Concept explainers

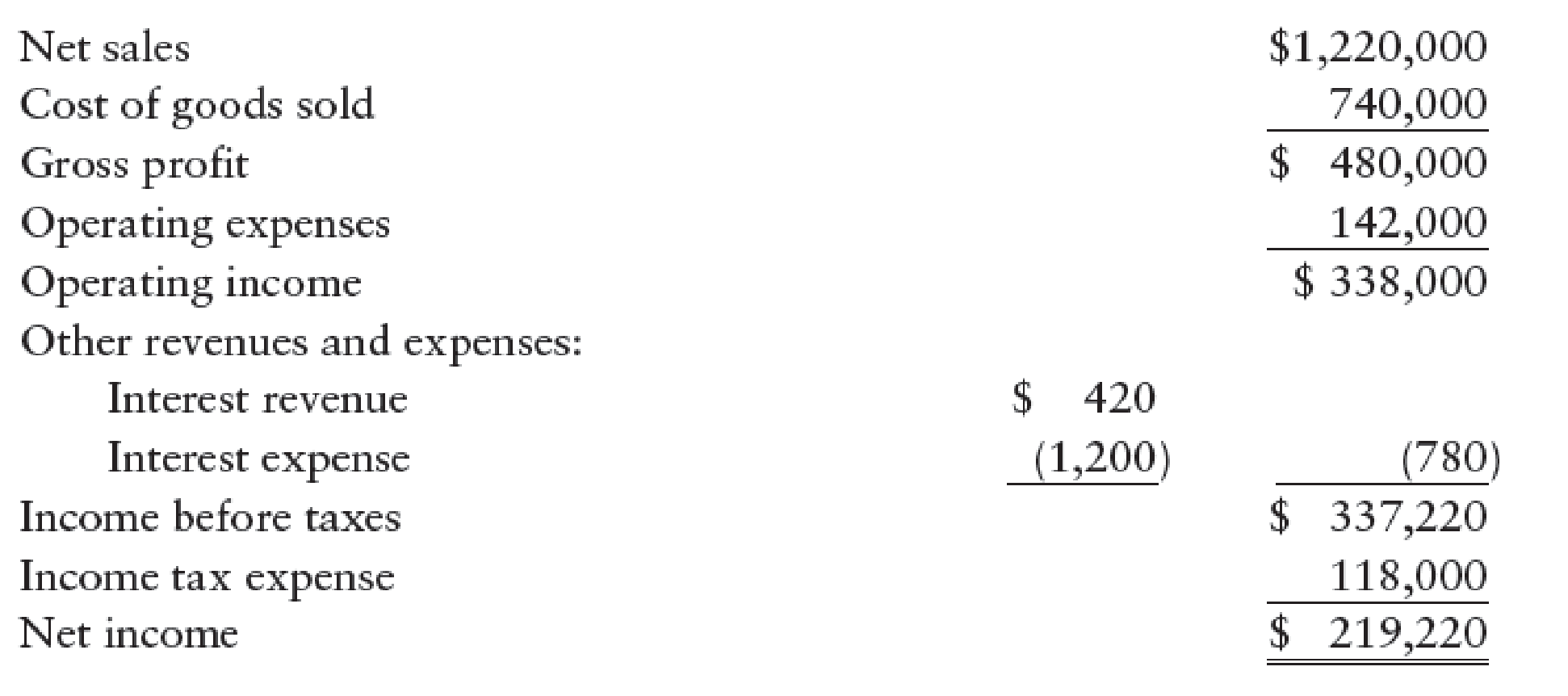

COMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Horn Company’s condensed income statement for the year ended December 31, 20-2, was as follows:

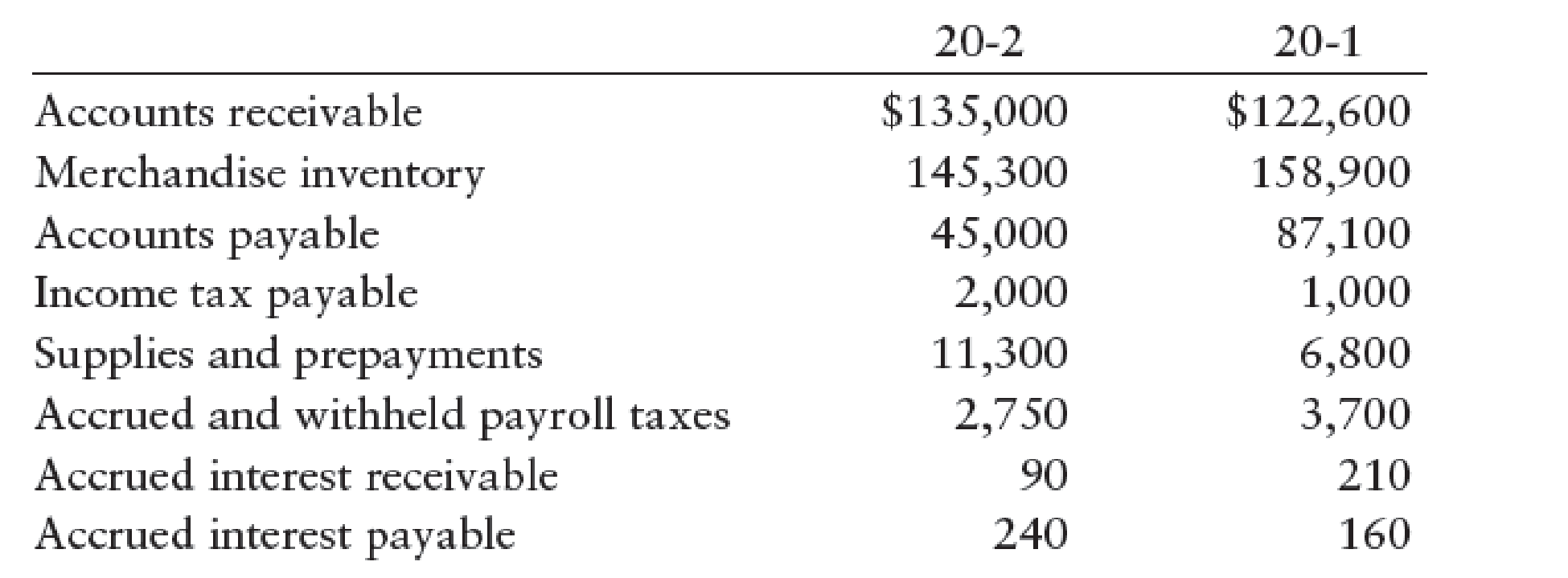

Additional information obtained from Horn’s comparative

REQUIRED

Prepare a partial statement of

SCHEDULE FOR CALCULATION OF CASH GENERATED FROM OPERATING ACTIVITIES Using the information provided in Problem 23-9A for Horn Company, prepare the following:

1. A schedule for the calculation of cash generated from operating activities for Horn Company for the year ended December 31, 20-2.

2. A partial statement of cash flows for Horn Company reporting cash from operating activities under the direct method for the year ended December 31, 20-2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 23A Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

- COMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Powell Companys condensed income statement for the year ended December 31, 20-2, was as follows: Additional information obtained from Powells comparative balance sheet and auxiliary records as of December 31, 20-2 and 20-1, was as follows: Depreciation expense for 20-2, included in operating expenses on the income statement, was 29,000. REQUIRED Prepare a partial statement of cash flows reporting cash provided by operating activities for the year ended December 31, 20-2.arrow_forwardCOMPUTE CASH PROVIDED BY OPERATING ACTIVITIES Powell Companys condensed income statement for the year ended December 31, 20-2, was as follows: Additional information obtained from Horns comparative balance sheet and auxiliary records as of December 31, 20-2 and 20-1, was as follows: Depreciation expense for 20-2, included in operating expenses on the income statement, was 32,000. REQUIRED Prepare a partial statement of cash flows reporting cash provided by operating activities for the year ended December 31, 20-2. SCHEDULE FOR CALCULATION OF CASH GENERATED FROM OPERATING ACTIVITIES Using the information provided in Problem 23-11B for Powell Company, prepare the following: 1. A schedule for the calculation of cash generated from operating activities for Powell Company for the year ended December 31, 20-2. 2. A partial statement of cash flows for Powell Company reporting cash from operating activities under the direct method for the year ended December 31, 20-2.arrow_forwardReporting changes in equipment on statement of cash flows An analysis of the general ledger accounts indicates that office equipment, which cost 245,000 and on which accumulated depreciation totaled 112,500 on the date of sale, was sold for 105,900 during the year. Using this information, indicate the items to be reported on the statement of cash flows.arrow_forward

- Cash flows from operating activitiesindirect method The net income reported on the income statement for the current year was 93,700. Depreciation recorded on store equipment for the year amounted to 31,200. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: a. Prepare the Cash flows from operating activities section of the statement of cash flows, using the indirect method. b. Briefly explain why net cash flow from operating activities is different than net income.arrow_forwardStatement of cash flowsindirect method The comparative balance sheet of Yellow Dog Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income, 250,000. b. Depreciation reported on the income statement, 135,000. c. Equipment was purchased at a cost of 420,000 and fully depreciated equipment costing 90,000 was discarded, with no salvage realized. d. The mortgage note payable was not due for six years, but the terms permitted earlier payment without penalty. e. 30,000 shares of common stock were issued at 20 for cash. f. Cash dividends declared and paid, 45,000. Instructions Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.arrow_forwardCash flows from (used for) operating activities-indirect method The net income reported on the income statement for the current year was $106,800. Depreciation recorded on store equipment for the year amounted to $41,700. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Cash Accounts receivable (net) Inventories End of Year Beginning of Year $24,100 65,000 47,200 3,250 23,400 4,700 $19,700 54,000 52,000 Prepaid expenses 6,000 Accounts payable (merchandise creditors) 18,500 6,400 Wages payable a. Prepare the "Cash flows from (used for) operating activities" section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Line Item Description Cash flows from (used for) operating activities: Adjustments to reconcile net income to net cash flows from (used for) operating activities:…arrow_forward

- Cash flows from operating activities-indirect methodThe net income reported on the income statement for the current yearwas $93,700. Depreciation recorded on store equipment for the yearamounted to $31,200. Balances of the current asset and current liabilityaccounts at the beginning and end of the year are as follows: End of Year Beginning of Year CashAccounts receivable (net)InventoriesPrepaid expensesAccounts payable (merchandise creditors)Wages payable $24,10065,00047,2003,25023,4005,300 $19,70056,00050,0008,00017,2006,400 a. Prepare the "Cash flows from operating activities" section of thestatement of cash flows, using the indirect methodb. Briefly explain why net cash flow from operating activities isdifferent than net income.arrow_forwardRequired: Prepare a statement of cash flows using indirect method for operating activities.arrow_forwardHow do I complete this chart of cash flow?arrow_forward

- Cash Flows from Operating Activities-Indirect Method The net income reported on the income statement for the current year was $154,900. Depreciation recorded on store equipment for the year amounted to $25,600. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $60,720 $55,860 Accounts receivable (net) 43,540 41,280 Inventories 59,440 62,840 Prepaid expenses 6,680 5,310 Accounts payable (merchandise creditors) 56,890 52,840 Wages payable 31,090 34,520 a. Prepare the "Cash flows from operating activities" section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardStatement of cash flows-indirect methodThe comparative balance sheet of Yellow Dog Enterprises Inc. atDecember 31, 20Y8 and 20Y7, is as follows: Additional data obtained from the income statement and from anexamination of the accounts in the ledger for 20Y8 are as follows: a. Net income, $250,000.b. Depreciation reported on the income statement, $135,000.c. Equipment was purchased at a cost of $420,000 and fullydepreciated equipment costing $90,000 was discarded, with no salvage realized.d. The mortgage note payable was not due for six years, but theterms permitted earlier payment without penalty.e. 30,000 shares of common stock were issued at $20 for cash.f. Cash dividends declared and paid, $45,000. InstructionsPrepare a statement of cash flows, using the indirect method ofpresenting cash flows from operating activities.arrow_forwardSubject:arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning