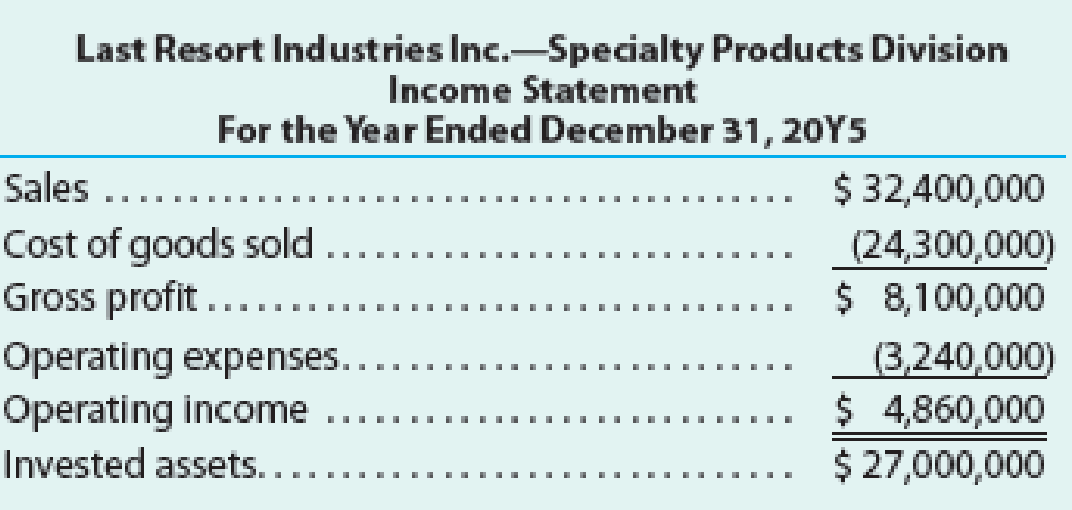

Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no support department allocations, along with asset information is as follows:

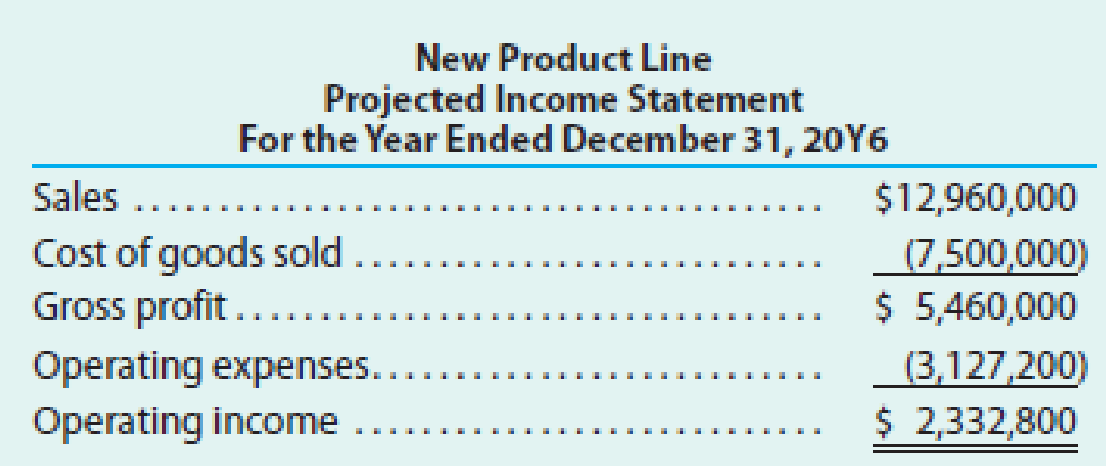

The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of $14,400,000. A

The Specialty Products Division currently has $27,000,000 in invested assets, and Last Resort Industries Inc.’s overall

The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line.

- a. Determine the return on investment for the Specialty Products Division for the past year.

- b. Determine the Specialty Products Division manager’s bonus for the past year.

- c. Determine the estimated return on investment for the new product line. Round percentages to one decimal place and the investment turnover to two decimal places.

- d.

Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5.

Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5. - e.

Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.

Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.

Trending nowThis is a popular solution!

Chapter 24 Solutions

FINANCIAL & MANAGERIAL ACCW/CENGAGENOWV

- Pinehill Inc. has annual fixed costs of $150,000 and variable costs of $4 per unit. Each unit is sold for $20, and the company expects to sell 15,000 units this year. Compute the operating profit (or loss) if the sales price decreases by 25%.arrow_forwardHi expert please give me answer general accounting questionarrow_forwardABC Corp has fixed costs of $200,000, and variable costs as a percentage of sales are 70%. If the company currently makes $1,000,000 in sales, what amount of sales must be achieved to earn a net income of $90,000?arrow_forward

- RIO is a retailer of smart televisions. Typically, the company purchases atelevision for $1,200 and sells it for $1,500. What is the gross profit margin on this television? General Accountarrow_forwardMCQarrow_forwardA Medical Lab has introduced a new sample processing efficiency measurement system. This system awards points for adherence to standards: 5 points for tests completed within one hour, 3 points for proper documentation, and 2 points for maintaining sample integrity. Yesterday's analysis of 150 samples showed 140 met timing standards, 144 were properly documented, and all samples maintained integrity. The lab director needs to assess the overall efficiency percentage. [JOB COSTING 2.8]. ANSWERarrow_forward

- Activity cost pool is?arrow_forwardCrescent Corporation has a cash balance of $22,500 on May 1. The company must maintain a minimum cash balance of $18,000. During May, expected cash receipts are $55,000. Cash disbursements during the month are expected to total $72,500. Ignoring interest payments, during May the company will need to borrow: a. $10,000 b. $13,000 c. $20,000 d. $5,000arrow_forwardWhat is the company's operating marginarrow_forward

- Summit Enterprises prepared the following tentative budget for next month: Sales Revenue = $400,000 • Selling Price per Unit = $8 Variable Expenses = $260,000 Fixed Expenses = $140,000 The sales manager suggests that the unit selling price could be increased by 18%, with an expected volume decrease of only 15%. Compute the budgeted net income if these changes are incorporated.arrow_forwardCompute the fixed overhead volume variancearrow_forwardNeed help with this general accounting question please solve this problemarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning