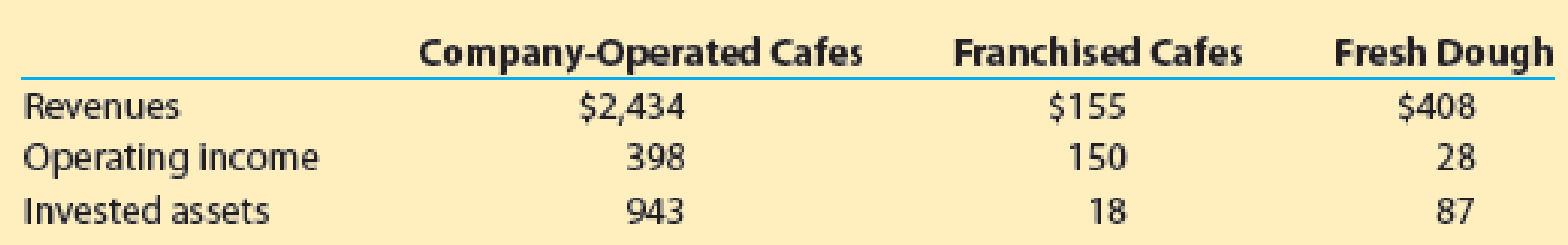

Panera Bread Company (PNRA) operates over 2,000 bakery-cafe locations throughout the United States and Canada and serves over 9 million customers per week. Panera’s operations are divided into the following segments:

- Company-Operated Bakery-Cafes

- Franchised Bakery-Cafes

- Fresh Dough and Other Products

The Fresh Dough and Other Products segment supplies fresh dough, produce, tuna, and other products to the company-operated and franchised cafes. Recent data (in millions) for each of these segments are as follows:

- a. Determine the profit margin for each segment. Round to one decimal place.

- b. Determine the investment turnover for each segment. Round to two decimal places.

- c. Use the DuPont formula to determine the

return on investment for each segment. Round to one decimal place. - d.

Which segment has the highest profit margin, investment turnover, and return on investment? Explain why.

Which segment has the highest profit margin, investment turnover, and return on investment? Explain why. - e.

If franchised cafes are more profitable, why would Panera operate company- owned cafes?

If franchised cafes are more profitable, why would Panera operate company- owned cafes?

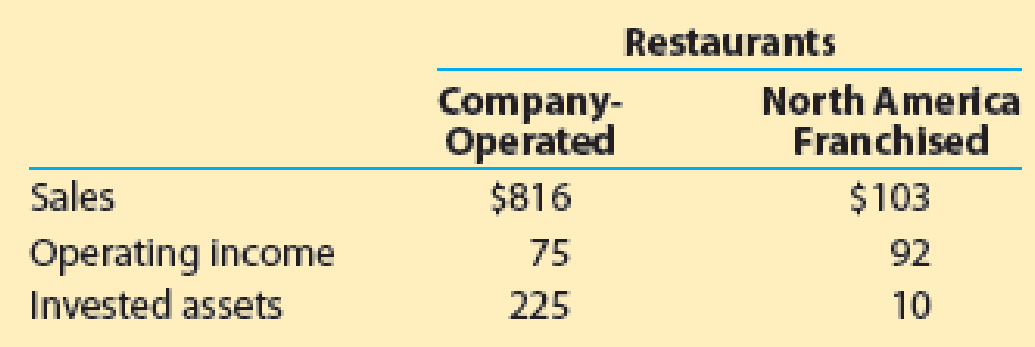

MAD 24-3 Analyze Papa John’s International, Inc. Obj. 6

Papa John’s International, Inc. (PZZA), operates over 5,000 restaurants in the United States and 45 countries. The company operates primarily as a franchisor with 4,353 franchised restaurants and 744 company-operated restaurants. Recent data (in millions) for the company-operated and North America franchised restaurants are as follows:

- a. Determine the profit margin for each segment. Round to one decimal place.

- b. Determine the investment turnover for each segment. Round to two decimal places.

- c. Use the DuPont formula to determine the return on investment for each segment. Round to one decimal place.

- d.

Analyze and interpret the results of (a), (b), and (c).

Analyze and interpret the results of (a), (b), and (c).

MAD 24-4 Compare Panera Bread and Papa John’s Obj. 6

Compare Panera Bread (PNRA) and Papa John’s (PZZA) using your computations from MAD 24-2 and MAD 24-3.

Compare Panera Bread (PNRA) and Papa John’s (PZZA) using your computations from MAD 24-2 and MAD 24-3.

Trending nowThis is a popular solution!

Chapter 24 Solutions

FINANCIAL & MANAGERIAL ACCW/CENGAGENOWV

- Accurate Answerarrow_forwardHelparrow_forwardOne year ago you purchased a two-year bond at a discount for $900. It has a par value of $1000 and one year left until maturity. You have one interest payment of $50 at maturity. If the interest rate is 5% per year, what would be the capital gain or loss?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning