Concept explainers

Factory overhead is applied on the basis of direct labor hours. For Job Nos. 101, 102, 103, and 104, direct labor hours are 12,000, 10,000, 11,000, and 18,000, respectively. The overhead application rate is $1.20/direct labor hour

- (a) Purchased raw materials on account, $50,000.

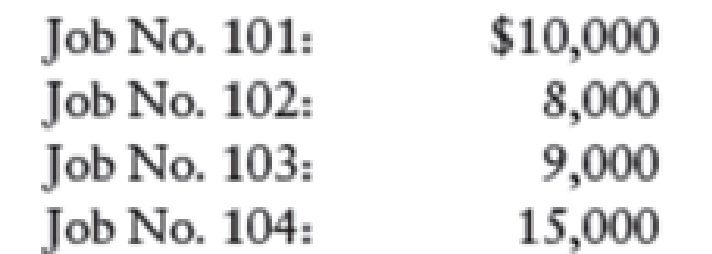

- (b) Issued direct materials:

- (c) Issued indirect materials to production, $8,000.

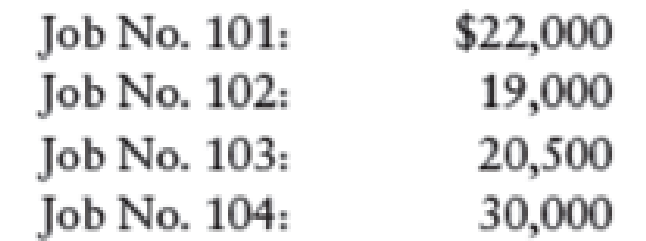

- (d) Incurred direct labor costs:

- (e) Charged indirect labor to production, $15,000.

- (f) Paid electricity bill, taxes, and repair fees for the factory and charged to production, $8,000.

- (g)

Depreciation expense on factory equipment, $30,000. - (h) Applied factory overhead to Job Nos. 101-104 using the predetermined factory overhead rare (see above).

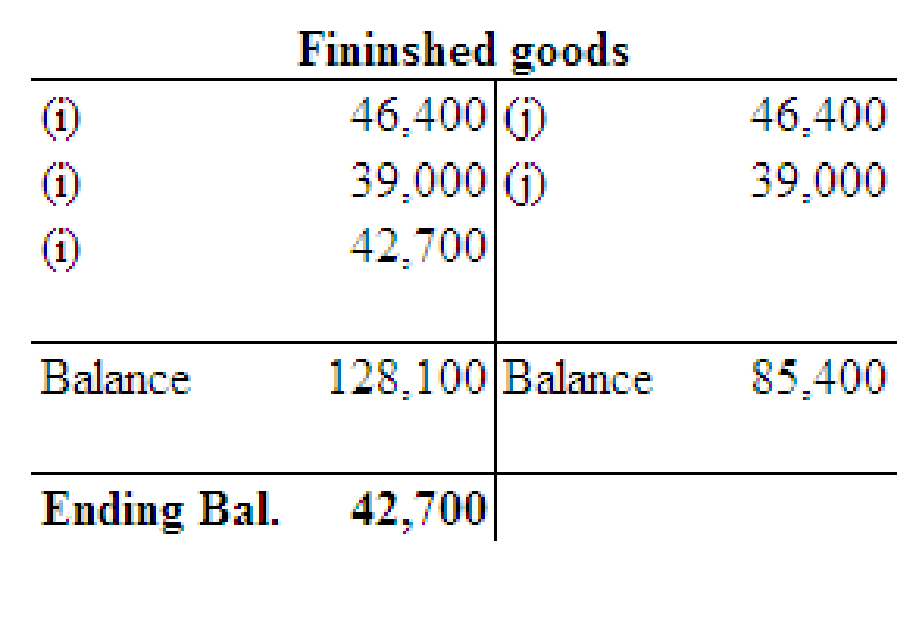

- (i) Finished Job Nos. 101-103 and transferred to the finished goods inventory account as products N, O, and P.

- (j) Sold products N and O for $50,000 and $45,400, respectively.

- (k) Transferred under- or overapplied factory overhead balance to the cost of goods sold account.

REQUIRED

- 1. Prepare general

journal entries to record transactions (a) through (k). Make compound entries for (b), (d), and (h), with separate debits for each job. - 2.

Post the entries to the work in process and finished goods T accounts only and determine the ending balances in these accounts. - 3. Compute the balance in the job cost ledger and verify that this balance agrees with that in the work in process control account.

1.

Prepare general journal entries to record transactions (a) through (k) and make compound entries for (b), (d), and (h), with separate debits for each job.

Explanation of Solution

Job order costing:

Job order costing is one of the methods of cost accounting under which cost is collected and gathered for each job, work order, or project separately. It is a system by which a factory maintains a separate record of each particular quantity of product that passes through the factory. Job order costing is used when the products produced are significantly different from each other.

Prepare journal entry to record the given transactions.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| a. | Material | 50,000 | |

| Accounts payable | 50,000 | ||

| (To record the purchase of materials on account.) | |||

| b. | Work in process | 10,000 | |

| Work in process | 8,000 | ||

| Work in process | 9,000 | ||

| Work in process | 15,000 | ||

| Materials | 42,000 | ||

| (To record issuance of direct materials for the job: job no.101,102,103,104) | |||

| c. | Factory overhead | 8,000 | |

| Materials | 8,000 | ||

| (To record the issuance of indirect materials) | |||

| d. | Work in process | 22,000 | |

| Work in process | 19,000 | ||

| Work in process | 20,500 | ||

| Work in process | 30,000 | ||

| Wages payable | 91,500 | ||

| (To record direct labor incurred for the job: job no.101,102,103,104) | |||

| e. | Factory overhead | 15,000 | |

| Wages payable | 15,000 | ||

| (To record the indirect labor charged to production) | |||

| f. | Factory overhead | 8,000 | |

| Cash | 8,000 | ||

| (To record the payment of electricity bill, heating oil, and repairs bills for the factory and charge made to production) | |||

| g. | Factory overhead | 30,000 | |

| Accumulated depreciation | 30,000 | ||

| (To record the depreciation expense on factory equipment) | |||

| h. | Work in process | 14,400 | |

| Work in process | 12,000 | ||

| Work in process | 13,200 | ||

| Work in process | 21,600 | ||

| Factory overhead | 61,200 | ||

| (To record applied factory overhead to the job: job no.101,102,103,104) | |||

| i. | Finished goods (Product N) | 46,400 | |

| Work in process | 46,400 | ||

| (To record the transfer of Job no. 101 to Product N) | |||

| Finished goods (Product O) | 39,000 | ||

| Work in process | 39,000 | ||

| (To record the transfer of Job no.102 to Product O) | |||

| Finished goods (Product P) | 42,700 | ||

| Work in process | 42,700 | ||

| (To record the transfer of Job no.103 to Product P) | |||

| j. | Accounts receivable | 50,000 | |

| Sales | 50,000 | ||

| (To record sale of product N) | |||

| Cost of goods sold | 46,400 | ||

| Finished goods (Product N) | 46,400 | ||

| (To record cost of goods sold on finished goods of Product N) | |||

| Accounts receivable | 45,400 | ||

| Sales | 45,400 | ||

| (To record sale of product O) | |||

| Cost of goods sold | 39,000 | ||

| Finished goods (Product O) | 39,000 | ||

| (To record cost of goods sold on finished goods of Product O) | |||

| k. | Factory overhead | 200 | |

| Cost of goods sold (2) | 200 | ||

| (To record cost of goods sold) |

(Table 1)

Working note:

(1) Calculate the actual factory overhead:

(2) Calculate the cost of goods sold:

2.

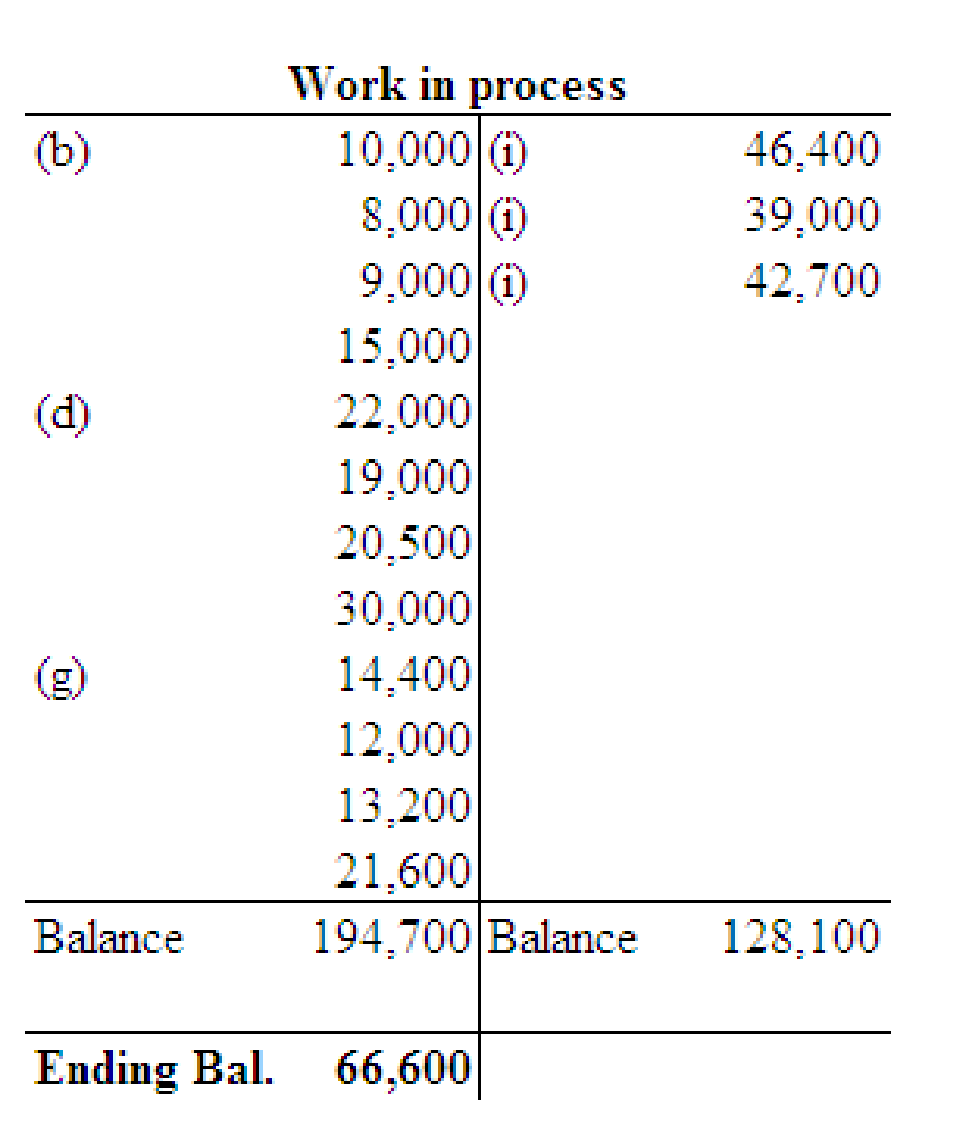

Post the entries to the work in process and finished goods T accounts and determine the ending balances in these accounts.

Explanation of Solution

Post the entries to the work in process and finished goods T accounts and determine the ending balances in these accounts.

3.

Compute the balance in the job cost ledger and verify whether the balance agrees with that in the work in process control account.

Explanation of Solution

The balance of the job cost ledger (Job No.104) is $66,600

Want to see more full solutions like this?

Chapter 26 Solutions

EP CENGAGENOWV2 FOR HEINTZ/PARRY'S COLL

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College