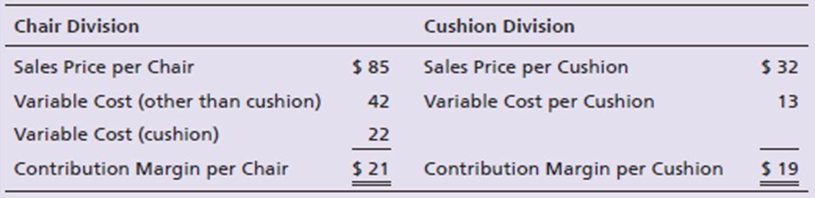

The Harris Company is decentralized, and divisions are considered investment centers. Harris has one division that manufactures oak dining room chairs with upholstered seat cushions. The Chair Division cuts, assembles, and finishes the oak chairs and then purchases and attaches the seat cushions. The Chair Division currently purchases the cushions for $22 from an outside vendor. The Cushion Division manufactures upholstered seat cushions that are sold to customers outside the company. The Chair Division currently sells 800 chairs per quarter, and the Cushion Division is operating at capacity, which is 800 cushions per quarter. The two divisions report the following information:

Requirements

- 1. Determine the total contribution margin for Harris Company for the quarter.

- 2. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current sales price. What is the total contribution margin for each division and the company?

- 3. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current variable cost. What is the total contribution margin for each division and the company?

- 4. Review your answers for Requirements 1, 2, and 3. What is the best option for Harris Company?

- 5. Assume the Cushion Division has capacity of 1,600 cushions per quarter and can continue to supply its outside customers with 800 cushions per quarter and also supply the Chair Division with 800 cushions per quarter. What transfer price should Harris Company set? Explain your reasoning. Using the transfer price you determined, calculate the total contribution margin for the quarter.

Want to see the full answer?

Check out a sample textbook solution

Chapter 24 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management

Essentials of MIS (13th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Intermediate Accounting (2nd Edition)

- Accounting question is correct answer with solutionarrow_forwardThe industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardprovide correct answer of this General accounting questionarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,