Concept explainers

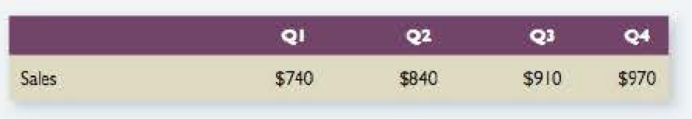

Calculating Cash Collections The Litzenberger Company has projected the following quarterly sales amounts for the coming year:

- a. Accounts receivable at the beginning of the year are $335. The company has a 45-day collection period. Calculate cash collections in each of the four quarters by completing the following:

- b. Rework (a) assuming a collection period of 60 days.

- c. Rework (a) assuming a collection period of 30 days.

a.

To compute: The cash collection in each of 4 quarters.

Cash Collection:

The receipts at the side of the cash account show the cash collection by the company. The company receives cash when there are cash sales and the collection from accounts receivable is also the cash collection of a company.

Explanation of Solution

Given,

Sales for Q1 are $740.

Sales for Q2 are $840.

Sales for Q3 are $910.

Sales for Q4 are $970.

Accounting receivables at the beginning of the year are $335.

Collection period is 45-days.

Table that shows the amount of cash collection in each quarter,

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

| Beginning Receivable | 335 | 370 | 420 | 455 |

| Sales | 740 | 840 | 910 | 970 |

| Cash Collections | (705) | (790) | (875) | (940) |

| Ending Receivables | 370 | 420 | 455 | 485 |

Table (1)

Working notes:

Calculate the amount of ending receivable in Q1,

Calculate the cash collection in Q1,

Calculate the amount of ending receivable in Q2,

Calculate the cash collection in Q2,

Calculate the amount of ending receivable in Q3,

Calculate the cash collection in Q3,

Calculate the amount of ending receivable in Q4,

Calculate the cash collection in Q4,

Thus, the cash collection in Q1 is $705, Q2 is $790, Q3 is $875, and Q4 is $940.

b.

To compute: The cash collection in each of 4 quarters. The collection period is 60 days.

Explanation of Solution

Given,

Collection period is 60-days.

Table that shows the amount of cash collection in each quarter,

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

| Beginning Receivable | 335 | 493 | 560 | 607 |

| Sales | 740 | 840 | 910 | 970 |

| Cash Collections | (582) | (773) | (863) | (930) |

| Ending Receivables | 493 | 560 | 607 | 647 |

Table (2)

Working Notes:

Calculate the amount of ending receivable in Q1,

Calculate the cash collection in Q1,

Calculate the amount of ending receivable in Q2,

Calculate the cash collection in Q2,

Calculate the amount of ending receivable in Q3,

Calculate the cash collection in Q3,

Calculate the amount of ending receivable in Q4,

Calculate the cash collection in Q4,

Thus, the cash collection in Q1 is $582, Q2 is $773, Q3 is $863, and Q4 is $930.

c.

To compute: The cash collection in each of 4 quarters. The collection period is 30days.

Explanation of Solution

Given,

Collection period is 30-days.

Table that shows the amount of cash collection in each quarter,

| Particulars |

Q1 ($) |

Q2 ($) |

Q3 ($) |

Q4 ($) |

| Beginning Receivable | 335 | 247 | 280 | 303 |

| Sales | 740 | 840 | 910 | 970 |

| Cash Collections | (828) | (807) | (887) | (950) |

| Ending Receivables | 247 | 280 | 303 | 323 |

Table (3)

Working notes:

Calculate the amount of ending receivable in Q1,

Calculate the cash collection in Q1,

Calculate the amount of ending receivable in Q2,

Calculate the cash collection in Q2,

Calculate the amount of ending receivable in Q3,

Calculate the cash collection in Q3,

Calculate the amount of ending receivable in Q4,

Calculate the cash collection in Q4,

Thus, the cash collection in Q1 is $828, Q2 is $807, Q3 is $887, and Q4 is $950.

Want to see more full solutions like this?

Chapter 26 Solutions

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Please help with the problem 5-49.arrow_forwardPlease help with these questionsarrow_forwardIn 1895, the first U.S. Putting Green Championship was held. The winner's prize money was $170. In 2022, the winner's check was $3,950,000. a. What was the percentage increase per year in the winner's check over this period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. If the winner's prize increases at the same rate, what will it be in 2053? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Increase per year b. Winners prize in 2053 %arrow_forward

- Derek plans to retire on his 65th birthday. However, he plans to work part-time until he turns 73.00. During these years of part-time work, he will neither make deposits to nor take withdrawals from his retirement account. Exactly one year after the day he turns 73.0 when he fully retires, he will begin to make annual withdrawals of $183,008.00 from his retirement account until he turns 94.00. After this final withdrawal, he wants $1.52 million remaining in his account. He he will make contributions to his retirement account from his 26th birthday to his 65th birthday. To reach his goal, what must the contributions be? Assume a 6.00% interest rate. Round to 2 decimal places.arrow_forwardDerek plans to retire on his 65th birthday. However, he plans to work part-time until he turns 71.00. During these years of part-time work, he will neither make deposits to nor take withdrawals from his retirement account. Exactly one year after the day he turns 71.0 when he fully retires, he will begin to make annual withdrawals of $177,333.00 from his retirement account until he turns 94.00. He he will make contributions to his retirement account from his 26th birthday to his 65th birthday. To reach his goal, what must the contributions be? Assume a 9.00% interest rate. Submit Answer format: Currency: Round to: 2 decimal places.arrow_forwardDerek plans to retire on his 65th birthday. However, he plans to work part-time until he turns 72.00. During these years of part-time work, he will neither make deposits to nor take withdrawals from his retirement account. Exactly one year after the day he turns 72.0 when he fully retires, he will wants to have $3,104,476.00 in his retirement account. He he will make contributions to his retirement account from his 26th birthday to his 65th birthday. To reach his goal, what must the contributions be? Assume a 8.00% interest rate. Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward

- Banking and finance sector ma job kaise payearrow_forward1. Bond X is worth $91 today. The bond will mature in one year and pay $100 or $84 with probabilities 0.75 and 0.25, respectively. Assuming the bond pays no cash flows during the year, which of the following is closest to the expected return on the bond? 5% 0% 0% 5% 0% 2. At the beginning of the year, a mutual fund has a NAV of $20. At the end of the year, the NAV is $21 and the fund has received no dividends or other distributions throughout the year. The return on the fund’s benchmark over the same period of time was 10%. Suppose the fund incurred expenses of $2 per fund share during the year. What was the return on the fund’s underlying portfolio before any expenses that affected NAV? Did this before-expense return beat the fund’s benchmark? 15%; Yes, the fund’s underlying portfolio beat its benchmark 15%; No, the fund’s underlying portfolio beat its benchmark 0%; No, the fund’s underlying portfolio beat its benchmark 20%; Yes, the fund’s underlying portfolio beat its benchmark…arrow_forward1. Which of the following assets is most likely to trade over the counter but still have high liquidity? a. A short-term Treasury bond b. A long-term corporate bond c. A short-term corporate bond d. A large-cap stock e. A small-cap stock 2. Assume you purchased 600 shares of XYZ common stock on margin at $35 per share from your broker. If the initial margin is 60%, the amount you borrowed from the broker is closest to _________. a. $8,500 b. $21,000 c. $29,500 d. $12,500 e. $16,000 3. You invest $1,550 in security A with a beta of 1.4 and $1,350 in security B with a beta of 0.4. The beta of this portfolio is closest to _____________ . a. 0.95 b. 0.90 c. 1.35 d. 1.05 e. 1.15 4. Which of the following orders is most likely to increase the difference between the highest bid price and the lowest ask price? a. A large market order b. A large limit order c. A small limit order d. A small market order e. There will be no major difference between these 5. Bond X is worth $91 today.…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub