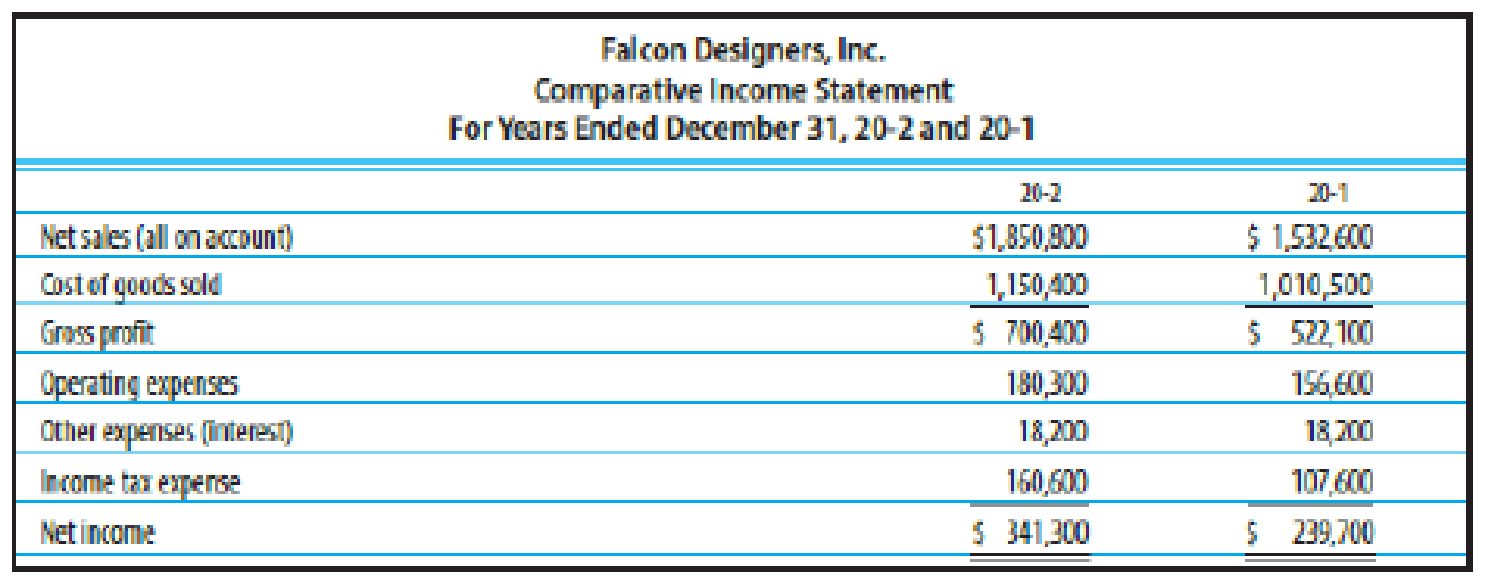

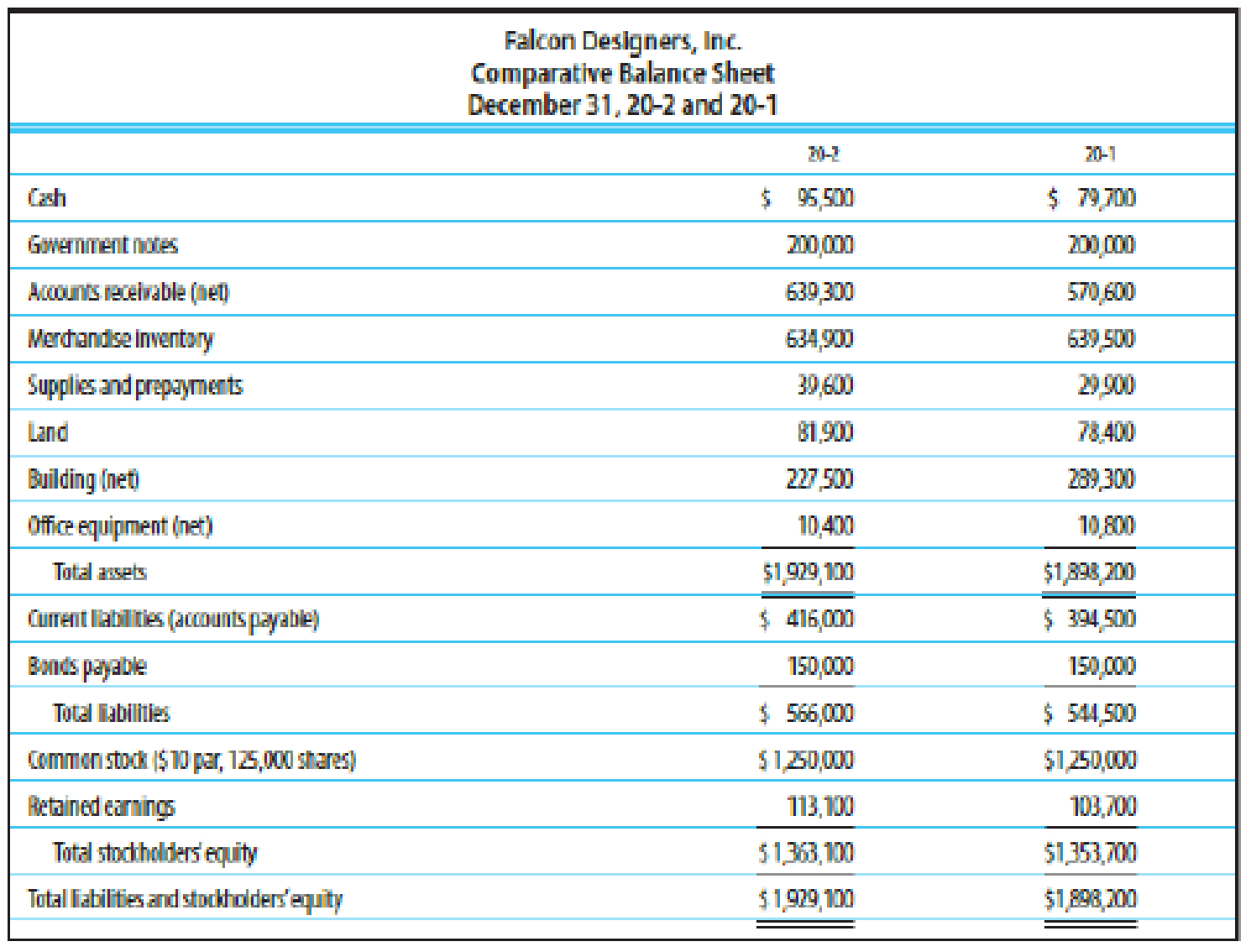

ANALYSIS OF ACTIVITY MEASURES Based on the financial statement data in Exercise 24-1B, compute the following activity measures for 20-2 (round all calculations to two decimal places):

- (a)

Accounts receivable turnover - (b) Merchandise inventory turnover

- (c) Asset turnover

(a)

Calculate accounts receivable turnover and average collection period for the period 20-2.

Explanation of Solution

Accounts receivable turnover:

Accounts receivable turnover is a liquidity measure of accounts receivable in times, which is calculated by dividing the net credit sales by the average amount of net accounts receivables. In other words, it indicates the number of times the average amount of net accounts receivables collected during a particular period.

Calculate accounts receivable turnover ratio for the period 20-2 as follows:

Therefore, accounts receivable turnover ratio for the period 20-2 is 3.06 times.

Average collection period:

Average collection period indicates the number of days taken by a business to collect its outstanding amount of accounts receivable on an average.

Calculate average collection period for the period 20-2.

Therefore, average collection period for the period 20-2 is 119.28 days.

b.

Calculate merchandise inventory turnover and average number of days to sell inventory.

Explanation of Solution

Inventory turnover ratio:

Inventory turnover ratio is used to determine the number of times inventory used or sold during the particular accounting period.

Calculate merchandise inventory for the period 20-2.

Therefore, inventory turnover ratio for the period 20-2 is 1.81 times.

Days’ sales in inventory:

Days’ sales in inventory are used to determine number of days a particular company takes to make sales of the inventory available with them.

Calculate average number of days to sell inventory for the period 20-2.

Therefore, average number of days to sell inventory during the period 20-2 is 201.66 days.

(c)

Calculate asset turnover ratio.

Explanation of Solution

Asset turnover:

Asset turnover is a ratio that measures the productive capacity of the fixed assets to generate the sales revenue for the company. Thus, it shows the relationship between the net sales and the average total fixed assets.

Calculate assets turnover ratio for the period 20-2.

Therefore, assets turnover ratio is 0.97 to 1.

Want to see more full solutions like this?

Chapter 24 Solutions

CENGAGENOWV2 FOR HEINTZ/PARRY'S COLLEGE

- What is the accounts receivablearrow_forward??!!arrow_forwardDuring the first month of operations, the following transactions were completed by ABC Corporation: Dec 1 Issued 25,000 shares of $1 par common stock for cash of $23 per share. Dec 3 ABC Company pays cash for Land and a building to be used in operations. The land cost $65,000 and the building cost $154,800. Dec 4 Purchased $18,000 of store fixtures on account. Dec 5 Purchased merchandise inventory from XYZ Company for $125,000, terms n/eom, FOB destination. Dec 6 ABC sold $50,000 of merchandise on account, n/10, FOB shipping point. The cost of merchandise sold was $20,000. Dec 9 Paid adverting costs of $20,000 to promote new business. Dec 10 Purchased merchandise inventory from QRS Company for $100,000, terms n/30, FOB destination. Dec 11 Purchased 500 shares of treasury stock for $17 per share. Dec 12 ABC's Board of Directors declared a $30,000 cash dividend. Dec 13 Paid $750 for utilities. Dec 15 Paid cash dividends to common shareholders. Dec 16 Received…arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning