Capital rationing decision for a service company involving four proposals

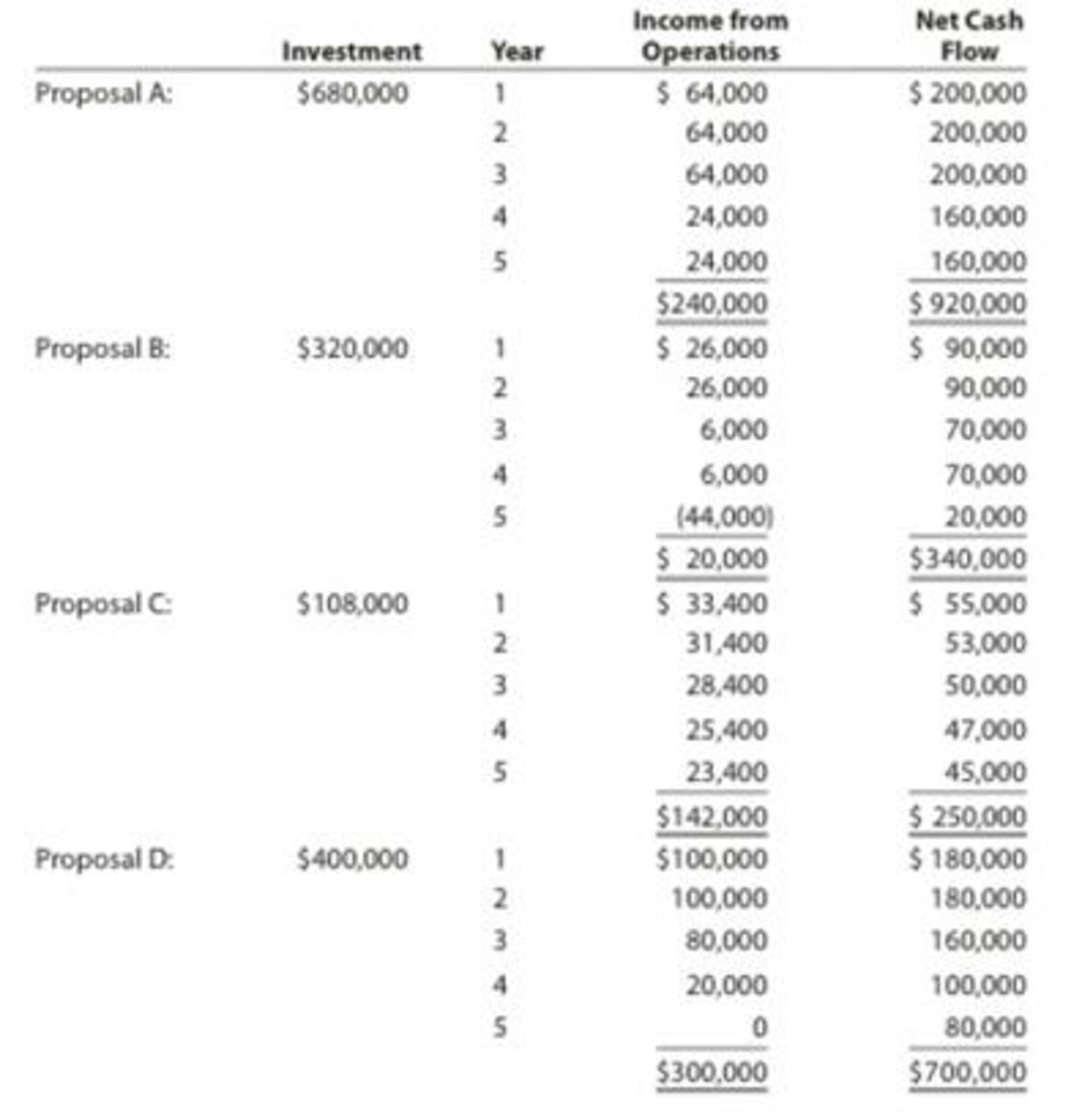

Renaissance Capital Group is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated operating income, and net cash flow for each proposal are as follows:

The company’s capital rationing policy requires a maximum cash payback period of three years. In addition, a minimum average

Instructions

- 1. Compute the cash payback period for each of the four proposals.

- 2. Giving effect to straight-line depreciation on the investments and assuming no estimated residual value, compute the average rate of return for each of the four proposals. (Round to one decimal place.)

- 3. Using the following format, summarize the results of your computations in parts (1) and (2). By placing the computed amounts in the first two columns on the left and by placing a check mark in the appropriate column to the right, indicate which proposals should be accepted for further analysis and which should be rejected.

- 4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 15% and the present value table appearing in Exhibit 2 of this chapter.

- 5. Compute the present value index for each of the proposals in part (4). Round to two decimal places.

- 6. Rank the proposals from most attractive to least attractive, based on the present values of net

cash flows computed in part (4). - 7. Rank the proposals from most attractive to least attractive, based on the present value indexes computed in part (5).

- 8. Based on the analyses, comment on the relative attractiveness of the proposals ranked in parts (6) and (7).

1.

Calculate the cash payback period for the given proposals.

Explanation of Solution

Cash payback method:

Cash payback period is the expected time period which is required to recover the cost of investment. It is one of the capital investment method used by the management to evaluate the long-term investment (fixed assets) of the business.

The cash payback period for the given proposals is as follows:

Proposal A:

Initial investment=$680,000

| Cash payback period of Proposal A | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 200,000 | 200,000 | ||

| 2 | 200,000 | 400,000 | ||

| 3 | 200,000 | 600,000 | ||

| 6 months (1) | 80,000 | 680,000 | ||

Table (1)

Hence, the cash payback period of proposal A is 3 years and 6 months.

Working note:

1. Calculate the no. of months in the cash payback period:

Proposal B:

Initial investment=$320,000

| Cash payback period of Proposal B | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 90,000 | 90,000 | ||

| 2 | 90,000 | 180,000 | ||

| 3 | 70,000 | 250,000 | ||

| 4 | 70,000 | 320,000 | ||

Table (2)

Hence, the cash payback period of proposal B is 4 years.

Proposal C:

Initial investment=$108,000

| Cash payback period of Proposal C | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 55,000 | 55,000 | ||

| 2 | 53,000 | 108,000 | ||

Table (3)

Hence, the cash payback period of proposal C is 2 years.

Proposal D:

Initial investment=$400,000

| Cash payback period of Proposal D | ||||

| Year | Net cash flows | Cumulative net cash flows | ||

| 1 | 180,000 | 180,000 | ||

| 2 | 180,000 | 360,000 | ||

| 3 months (2) | 40,000 | 400,000 | ||

Table (4)

Hence, the cash payback period of proposal D is 2 years and 3 months.

Working note:

2. Calculate the no. of months in the cash payback period:

2.

Calculate the average rate of return for the give proposals.

Explanation of Solution

Average rate of return method:

Average rate of return is the amount of income which is earned over the life of the investment. It is used to measure the average income as a percent of the average investment of the business, and it is also known as the accounting rate of return.

The average rate of return is computed as follows:

The average rate of return for the given proposals is as follows:

Proposal A:

Hence, the average rate of return for Proposal A is 14.1%.

Proposal B:

Hence, the average rate of return for Proposal B is 2.5%.

Proposal C:

Hence, the average rate of return for Proposal C is 52.6%.

Proposal D:

Hence, the average rate of return for Proposal D is 30.0%.

3.

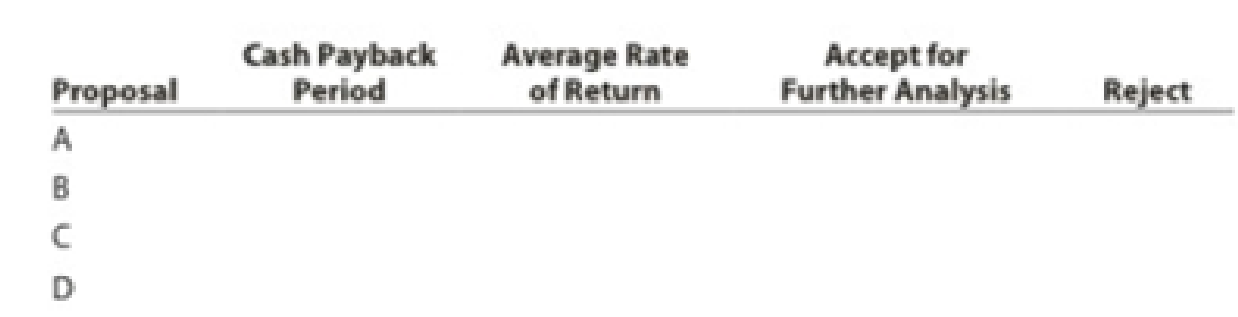

Indicate the proposals which should be accepted for further analysis, and which should be rejected.

Explanation of Solution

The proposals which should be accepted for further analysis, and which should be rejected is as follows:

Figure (1)

Proposals A and B are rejected, because proposal A and B fails to meet the required maximum cash back period of 3 years, and they has less rate of return than the other proposals. Hence, Proposals C and D are preferable.

4.

Calculate the net present value of preferred proposals.

Explanation of Solution

Net present value method:

Net present value method is the method which is used to compare the initial cash outflow of investment with the present value of its cash inflows. In the net present value, the interest rate is desired by the business based on the net income from the investment, and it is also called as the discounted cash flow method.

Calculate the net present value of the proposals which has 12% rate of return as follows:

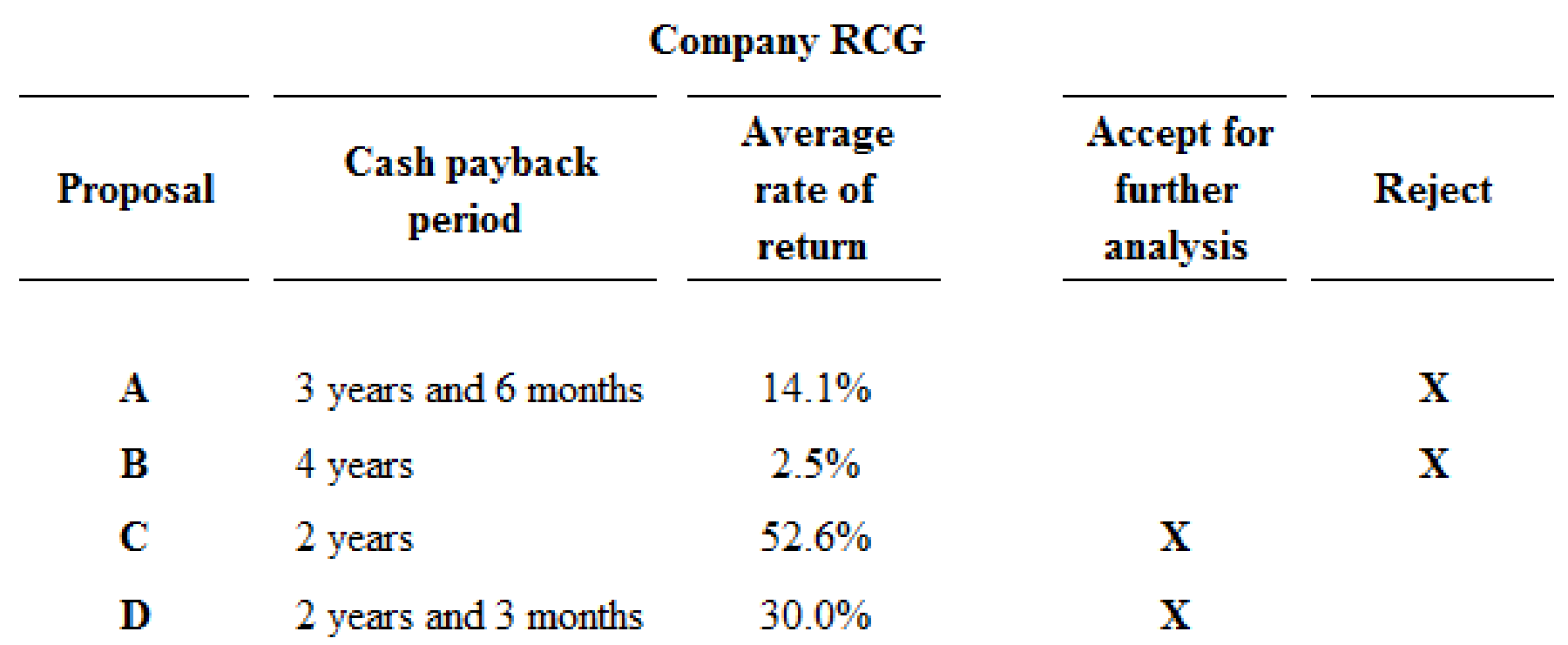

Proposal C:

Figure (2)

Hence, the net present value of proposal C is $62,067.

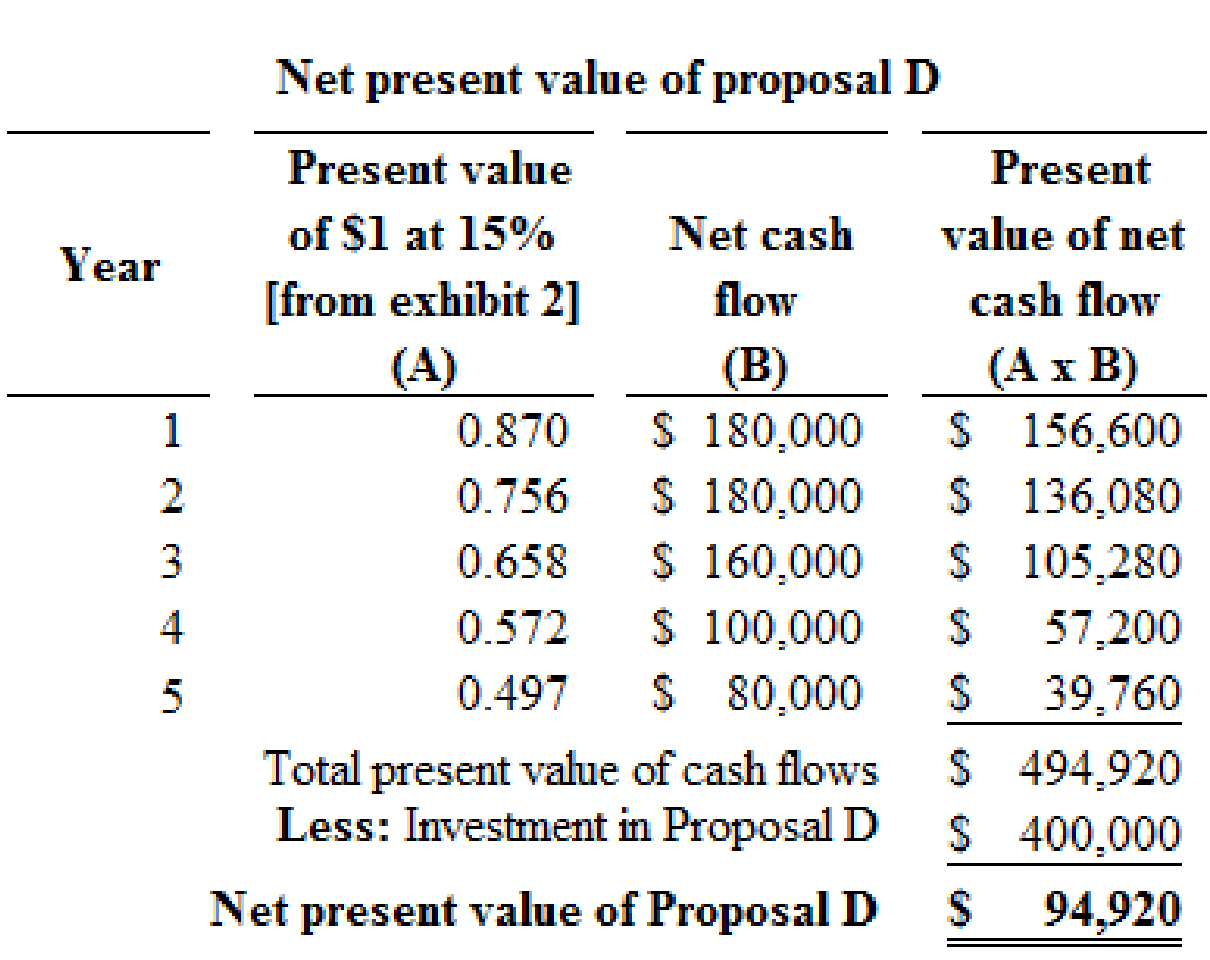

Proposal D:

Figure (3)

Hence, the net present value of proposal D is $94,920.

5.

Calculate the present value index for each proposal.

Explanation of Solution

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index for each proposal is as follows:

Proposal C:

Calculate the present value index for proposal C:

Hence, the present value index for proposal C is 1.575.

Proposal D:

Calculate the present value index for proposal D:

Hence, the present value index for proposal D is 1.237.

6.

Rank the proposal from most attractive to least attractive, based on the present value of net cash flows.

Explanation of Solution

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index is computed as follows:

Proposals are arranged by rank is as follows:

| Proposals | Net present value | Rank |

| Proposal D | $ 94,920 | 1 |

| Proposal C | $ 62,067 | 2 |

Table (5)

7.

Rank the proposal from most attractive to least attractive, based on the present value of index.

Explanation of Solution

Present value index:

Present value index is a technique, which is used to rank the proposals of the business. It is used by the management when the business has more investment proposals, and limited fund.

The present value index is computed as follows:

Proposals are arranged by rank is as follows:

| Proposals | Present value index | Rank |

| Proposal C | 1.57 | 1 |

| Proposal D | 1.24 | 2 |

Table (6)

8.

Analyze the proposal which is favor to investment, and comment on the relative attractiveness of the proposals based on the rank.

Explanation of Solution

On the basis of net present value:

The net present value of Proposal C is $62,067, and Proposal D is $94,920. In this case, the net present value of proposal D is more than the net present value of proposal C. Hence, investment in Proposal D is preferable.

On the basis of present value index:

The present value index of Proposal C is 1.57, and the present value index of Proposal D is 1.24. In this case, Proposal C has the favorable present value index, because the present value index of Proposal C (1.57) is more than Proposal D (1.24). Thus, the investment in Proposal C is preferable (favorable).

Every business tries to get maximum profit with minimum investment. Hence, the cost of investment in Proposal C is less than the proposal D. Thus, investment in Proposal C is preferable.

Want to see more full solutions like this?

Chapter 26 Solutions

FINANCIAL&MANAGERIAL ACCOUNTING(LL)W/AC

- 9. In a bank reconciliation, a bank service charge would be:A. Deducted from the book balanceB. Added to the bank balanceC. Deducted from the bank balanceD. Ignoredarrow_forwardWhich statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statement need helparrow_forward10. Which statement is prepared first in the accounting cycle?A. Balance SheetB. Statement of Retained EarningsC. Income StatementD. Cash Flow Statementhelp mearrow_forward

- I need help The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardNo use chatgpt 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward

- Don't use chatgpt The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardThe normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed help in this .arrow_forwardThe normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the asset Help!arrow_forward

- No AI The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardWhich item would appear on the statement of retained earnings?A. DividendsB. InventoryC. Prepaid RentD. Notes Payablearrow_forwardWhat does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College