Concept explainers

(LO 2) Zelmer Company manufactures tablecloths. Sales have grown rapidly over the past 2 years. As a result, the president has installed a budgetary

Prepare flexible budget, budget report, and graph for manufacturing overhead.

The

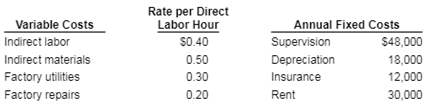

Variable—per direct labor hour: indirect labor $0.44, indirect materials $0.48, factory utilities $0.32, and factory repairs $0.25.

Fixed: same as budgeted.

Instructions

a. Prepare a monthly manufacturing overhead flexible budget for the year ending December 31, 2020. assuming production levels range from 35,000 to 50,000 direct labor hours. Use increments of 5,000 direct labor hours.

b. Prepare a budget report for June comparing actual results with budget data based on the flexible budget.

c. Were costs effectively controlled? Explain.

d. State the formula for computing the total budgeted costs for the Ironing Department.

e. Prepare the flexible budget graph, showing total budgeted costs at 35,000 and 45,000 direct labor hours. Use increments of 5,000 direct labor hours on the horizontal axis and increments of $10,000 on the vertical axis.

a. Total costs: 35,000 DLH, $58,000; 50,000 DLH, $79,000

b. Budget $66,400

Actual $70,090

Want to see the full answer?

Check out a sample textbook solution

Chapter 25 Solutions

ACCOUTING PRIN SET LL INCLUSIVE

- accounting question?arrow_forwardThree individuals form JEY Corporation with the following contributions: Joe, cash of $50,000 for 50 shares; Ethan, land worth $20,000 (basis of $11,000) for 20 shares; and Young, cattle worth $9,000 (basis of $6,000) for 9 shares and services worth $21,000 for 21 shares. a. These transfers are fully taxable and not subject to § 351. b. Young’s basis in her stock is $27,000. c. Young’s basis in her stock is $6,000. d. Ethan’s basis in his stock is $20,000. e. None of the above.arrow_forwardNonearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning