Fundamental Accounting Principles

24th Edition

ISBN: 9781259916960

Author: Wild, John J., Shaw, Ken W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem 3E

Exercise 23-2

Preparing flexible budgets

P1

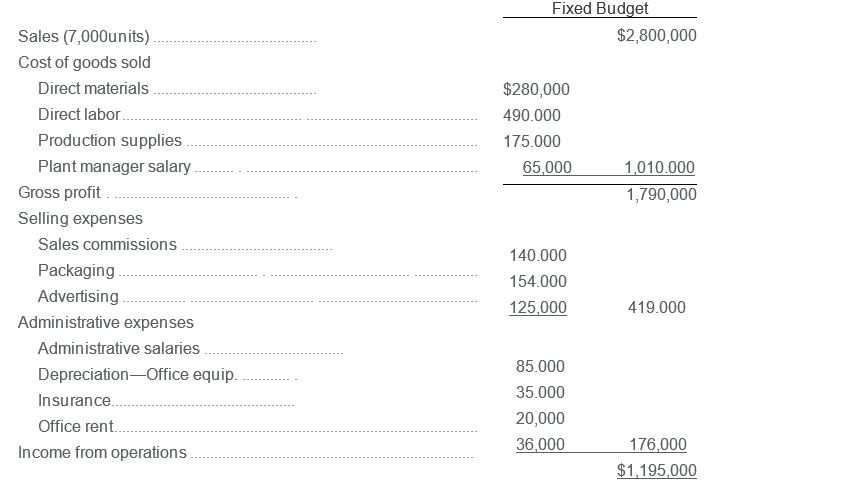

Tempo Company's fixed budget (based on sales of 7,000 units) for the first quarter of calendar year 2017 reveals the following. Prepare flexible budgets following the format of Exhibit 23.3 that show variable costs per unit, fixed costs, and three different flexible budgets for sales volumes of 6,000, 7,000, and 8,000 units.

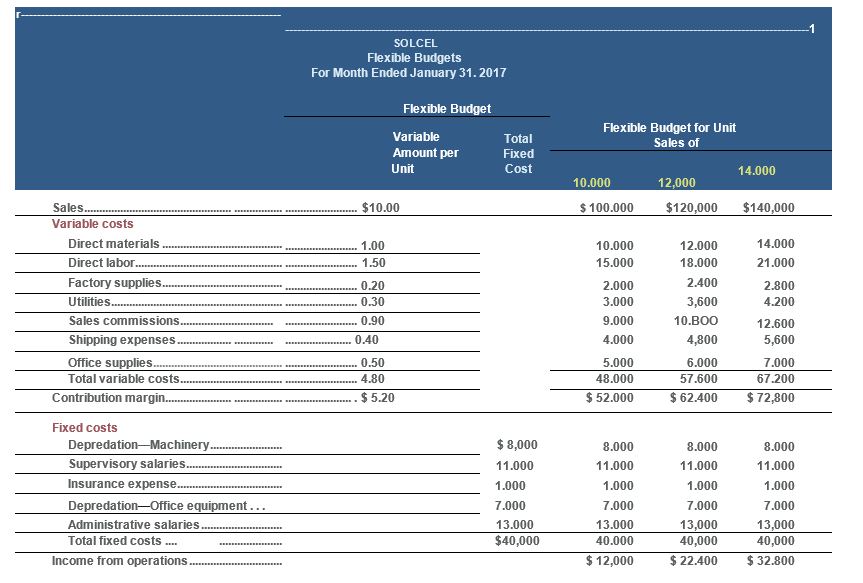

EXHIBIT 23.3 Flexible Budgets (prepared Before the Period)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the standard rate per direct labor hours ?

Please provide the correct answer to this financial accounting problem using accurate calculations.

Can you solve this general accounting question with the appropriate accounting analysis techniques?

Chapter 23 Solutions

Fundamental Accounting Principles

Ch. 23 - Prob. 1DQCh. 23 - Prob. 2DQCh. 23 - Prob. 3DQCh. 23 - Prob. 4DQCh. 23 - Prob. 5DQCh. 23 - Prob. 6DQCh. 23 - Prob. 7DQCh. 23 - Prob. 8DQCh. 23 - Prob. 9DQCh. 23 - Prob. 10DQ

Ch. 23 - Prob. 11DQCh. 23 - Prob. 12DQCh. 23 - Prob. 13DQCh. 23 - How can the manager of advertising sales at Google...Ch. 23 - Prob. 15DQCh. 23 - Prob. 16DQCh. 23 - Is it possible to evaluate a cost center’s...Ch. 23 - Prob. 18DQCh. 23 - Prob. 1QSCh. 23 - Prob. 2QSCh. 23 - Prob. 3QSCh. 23 - Prob. 4QSCh. 23 - Prob. 5QSCh. 23 - Prob. 6QSCh. 23 - Prob. 7QSCh. 23 - Prob. 8QSCh. 23 - Prob. 9QSCh. 23 - Prob. 10QSCh. 23 - Prob. 11QSCh. 23 - Prob. 12QSCh. 23 - Prob. 13QSCh. 23 - Prob. 14QSCh. 23 - Volume variance P3 Refer to information in QS...Ch. 23 - Prob. 16QSCh. 23 - Prob. 17QSCh. 23 - Prob. 18QSCh. 23 - Prob. 19QSCh. 23 - Prob. 20QSCh. 23 - Prob. 21QSCh. 23 - Prob. 22QSCh. 23 - Prob. 23QSCh. 23 - Prob. 24QSCh. 23 - Exercise 23-1 Management by exception C1 Resset...Ch. 23 - Prob. 2ECh. 23 - Exercise 23-2 Preparing flexible budgets P1 Tempo...Ch. 23 - Prob. 4ECh. 23 - Prob. 5ECh. 23 - Prob. 6ECh. 23 - Prob. 7ECh. 23 - Prob. 8ECh. 23 - Prob. 9ECh. 23 - Prob. 10ECh. 23 - Prob. 11ECh. 23 - Prob. 12ECh. 23 - Exercise 23-13 Computing and interpreting...Ch. 23 - Prob. 14ECh. 23 - Exercise 23-15

Direct materials and direct labor...Ch. 23 - Prob. 16ECh. 23 - Prob. 17ECh. 23 - Exercise 23-18A Detailed overhead variances P5...Ch. 23 - Prob. 19ECh. 23 - Prob. 20ECh. 23 - Prob. 21ECh. 23 - Prob. 22ECh. 23 - Prob. 23ECh. 23 - Prob. 1APSACh. 23 - Prob. 2APSACh. 23 - Prob. 3APSACh. 23 - Prob. 4APSACh. 23 - Prob. 5APSACh. 23 - Prob. 6APSACh. 23 - Prob. 2BPSBCh. 23 - Prob. 3BPSBCh. 23 - Prob. 4BPSBCh. 23 - Prob. 5BPSBCh. 23 - Prob. 6BPSBCh. 23 - Prob. 23SPCh. 23 - Flexible budgets and standard costs emphasize the...Ch. 23 - Prob. 2AACh. 23 - Prob. 3AACh. 23 - Prob. 1BTNCh. 23 - Prob. 2BTNCh. 23 - Prob. 3BTNCh. 23 - Prob. 4BTNCh. 23 - Prob. 5BTNCh. 23 - Training employees to use standard amounts of...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2018, Sycamore International reports net assets of $1,245,000, although machinery (with an eight-year life) having a book value of $720,000 is worth $840,000 and an unrecorded trademark is valued at $75,600. Teton Group pays $1,140,000 on that date for a 90 percent ownership in Sycamore. If the trademark is to be written off over a 15-year period, at what amount should it be reported on the consolidated statements on December 31, 2020?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardMontu Consultants Corporation obtained a building, its surrounding land, and a computer system in a lump-sum purchase for $375,000. An appraisal set the value of the land at $184,500, the building at $144,000, and the computer system at $121,500. At what amount should Montu Consultants record each new asset on its books?arrow_forward

- Please provide the solution to this financial accounting question with accurate financial calculations.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardQuestion: The balanced scorecard approach includes a) Only financial measures b) Only non-financial measures c) Both financial and non-financial measures d) Only customer measuresarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY