Adequate information:

Opening value of saving 1,48,000

Closing value of saving 1,98,000

To compute: Dollar weighted average return.

Introduction: Dollar weighted average return is a way to measure an investment’s performance.

Explanation of Solution

Assuming that an investment was made for $148,000.

Thus, all the values in addition and investment in account are considered as outflow of cash flow and all the values of withdrawal and final value are considered as inflow of cash.

PV of inflow = PV of outflow

23000(1+r)15 + 198000(1+r)17 = 148000+2500+4000(1+r)3+1500(1+r)7+13460(1+r)12+3000(1+r)16

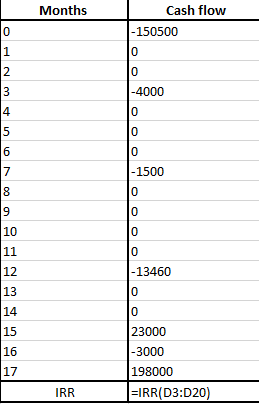

IRR can be computed using the following formula in excel:

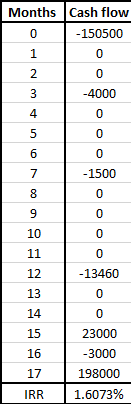

Following is the calculated answer using the above mentioned formula:

The above return has been calculated on monthly basis.

So, as per the question the dollar weighted average return between first and last date can be calculated by multiplying it by 17 (1/1/2016-5/3/2017)

1.6073%×17 =27.32%

Dollar weight average return is 27.32%

Want to see more full solutions like this?

Chapter 24 Solutions

EBK INVESTMENTS

- Suppose that the exchange rate is $0.92/€. Let r$ = 4%, and r€ = 3%, u = 1.2, d = 0.9, T = 0.75, n = 3, and K = $0.85. 1. What is the price of a 9-month European call? 2. What is the price of a 9-month American call? Please show step by step from the beginning.arrow_forwardWhich of the following statements is true about a bond's yield to maturity (YTM)?A) YTM is the interest rate that makes the present value of bond payments equal to its current market priceB) YTM is only calculated at the time of purchaseC) YTM does not account for the bond’s coupon paymentsD) YTM is the same as the bond’s coupon rate if purchased at face value helparrow_forwardWhich of the following statements is true about a bond's yield to maturity (YTM)?A) YTM is the interest rate that makes the present value of bond payments equal to its current market priceB) YTM is only calculated at the time of purchaseC) YTM does not account for the bond’s coupon paymentsD) YTM is the same as the bond’s coupon rate if purchased at face valuearrow_forward

- Which of the following would likely decrease the cost of debt for a company?A) An increase in the company's credit ratingB) A decrease in the company's profitabilityC) A rise in interest rates across the marketD) An increase in the company's dividend payoutsarrow_forwardWhich of the following is considered a long-term financing source for a company?A) Accounts PayableB) Common StockC) Short-term loansD) Accrued Expenses helparrow_forwardWhich of the following is considered a long-term financing source for a company?A) Accounts PayableB) Common StockC) Short-term loansD) Accrued Expensesarrow_forward

- What is the primary goal of financial management?A) Maximizing profitsB) Maximizing shareholder wealthC) Minimizing costsD) Ensuring liquidityhelp.arrow_forwardIf a bond has a coupon rate lower than the market interest rate, the bond will sell at:A) Par valueB) A premiumC) A discountD) Its face valuehelp.arrow_forwardIf a bond has a coupon rate lower than the market interest rate, the bond will sell at:A) Par valueB) A premiumC) A discountD) Its face valuearrow_forward

- The primary objective of financial accounting is to:a) Provide management with detailed reports for decision-making.b) Help the company save taxes.c) Provide financial information to external users.d) Track inventory levels. please help.arrow_forwardWhich of the following is an example of a capital budgeting decision?A) Determining the amount of inventory to keep on handB) Deciding whether to purchase a new piece of machineryC) Setting the credit terms for customersD) Deciding how much cash to keep in the bankarrow_forwardFor pueblo super market in st thomas usviarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage  Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub