit the interest revenue account with $730.

Prepare an adjusting entry to record the bad debt expense incurred during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Bad debt expense | 4,200 | ||

| Allowance for doubtful account | 4,200 | |||

| (To record the bad debt expense estimated at the end of the year) |

Table (3)

- Bad expense is component of owner’ equity and it decreases the value of owner’s equity. Hence, debit the bad expense with $4,200.

- Allowance for doubtful accounts is a contra-asset account, and it decreases the value of assets. Hence, credit the allowance for doubtful account with $4,200.

Prepare an adjusting entry to record the office supplies expense incurred during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Office supplies expense | 990 | ||

| Office supplies | 990 | |||

| (To adjust the office supplies expense incurred at the end of the accounting year) |

Table (4)

- Offices supplies expense is component of shareholders’ equity, and it decreases the value of owner’s equity. Hence, debit the office supplies expense with $990.

- Office supplies are asset account, and it decreases the value of assets. Hence, credit the office supplies account with $990.

Prepare an adjusting entry to record the factory supplies used during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Factory overhead (factory supplies expense) | 3,800 | ||

| Factory supplies | 3,800 | |||

| (To record the supplies expense incurred at the end of the year) |

Table (5)

- Factory overhead (expense) is a component of owner’s equity, and there is an increase in the value of expense. Hence, debit the factory overhead account with $3,800.

- Factory supplies are asset account, and it decreases the value of asset. Hence, credit the factory overhead account with $3,800.

Prepare an adjusting entry to record the insurance expense on the factory building and equipment incurred during the year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Factory overhead (insurance expense-factory and equipment) | 3,100 | ||

| Prepaid insurance | 3,100 | |||

| (To record the insurance expense incurred at the end of the year) |

Table (6)

- Factory overhead (insurance expense) is a component of owner’s equity, and there is an increase in the value of expense. Hence, debit the factory overhead account with $3,100.

- Prepaid insurance is an asset account, and it decreases the value of asset. Hence, credit the prepaid insurance account with $3,100.

Prepare an adjusting entry to record the depreciation expense on building incurred at the end of the accounting year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Factory overhead (depreciation expense) | 8,000 | ||

| Accumulated depreciation-Factory building | 8,000 | |||

| (To record the depreciation expense incurred at the end of the year) |

Table (7)

- Factory overhead (depreciation expense) is a component of owner’s equity, and there is an increase in the value of expenses. Hence, debit the factory overhead account with $8,000.

- Accumulated depreciation-factory building is a contra-asset account, and it decreases the value of asset. Hence, credit the accumulated depreciation-Factory building account with $8,000.

Prepare an adjusting entry to record the depreciation expense on equipment incurred at the end of the accounting year.

| Date | Account Title and Explanation | Post ref. |

Debit ($) |

Credit ($) |

| December 31 | Factory overhead (depreciation expense) | 6,300 | ||

| Accumulated depreciation-Factory equipment | 6,300 | |||

| (To record the depreciation expense incurred at the end of the year) |

Table (8)

- Factory overhead (depreciation expense) is a component of owner’s equity, and there is an increase in the value of expenses. Hence, debit the factory overhead account with $6,300.

- Accumulated depreciation-factory equipment is a contra-asset account, and it decreases the value of asset. Hence, credit the accumulated depreciation-factory equipment account with $6,300.

Want to see more full solutions like this?

Chapter 27 Solutions

Bundle: College Accounting, Chapters 1-15, Loose-Leaf Version, 22nd + LMS Integrated for CengageNOWv2, 1 term Printed Access Card

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage