Concept explainers

Problem 23-3B

Flexible budget preparation; computation of materials, labor, and

P1P2P3

Suncoast Company set the following standard costs for one unit of its product.

Direct materials (6 lbs. @ $5 per lb.) …………………. $ 27

Direct labor (2 hrs. @ $17 per hr.) ……………………... 18

Overhead (2 hrs. @ $ 18.50 per hr.) ……………………. 24

Total

The predetermined overhead rate ($ 16.00 per direct labor hour) is based on an expected volume of 75% of the factory’s capacity of 20,000 units per month. Following are the company’s budgeted overhead costs per month at the 75% capacity level.

Overhead Budget (75% Capacity)

Variable overhead costs

Indirect materials ……………………………………… $ 22,000

Indirect labor …………………………………………… 90,000

Power …………………………………………………… 22,500

Repairs and maintenance ……………………………….. 45,000

Total variable overhead costs …………………………… $180,000

Fixed overhead costs

Depreciation- Machinery ………………………………… 72,000

Taxes and insurance ……………………………………… 18,000

Supervision ………………………………………………... 66,000

Total fixed overhead costs …………………………………180,000

Total overhead costs ………………………………………………$ 360,000

The company incurred the following actual costs when it operated at 75% of capacity in October.

Direct materials (91,000 lbs. @ $5.10 per lb) …………………… $ 420,900

Direct labor (30,500 hrs. @ $ 17.25 per hr.) ……………………… 280,440

Overhead costs

Indirect materials …………………………………………. $ 21,600

Indirect labor ………………………………………………. 82,260

Power ………………………………………………………. 23,100

Repairs and maintenance …………………………………… 46,800

Depreciation-Building ……………………………………… 24,000

Depreciation-Machinery …………………………………….. 75,000

Taxes and insurance …………………………………………. 16,500

Supervision …………………………………………………… 66,000

355,260

Total costs ……………………………………………………………_____

$1,056,600 _______

Required

- Examine the monthly overhead budget to (a) determine the costs per unit for each variable overhead item and its total per unit costs and (b) identity the total fixed costs per month.

- Prepare flexible overhead budgets (as in Exhibit 23.12) for October showing the amounts of each variable and fixed cost at the 65%, 75%, and 85% capacity levels.

- Compute the direct materials cost variance, including its price and quantity variances.

- Compute the direct labor cost variance, including its rate and efficiency variances.

- Prepare a detailed overhead variance report (as in Exhibit 23.16) that shows the variances for individual items of overhead.

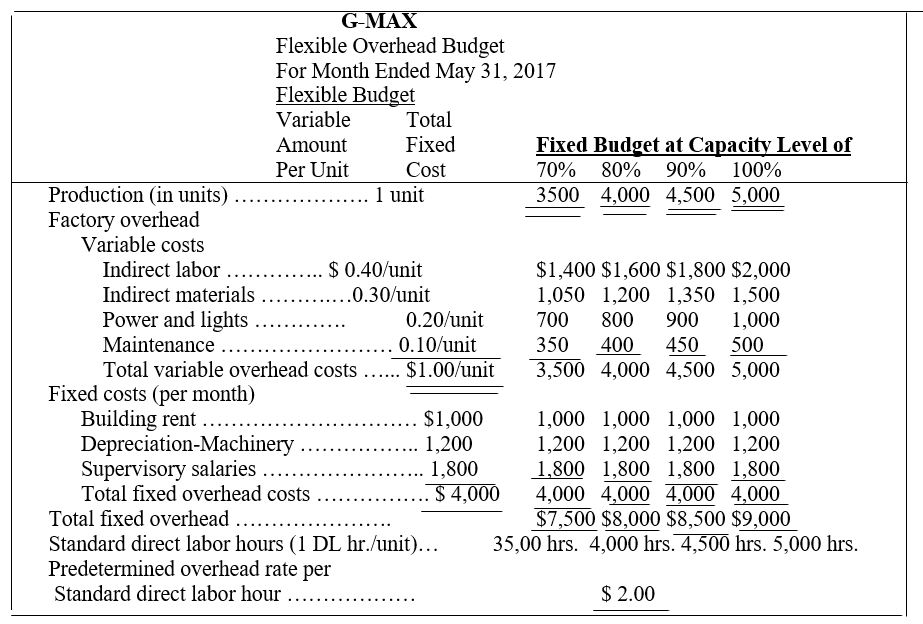

EXHIBIT 23.12 Flexible Overhead Budgets

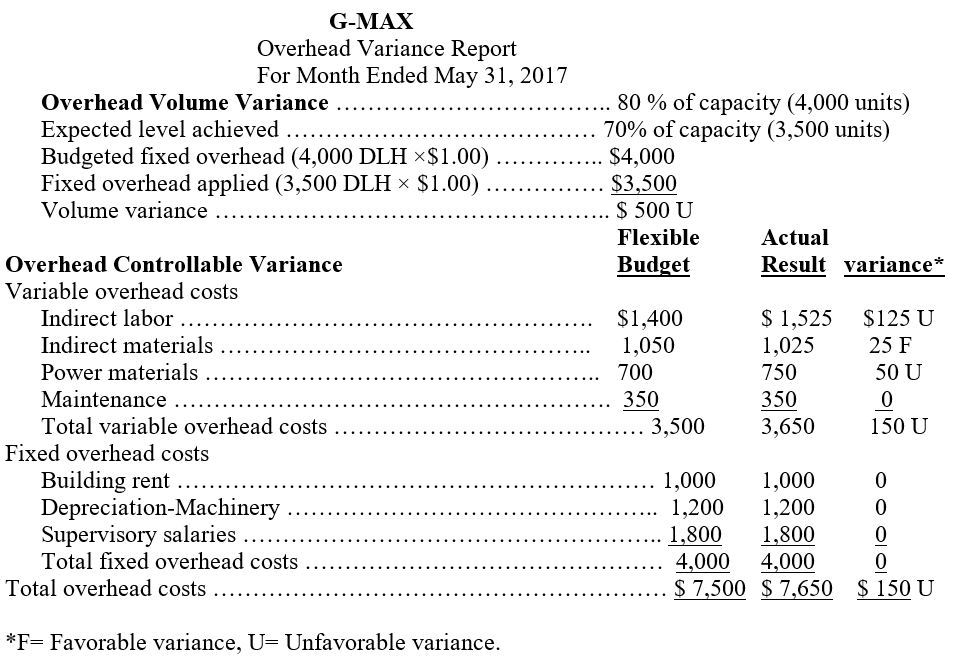

EXHIBIT 23.16 Overhead Variance Report

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

WORKING PAPERS F/ FUND ACCOUNTING

- A company purchased for cash a machine with a list price of $85,000. The machine was shipped FOB shipping point at a cost of $6,500. Installation and test runs of the machine cost $4,500. The recorded acquisition cost of the machine is which amount? a. $96,000 b. $126,000 c. $85,000 d. $92,000arrow_forwardBaxter Industries reported the following financial data for one of its divisions for the year: • Average invested assets = $600,000 • Sales = $1,200,000 Income = $140,000 What is the investment turnover? a) 2.75 b) 3.40 c) 2.00 d) 4.25 e) 5.00arrow_forwardChapter: Work in process - Vicky Company has beginning work in process inventory of $216,000 and total manufacturing costs of $954,000. If cost of goods manufactured is $980,000, what is the cost of the ending work in process inventory? Don't want wrong answerarrow_forward

- A company bought a new cooling system for $150,000 and was given a trade-in of $95,000 on an old cooling system, so the company paid $55,000 cash with the trade-in. The old system had an original cost of $140,000 and accumulated depreciation of $60,000. If the transaction has commercial substance, the company should record the new cooling system at _. Solvearrow_forwardFinancial accountingarrow_forwardCorrect Answerarrow_forward

- Harry Company sells 30,000 units at $25 per unit. Variable costs are $20.50 per unit, and fixed costs are $52,000. Determine the following: a. The contribution margin ratio b. The unit contribution margin c. The income from operationsarrow_forwardCorrect answerarrow_forwardA company sold a piece of equipment that originally cost $55,000 for $20,000 when accumulated depreciation on the equipment was $40,000. What is the amount of gain or loss recorded on the sale of this equipment?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,