Concept explainers

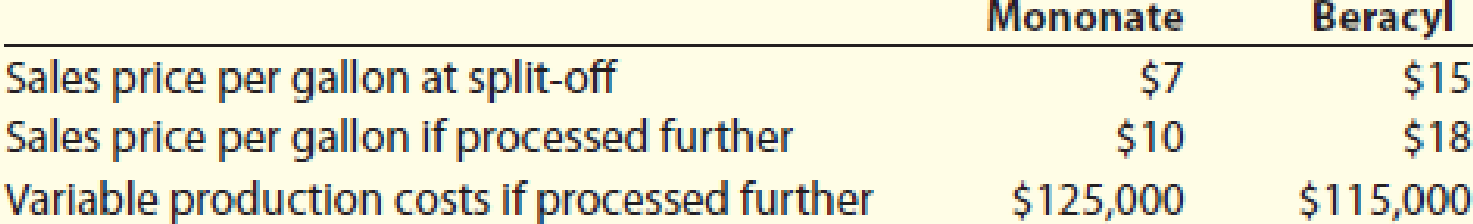

Oakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint production process, incurring $250,000 of joint costs. Oakes allocates joint costs based on the physical volume of each product produced. Mononate and Beracyl can each be sold at the split-off point in a semifinished state or, alternatively, processed further. Additional data about the two products are as follows:

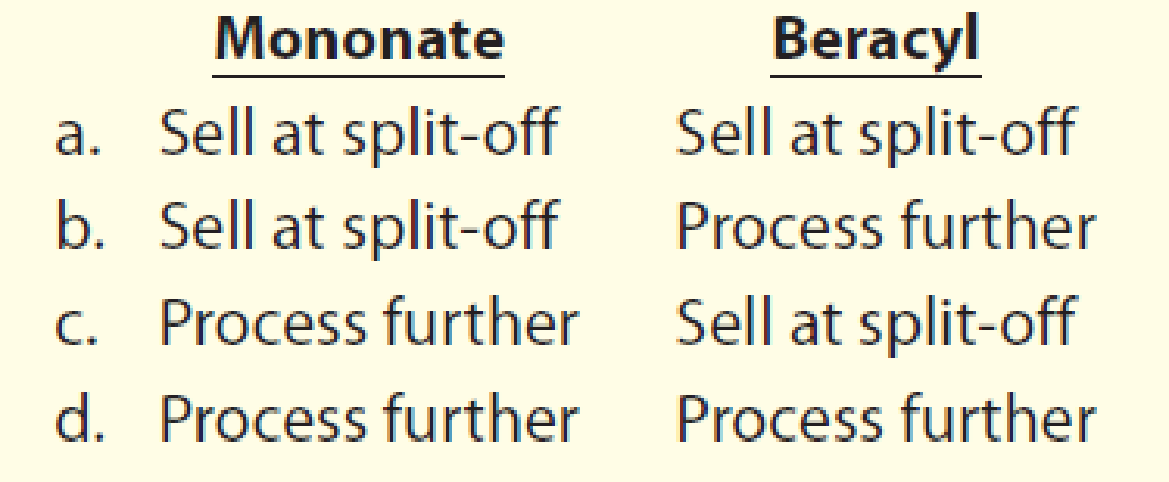

An assistant in the company’s cost accounting department was overheard saying “...that when both joint and separable costs are considered, the firm has no business processing either product beyond the split-off point. The extra revenue is simply not worth the effort.” Which of the following strategies should be recommended for Oakes?

Trending nowThis is a popular solution!

Chapter 25 Solutions

Financial and Managerial Accounting - Workingpapers

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning