Requirement 1:

To compute:

Payback period of Investment

Requirement 1:

Answer to Problem 18QS

Solution:

Payback period of Investment = 5 years

Explanation:

Payback period of the investment is calculated as under −

Given,

- Initial investment = $ 80 million

- Annual net

cash flows = $ 16 million

Explanation of Solution

Given,

Initial investment = $ 80 million

Total present value of cash inflows will be calculated as under −

Now, for present value of cash inflows −

Given −

- Annual net

cash inflow = $ 16 million - Number of years = 8 years

- Interest rate or required rate = 8% Total present value of cash inflows =

Initial investment = $ 80 million

Total present value of cash inflows = $ 91.952 million

Thus,the payback period of the investment = 5 years.

---->

Requirement 2:

To compute:

Net present value of the investment.

Requirement 2:

Answer to Problem 18QS

Solution:

Net present value of the investment = $11.952 million

Explanation of Solution

Given,

Initial investment = $ 80 million

Total present value of cash inflows will be calculated as under −

Now, for present value of cash inflows −

Given −

- Annual net cash inflow = $ 16 million

- Number of years = 8 years

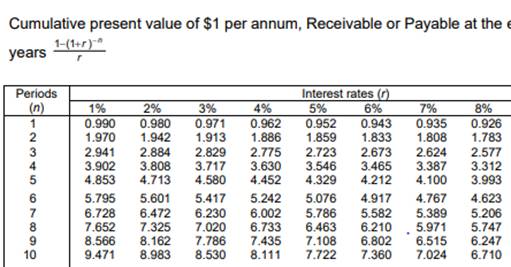

- Interest rate or required rate = 8% Total present value of cash inflows =

Net present value of the investment will be calculated as under −

Initial investment = $ 80 million

Total present value of cash inflows = $ 91.952 million

Thus, the net present value of the investment = $ 11.952 million.

Note −The following PVAF table has been used for referring PVAF @ 8 % for 8 years.

Want to see more full solutions like this?

Chapter 26 Solutions

Loose Leaf For Fundamental Accounting Principles Format: Loose-leaf

- Can you explain the correct approach to solve this general accounting question?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease explain this financial accounting problem by applying valid financial principles.arrow_forward

- Pine Ridge Corporation purchased a delivery van for $40,000 on January 1, 2018. The van has an expected salvage value of $2,000 and is expected to be driven 150,000 miles over its estimated useful life of 10 years. Actual miles driven were 18,500 in 2018 and 20,200 in 2019. Calculate the depreciation expense per mile under the units-of-activity method.arrow_forwardWhat role should the precautionary principle play in the development and application of accounting standards?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forward

- Which factor determines the capitalization of website development costs? a. Management's intention b. Application development stage c. Time spent on development d. Expected revenue generation HELParrow_forwardWhat was the cost of the item ?arrow_forwardCan you provide a detailed solution to this financial accounting problem using proper principles?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education