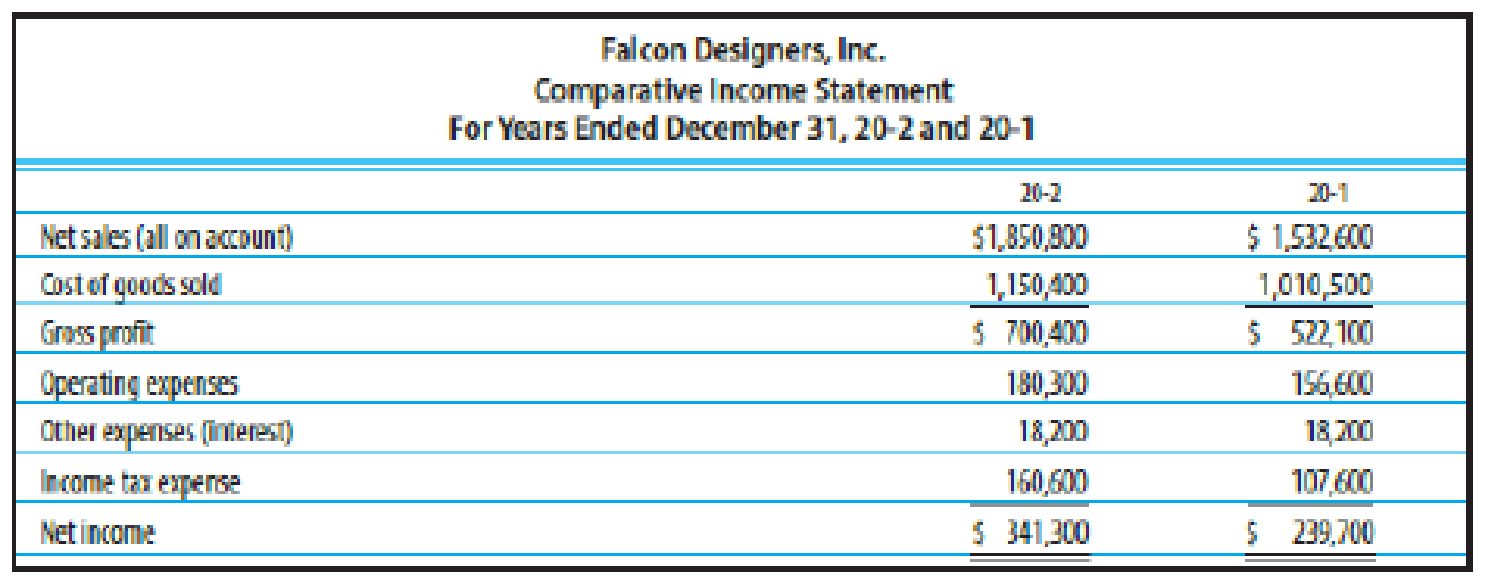

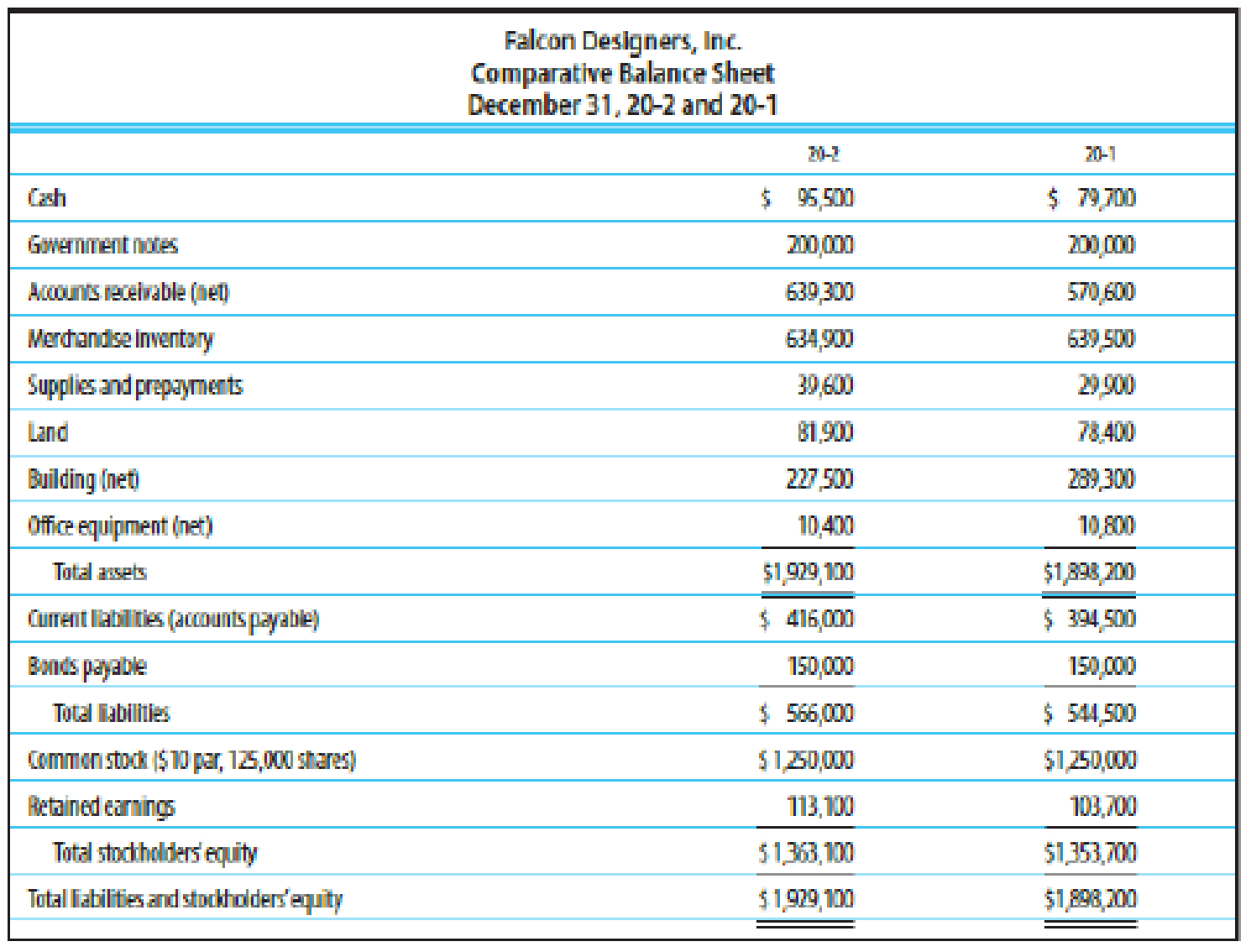

ANALYSIS OF ACTIVITY MEASURES Based on the financial statement data in Exercise 24-1B, compute the following activity measures for 20-2 (round all calculations to two decimal places):

- (a)

Accounts receivable turnover - (b) Merchandise inventory turnover

- (c) Asset turnover

(a)

Calculate accounts receivable turnover and average collection period for the period 20-2.

Explanation of Solution

Accounts receivable turnover:

Accounts receivable turnover is a liquidity measure of accounts receivable in times, which is calculated by dividing the net credit sales by the average amount of net accounts receivables. In other words, it indicates the number of times the average amount of net accounts receivables collected during a particular period.

Calculate accounts receivable turnover ratio for the period 20-2 as follows:

Therefore, accounts receivable turnover ratio for the period 20-2 is 3.06 times.

Average collection period:

Average collection period indicates the number of days taken by a business to collect its outstanding amount of accounts receivable on an average.

Calculate average collection period for the period 20-2.

Therefore, average collection period for the period 20-2 is 119.28 days.

b.

Calculate merchandise inventory turnover and average number of days to sell inventory.

Explanation of Solution

Inventory turnover ratio:

Inventory turnover ratio is used to determine the number of times inventory used or sold during the particular accounting period.

Calculate merchandise inventory for the period 20-2.

Therefore, inventory turnover ratio for the period 20-2 is 1.81 times.

Days’ sales in inventory:

Days’ sales in inventory are used to determine number of days a particular company takes to make sales of the inventory available with them.

Calculate average number of days to sell inventory for the period 20-2.

Therefore, average number of days to sell inventory during the period 20-2 is 201.66 days.

(c)

Calculate asset turnover ratio.

Explanation of Solution

Asset turnover:

Asset turnover is a ratio that measures the productive capacity of the fixed assets to generate the sales revenue for the company. Thus, it shows the relationship between the net sales and the average total fixed assets.

Calculate assets turnover ratio for the period 20-2.

Therefore, assets turnover ratio is 0.97 to 1.

Want to see more full solutions like this?

Chapter 24 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

- Charrd Corporation manufactures a gas-operated barbecue grill. The following information relates to Charrd's operations for last year: Unit product cost under absorption costing $55 per unit Fixed manufacturing overhead cost for the year $229,500 Fixed selling and administrative cost for the year $127,500 Units (grills) produced and sold 25,500arrow_forwardShort answer pleasearrow_forwardSanta Fe Corporation has computed the following unit costs for the year just: Direct material used Direct labor $ 25 19 Variable manufacturing overhead 35 Fixed manufacturing overhead 40 Variable selling and administrative cost 17 Fixed selling and administrative cost 32 Which of the following choices correctly depicts the per-unit cost of inventory under variable costing and absorption costing? Variable Costing a. b. C. d. e. Absorption Costing $ 79 $ 119 79 151 96 119 96 151 some other combinationarrow_forward

- What amount should be reported on Birk Camera Shop's financial statements, assuming the lower-of-cost-or-market rule is applied? The variable costing method ordinarily includes in product costs the following: a) Direct materials cost, direct labor cost, but no manufacturing overhead cost. b) Direct materials cost, direct labor cost, and variable manufacturing overhead cost. c) Prime cost but not conversion cost. d) Prime cost and all conversion cost.arrow_forwardTo what extent should tax considerations influence the selection and application of accounting methods within an organization? Discuss the potential conflicts that may arise between the objective of maximizing financial reporting transparency and the desire to minimize tax liabilities through strategic accounting choices.arrow_forwardExpert help to get answer thisarrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning