(a)

To indicate:

The movement that represents an unanticipated expansionary government policy in the short run.

Answer to Problem 3P

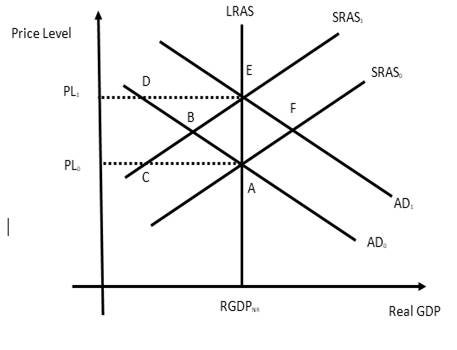

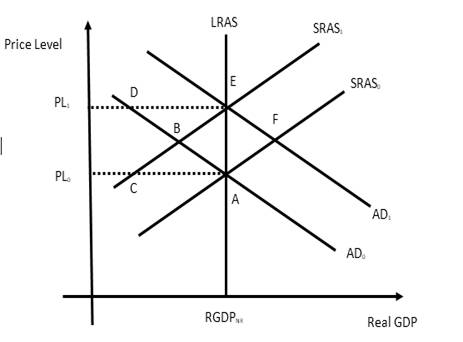

The movement of the equilibrium from point A to point F is due to an unanticipated expansionary government policy in the short run.

Explanation of Solution

The economy was in the initial equilibrium at point A with the intersection of AD0 and SARS0. At point A, the expected

Now, suppose the government wants to lower the

As the expansionary fiscal policy is implemented, the aggregate

Expansionary government policy:

The government policies that cause the aggregate demand of the economy to rise and thereby induce production and income along with the generation of employment is referred as the expansionary government policy. The tools used by the government for this purpose

(b)

To indicate:

The movement that represents an unanticipated contractionary government policy in the short run.

Answer to Problem 3P

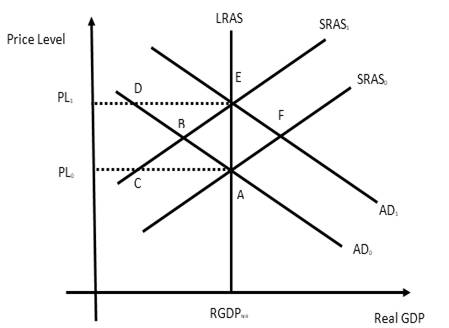

The movement from equilibrium point F to equilibrium point A represents the unanticipated contractionary government policy.

Explanation of Solution

The economy is in the long run equilibrium at point A with real GDP, RGDPNR and price level PL0. The economy is described by the aggregate demand curve AD0 and short-run

To bring back stability to the economy, government takes measures that shifts the aggregate demand curve to the left to its original position, which is only possible when the government pursues a contractionary fiscal policy. However, if the contractionary fiscal policy is unanticipated, the public will maintain its expectation about the price level and therefore, the short run aggregate supply curve will remain unaffected. A contractionary fiscal policy affects the aggregate demand by lowering it from its current level for all prices and thereby shifting the aggregate demand curve back from AD1to AD0. With no change in the position of the short run aggregate supply curve due to the unanticipated nature of the policy, the shift in the aggregate demand curve will being the economy back to the old equilibrium at point A from point F.

Contractionary government policy:

The government policies that cause the aggregate demand of the economy to fall and thereby discourages production and generation of income along with employment is referred as contractionary government policy. The tools used by the government for this purpose are taxation and government expenditure. For the contractionary purpose, the government may either raise the tax rate or lower its expenditure or both. Contractionary government policy, also called contractionary fiscal policy, help the economy control inflation by lowering the circulation of money in the economy.

(c)

To indicate:

The movement that represents an anticipated expansionary government policy under the rational expectations.

Answer to Problem 3P

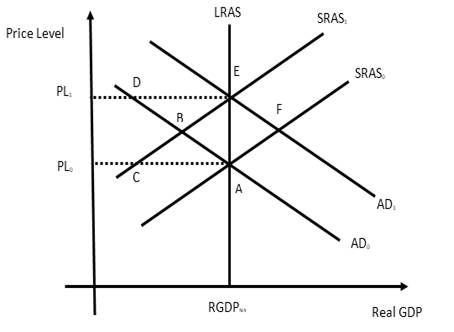

The movement from point A to point E represents completely anticipated expansionary government policy under rational expectations.

Explanation of Solution

When an expansionary fiscal policy is completely anticipated, public by virtue of rational expectation will know from before that there will be a rise in the price level due to the policy. They immediately revise their activities and thereby changes the position of the short-run aggregate supply curve. Labor will revise their wages upwards; household will revise its spending; producers will lower production due to rising cost and so on which will shift SRAS0to SRAS1 even before the policy comes into effect creating a new short run equilibrium point at R. As the expansionary policy is implemented, the shift in the aggregate demand curve from AD0to AD1 generates the long run equilibrium at point F, where the economy is in the long run potential level of output with a higher price level.

Expansionary government policy:

The government policies that cause the aggregate demand of the economy to rise and thereby induce production and income along with the generation of employment is referred as the expansionary government policy. The tools used by the government for this purpose taxation and government expenditure. For the expansionary purpose, the government may either lower the tax rate or increase its expenditure or both. Expansionary government policy, also called expansionary fiscal policy, can help the economy move out of a recessionary situation.

Rational expectations:

People make decisions based on three primary factors, namely human rationality, available information, and experiences. The theory of rational expectation suggests that the current expectation of people can influence the future state of the economy.

(d)

To indicate:

The movement that represents an anticipated contractionary government policy in the short-run.

Answer to Problem 3P

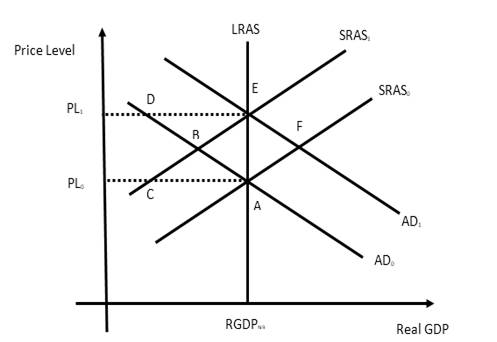

The movement from point E to point F represents completely anticipated contractionary government policy in the short run.

Explanation of Solution

Suppose the economy is in long-run equilibrium at point E. At this point, the government plans a contractionary fiscal policy. If the move is completely anticipated, public will know from before that a contractionary fiscal policy will lower the price level. They will immediately revise their activities and that will cause the short run supply curve to shift rightwards from SRAS1 to SRAS0 even before the policy is implemented. Thus, the economy will move to a new short run equilibrium at point F.

Contractionary government policy:

The government policies that cause the aggregate demand of the economy to fall and thereby discourages production and generation of income along with employment is referred as contractionary government policy. The tools used by the government for this purpose are taxation and government expenditure. For the contractionary purpose, the government may either raise the tax rate or lower its expenditure or both. Contractionary government policy, also called contractionary fiscal policy, help the economy control inflation by lowering the circulation of money in the economy.

(e)

To explain:

The result of a situation where an expansionary government policy is made, but the inflationary effects of this policy is less than expected.

Answer to Problem 3P

If the expansionary fiscal policy results in the less than expected inflation, it will inhibit the growth in output and employment.

Explanation of Solution

The expansionary fiscal policy boosts the aggregate demand which in turn puts an upward pressure on the price level. The rising price level encourages businesses to expand production level and generate income and employment. However, in case the fiscal policy fails to create the desired level of inflation, it will generate less impetus for the businesses to produce more and thereby inhibit the growth of output and employment.

Expansionary government policy:

The government policies that cause the aggregate demand of the economy to rise and thereby induce production and income along with the generation of employment is referred as the expansionary government policy. The tools used by the government for this purpose taxation and government expenditure. For the expansionary purpose, the government may either lower the tax rate or increase its expenditure or both. Expansionary government policy, also called expansionary fiscal policy, can help the economy move out of a recessionary situation.

Want to see more full solutions like this?

- Test Preparation QUESTION 2 [20] 2.1 Body Mass Index (BMI) is a summary measure of relative health. It is calculated by dividing an individual's weight (in kilograms) by the square of their height (in meters). A small sample was drawn from the population of UWC students to determine the effect of exercise on BMI score. Given the following table, find the constant and slope parameters of the sample regression function of BMI = f(Weekly exercise hours). Interpret the two estimated parameter values. X (Weekly exercise hours) Y (Body-Mass index) QUESTION 3 2 4 6 8 10 12 41 38 33 27 23 19 Derek investigates the relationship between the days (per year) absent from work (ABSENT) and the number of years taken for the worker to be promoted (PROMOTION). He interviewed a sample of 22 employees in Cape Town to obtain information on ABSENT (X) and PROMOTION (Y), and derived the following: ΣΧ ΣΥ 341 ΣΧΥ 176 ΣΧ 1187 1012 3.1 By using the OLS method, prove that the constant and slope parameters of the…arrow_forwardQUESTION 2 2.1 [30] Mariana, a researcher at the World Health Organisation (WHO), collects information on weekly study hours (HOURS) and blood pressure level when writing a test (BLOOD) from a sample of university students across the country, before running the regression BLOOD = f(STUDY). She collects data from 5 students as listed below: X (STUDY) 2 Y (BLOOD) 4 6 8 10 141 138 133 127 123 2.1.1 By using the OLS method and the information above derive the values for parameters B1 and B2. 2.1.2 Derive the RSS (sum of squares for the residuals). 2.1.3 Hence, calculate ô 2.2 2.3 (6) (3) Further, she replicates her study and collects data from 122 students from a rival university. She derives the residuals followed by computing skewness (S) equals -1.25 and kurtosis (K) equals 8.25 for the rival university data. Conduct the Jacque-Bera test of normality at a = 0.05. (5) Upon tasked with deriving estimates of ẞ1, B2, 82 and the standard errors (SE) of ẞ1 and B₂ for the replicated data.…arrow_forwardIf you were put in charge of ensuring that the mining industry in canada becomes more sustainable over the course of the next decade (2025-2035), how would you approach this? Come up with (at least) one resolution for each of the 4 major types of conflict: social, environmental, economic, and politicalarrow_forward

- How is the mining industry related to other Canadian labour industries? Choose one other industry, (I chose Forestry)and describe how it is related to the mining industry. How do the two industries work together? Do they ever conflict, or do they work well together?arrow_forwardWhat is the primary, secondary, tertiary, and quaternary levels of mining in Canada For each level, describe what types of careers are the most common, and describe what stage your industry’s main resource is in during that stagearrow_forwardHow does the mining industry in canada contribute to the Canadian economy? Describe why your industry is so important to the Canadian economy What would happen if your industry disappeared, or suffered significant layoffs?arrow_forward

- What is already being done to make mining in canada more sustainable? What efforts are being made in order to make mining more sustainable?arrow_forwardWhat are the environmental challenges the canadian mining industry face? Discuss current challenges that mining faces with regard to the environmentarrow_forwardWhat sustainability efforts have been put forth in the mining industry in canada Are your industry’s resources renewable or non-renewable? How do you know? Describe your industry’s reclamation processarrow_forward

- How does oligopolies practice non-price competition in South Africa?arrow_forwardWhat are the advantages and disadvantages of oligopolies on the consumers, businesses and the economy as a whole?arrow_forward1. After the reopening of borders with mainland China following the COVID-19 lockdown, residents living near the border now have the option to shop for food on either side. In Hong Kong, the cost of food is at its listed price, while across the border in mainland China, the price is only half that of Hong Kong's. A recent report indicates a decline in food sales in Hong Kong post-reopening. ** Diagrams need not be to scale; Focus on accurately representing the relevant concepts and relationships rather than the exact proportions. (a) Using a diagram, explain why Hong Kong's food sales might have dropped after the border reopening. Assume that consumers are indifferent between purchasing food in Hong Kong or mainland China, and therefore, their indifference curves have a slope of one like below. Additionally, consider that there are no transport costs and the daily food budget for consumers is identical whether they shop in Hong Kong or mainland China. I 3. 14 (b) In response to the…arrow_forward

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning