a)

To find how many batteries were tested.

a)

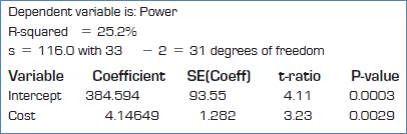

Answer to Problem 33E

The number of batteries tested = 33.

Explanation of Solution

Given:

The number of batteries tested = 33.

b)

To explain whether the conditions for inference are satisfied.

b)

Answer to Problem 33E

All conditions are satisfied.

Explanation of Solution

Given:

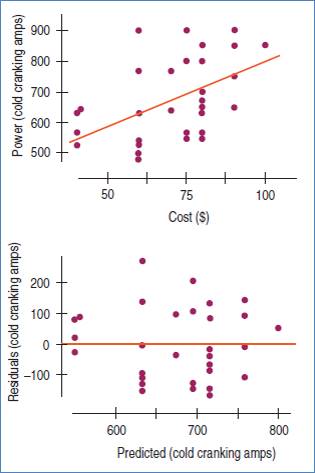

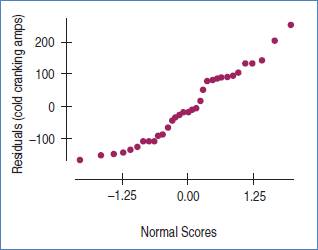

The conditions are: straight enough, Independence, Randomization, Random residual, Does plot thicken? and Nearly normal condition.

We will check it one by one.

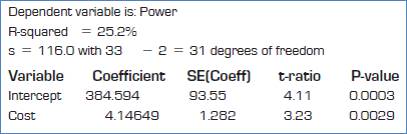

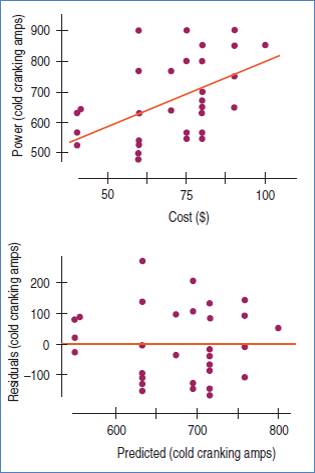

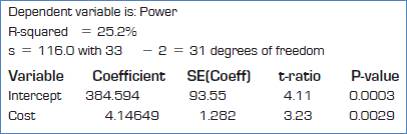

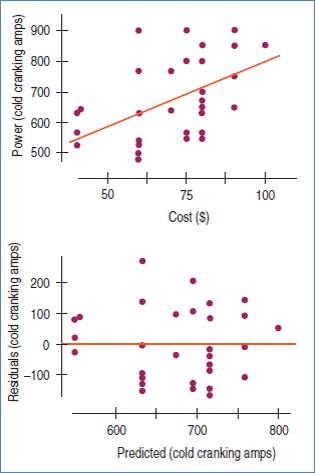

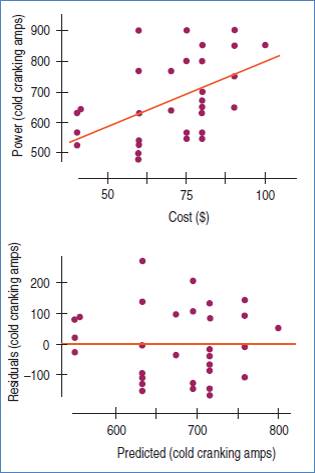

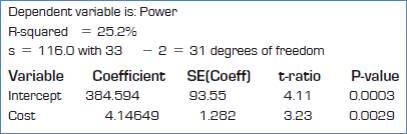

Straight enough condition: Satisfied, because no curvature is present in the

Independence assumption: Satisfied, because the 33 cars are less than 10% of the population of all cars.

Randomization condition: Satisfied, assuming that the sample is representative for the population.

Random residuals condition: Satisfied, because there is no obvious pattern in the residual plot.

Does the plot thicken? condition: Satisfied, because the vertical spread in the residual plot is not increasing or decreasing.

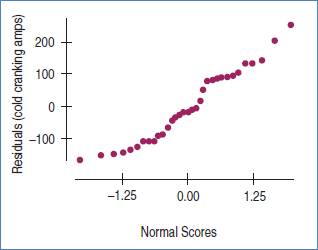

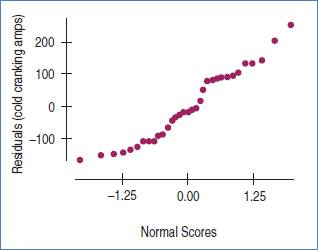

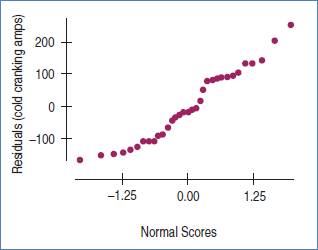

Nearly normal condition: Satisfied, because the normal quantile plot of the residual is roughly linear.

c)

To test an appropriate hypothesis.

c)

Answer to Problem 33E

There is sufficient evidence that the slope is non zero and provide evidence that the more expensive batteries do have more cranking amps.

Explanation of Solution

Given:

Formula:

Test statistic:

The null and alternative hypotheses:

Test statistic:

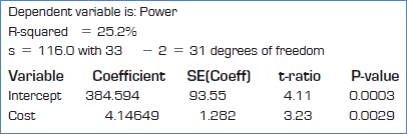

The degrees of freedom = df = 31

Therefore, p-value would be,

P-value = 0.00146 …Using excel formula, =TDIST(3.23,31,1)

Decision: P-value < 0.05, reject H0.

Conclusion: There is sufficient evidence that the slope is non zero and provide evidence that the more expensive batteries do have more cranking amps.

d)

To explain whether the association is strong.

d)

Answer to Problem 33E

No.

Explanation of Solution

Given:

The R-square value is 25.2% which is very low and s = 116. Therefore, there is no strong relationship.

e)

To write the equation of the regression line.

e)

Answer to Problem 33E

Explanation of Solution

Given:

The general regression equation is,

Here,

Therefore, the equation of regression line is,

f)

To find the 90% confidence interval for slope.

f)

Answer to Problem 33E

The 90% confidence interval for slope is,

Explanation of Solution

Given:

Formula:

Confidence interval for slope is,

First, need to find critical value

Critical value for df = 31 and confidence level = 0.90 is,

Therefore, the 90% confidence interval for slope is,

g)

To interpret the 90% confidence interval for slope.

g)

Answer to Problem 33E

We are 90% confident that Cranking amps increases on average between 1.97 and 6.32 per dollar of battery cost increases.

Explanation of Solution

Given:

The 90% confidence interval for slope is,

We are 90% confident that Cranking amps increases on average between 1.97 and 6.32 per dollar of battery cost increases.

Chapter 27 Solutions

Stats: Modeling the World Nasta Edition Grades 9-12

Additional Math Textbook Solutions

A First Course in Probability (10th Edition)

University Calculus: Early Transcendentals (4th Edition)

College Algebra (7th Edition)

Basic Business Statistics, Student Value Edition

Calculus for Business, Economics, Life Sciences, and Social Sciences (14th Edition)

A Problem Solving Approach To Mathematics For Elementary School Teachers (13th Edition)

- 3. Bayesian Inference – Updating Beliefs A medical test for a rare disease has the following characteristics: Sensitivity (true positive rate): 99% Specificity (true negative rate): 98% The disease occurs in 0.5% of the population. A patient receives a positive test result. Questions: a) Define the relevant events and use Bayes’ Theorem to compute the probability that the patient actually has the disease.b) Explain why the result might seem counterintuitive, despite the high sensitivity and specificity.c) Discuss how prior probabilities influence posterior beliefs in Bayesian inference.d) Suppose a second, independent test with the same accuracy is conducted and is also positive. Update the probability that the patient has the disease.arrow_forward4. Linear Regression - Model Assumptions and Interpretation A real estate analyst is studying how house prices (Y) are related to house size in square feet (X). A simple linear regression model is proposed: The analyst fits the model and obtains: • Ŷ50,000+150X YBoB₁X + € • R² = 0.76 • Residuals show a fan-shaped pattern when plotted against fitted values. Questions: a) Interpret the slope coefficient in context. b) Explain what the R² value tells us about the model's performance. c) Based on the residual pattern, what regression assumption is likely violated? What might be the consequence? d) Suggest at least two remedies to improve the model, based on the residual analysis.arrow_forward5. Probability Distributions – Continuous Random Variables A factory machine produces metal rods whose lengths (in cm) follow a continuous uniform distribution on the interval [98, 102]. Questions: a) Define the probability density function (PDF) of the rod length.b) Calculate the probability that a randomly selected rod is shorter than 99 cm.c) Determine the expected value and variance of rod lengths.d) If a sample of 25 rods is selected, what is the probability that their average length is between 99.5 cm and 100.5 cm? Justify your answer using the appropriate distribution.arrow_forward

- 2. Hypothesis Testing - Two Sample Means A nutritionist is investigating the effect of two different diet programs, A and B, on weight loss. Two independent samples of adults were randomly assigned to each diet for 12 weeks. The weight losses (in kg) are normally distributed. Sample A: n = 35, 4.8, s = 1.2 Sample B: n=40, 4.3, 8 = 1.0 Questions: a) State the null and alternative hypotheses to test whether there is a significant difference in mean weight loss between the two diet programs. b) Perform a hypothesis test at the 5% significance level and interpret the result. c) Compute a 95% confidence interval for the difference in means and interpret it. d) Discuss assumptions of this test and explain how violations of these assumptions could impact the results.arrow_forward1. Sampling Distribution and the Central Limit Theorem A company produces batteries with a mean lifetime of 300 hours and a standard deviation of 50 hours. The lifetimes are not normally distributed—they are right-skewed due to some batteries lasting unusually long. Suppose a quality control analyst selects a random sample of 64 batteries from a large production batch. Questions: a) Explain whether the distribution of sample means will be approximately normal. Justify your answer using the Central Limit Theorem. b) Compute the mean and standard deviation of the sampling distribution of the sample mean. c) What is the probability that the sample mean lifetime of the 64 batteries exceeds 310 hours? d) Discuss how the sample size affects the shape and variability of the sampling distribution.arrow_forwardA biologist is investigating the effect of potential plant hormones by treating 20 stem segments. At the end of the observation period he computes the following length averages: Compound X = 1.18 Compound Y = 1.17 Based on these mean values he concludes that there are no treatment differences. 1) Are you satisfied with his conclusion? Why or why not? 2) If he asked you for help in analyzing these data, what statistical method would you suggest that he use to come to a meaningful conclusion about his data and why? 3) Are there any other questions you would ask him regarding his experiment, data collection, and analysis methods?arrow_forward

- Businessarrow_forwardWhat is the solution and answer to question?arrow_forwardTo: [Boss's Name] From: Nathaniel D Sain Date: 4/5/2025 Subject: Decision Analysis for Business Scenario Introduction to the Business Scenario Our delivery services business has been experiencing steady growth, leading to an increased demand for faster and more efficient deliveries. To meet this demand, we must decide on the best strategy to expand our fleet. The three possible alternatives under consideration are purchasing new delivery vehicles, leasing vehicles, or partnering with third-party drivers. The decision must account for various external factors, including fuel price fluctuations, demand stability, and competition growth, which we categorize as the states of nature. Each alternative presents unique advantages and challenges, and our goal is to select the most viable option using a structured decision-making approach. Alternatives and States of Nature The three alternatives for fleet expansion were chosen based on their cost implications, operational efficiency, and…arrow_forward

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman