Concept explainers

Introduction:

Contribution Margin:

Contribution Margin is the profit earned from the sale of per unit and is the sum of turnover of the company less their direct sales costs. The margin is computed to measure the company’s ability to pay the fixed costs with the generated revenue after the payment of direct sales costs.

The Company always prefer a product with high contribution margins as they can easily cover the cost of manufacturing a product and generate a profit.

Requirement-1:

To determine:

The contribution margin per machine hour of Sung Company that is generated by each product.

Answer to Problem 5BPSB

Solution:

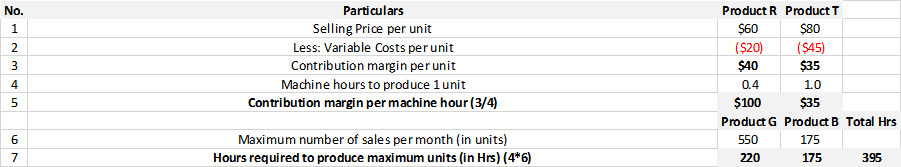

Below table shows the contribution of per machine hour for Project R and Project T.

Explanation of Solution

The contribution margin per machine hour is calculated by using the formula:

Therefore the Contribution Margin per machine hour for the Products R and T are calculated as follows:

Product R:

Given,

Contribution Margin per unit= $40

Machine hours to produce 1 unit= 0.4

Contribution Margin per Unit= $40/0.4=$100

Product T:

Given,

Contribution Margin per unit= $35

Machine hours to produce 1 unit= 1

Contribution Margin per Unit= $35/1=$35

Hence the contribution margin per machine hour for Product R is $100 and Product T is $35.

Requirement-2:

To determine:

The number of units of Products R and Products T produced by the company and total contribution margin , if the company continues to operate with only one shift.

Answer to Problem 5BPSB

Solution:

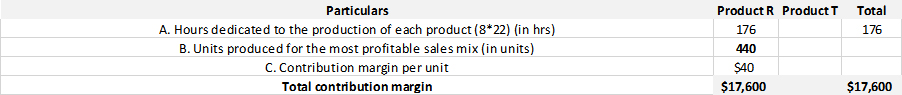

Below table shows the calculation of units produced for the most profitable sales mix and total contribution margin if the company continues with single shift.

Explanation of Solution

Step-1:

The hours dedicated to the production of each product in single shift = 8 Hours * 22 Working Days

The hours dedicated to the production of each product in single shift = 176 hours

Step-2:

Calculation of Units produced for most profitable sales mix when the company continues

with single shift.

Units Produced for the most profitable sales mix is calculated by using the formula:

Therefore the units produced for the most profitable sales mix=176/0.4=440 units

Step-3:

Calculation of contribution margin:

The contribution margin is computed by using the formula below:

Therefore the contribution margin of the product mix =440 units*$40=$17,600.

Hence the total units produced will be 440 units if the company operates in single shift of 8 hours for 22 working days and its total contribution margin is $17,600.

Requirement-3a:

To determine:

The number of units of Product R and T produced by the company and total contribution margin if the company adds another shift in addition to 8 hours.

Answer to Problem 5BPSB

Solution:

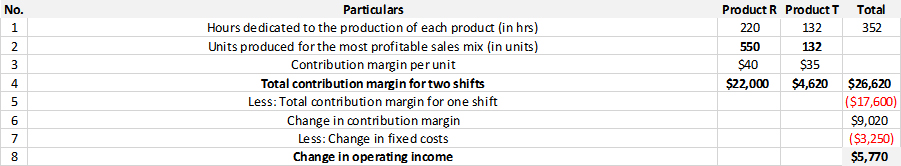

Below table shows the number of units produced by the company when it adds additional shift, total contribution margin in respect to change of shift.

Explanation of Solution

Step-1:

Hours dedicated for the production of products is done based on the ratio of maximum sales unit and machine hours to produce each unit.

Hours dedicated for the production of Product R= 550*0.4=220 hours

Total hours available after adding additional shift=22*16=352 hours

Hours dedicated for the production of Product T= Total hours available-Hours dedicated for the production of Product R

Hours dedicated for the production of Product T=352-220=132 hours

Step-2:

Calculation of Units produced for most profitable sales mix when the company adds additional shift:

Product R:

Units produced for most profitable sales mix =220/0.4=550 Units

Product T:

Units produced for most profitable sales mix =132/1=132 Units

Step-3:

Calculation of Total Contribution Margin:

The contribution margin is computed by using the formula below:

Units produced for the most profitable sales mix*Contribution margin per unit

Contribution Margin for Product R:

Units produced for the most profitable sales mix: 550 Units

Contribution margin per unit: $40

Therefore the contribution margin of Product R is 550 units*$40=$22,000.

Contribution Margin for Product T:

Units produced for the most profitable sales mix: 132 Units

Contribution margin per unit: $35

Therefore the contribution of Product T is 132 units*$35=$4,620.

Therefore the total contribution margin will be $22,000+$4,620=$26,620.

Requirement-3b:

To discuss:

The company whether to prefer adding new shift in addition to existing single shift of 8 hours.

Answer to Problem 5BPSB

Solution:

Yes, the company should add the new shift in addition to the existing shift of 8 hours.

Explanation of Solution

Increase in additional shift of 8 hours per day promotes the increase in productivity of the Sung Company to 682 Units compared to productivity of 440 units when it operates in single shift.

Requirement-4:

To discuss:

The company whether to pursue the marketing strategy by spending $4,500 additional costs to increase the maximum sales to 675 units of Product R by doubling the shift.

Answer to Problem 5BPSB

Solution:

No, the company should not pursue this marketing strategy with additional costs as this leads to the operating loss of the company.

Explanation of Solution

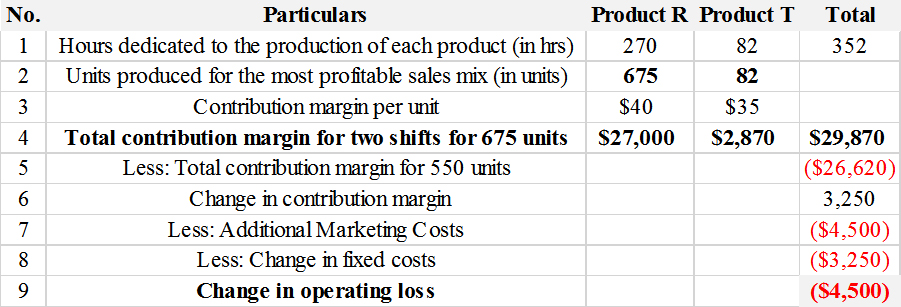

Below table shows the calculation for products by doubling the shifts and increasing the marketing costs by $4,500 to increase the maximum sales of Product R to 675 units.

Hours dedicated for the production of Product R= 675*0.4=270 hours

Total hours available after adding additional shift=22*16=352 hours

Hours dedicated for the production of Product T= Total hours available-Hours dedicated for the production of Product R

Hours dedicated for the production of Product T=352-270=82 hours

There is an operating loss of sales mix for the company of $4,500 and hence the idea of doubling the shift and spending additional costs for marketing to increase sales is not advisable to the management to proceed with.

Want to see more full solutions like this?

Chapter 25 Solutions

Loose Leaf for Fundamental Accounting Principles

- Solve this question and accountingarrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forwardMelford Industries sells a product to a wholesaler for $52. The wholesaler applies a 30% markup based on selling price when selling to a retailer. The retailer then applies a 40% markup based on selling price to determine the final price to the consumer. What is the final selling price to the consumer? Answerarrow_forward

- I need help with this general accounting problem using proper accounting guidelines.arrow_forwardIf sales revenue is $220 million and accounts receivable decreased by $30 million, the amount of cash received from customers: a. was $150 million. b. was $125 million. c. depends on the mix of cash sales and credit sales. d. was $250 million.arrow_forwardPlease provide the solution to this financial accounting question with accurate financial calculations.arrow_forward

- Please explain this financial accounting problem by applying valid financial principles.arrow_forwardHenry is an all-equity firm that has 63,500 shares of stock outstanding at a market price of $22.80 per share. The firm is considering a capital structure with 45% debt at a rate of 6% and use the proceeds to repurchase shares. Determine the shares outstanding once the debt is issued.arrow_forwardI want to correct answer general accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education