Concept explainers

Problem 23-3B

Flexible budget preparation; computation of materials, labor, and

P1P2P3

Suncoast Company set the following standard costs for one unit of its product.

Direct materials (6 lbs. @ $5 per lb.) …………………. $ 27

Direct labor (2 hrs. @ $17 per hr.) ……………………... 18

Overhead (2 hrs. @ $ 18.50 per hr.) ……………………. 24

Total

The predetermined overhead rate ($ 16.00 per direct labor hour) is based on an expected volume of 75% of the factory’s capacity of 20,000 units per month. Following are the company’s budgeted overhead costs per month at the 75% capacity level.

Overhead Budget (75% Capacity)

Variable overhead costs

Indirect materials ……………………………………… $ 22,000

Indirect labor …………………………………………… 90,000

Power …………………………………………………… 22,500

Repairs and maintenance ……………………………….. 45,000

Total variable overhead costs …………………………… $180,000

Fixed overhead costs

Depreciation- Machinery ………………………………… 72,000

Taxes and insurance ……………………………………… 18,000

Supervision ………………………………………………... 66,000

Total fixed overhead costs …………………………………180,000

Total overhead costs ………………………………………………$ 360,000

The company incurred the following actual costs when it operated at 75% of capacity in October.

Direct materials (91,000 lbs. @ $5.10 per lb) …………………… $ 420,900

Direct labor (30,500 hrs. @ $ 17.25 per hr.) ……………………… 280,440

Overhead costs

Indirect materials …………………………………………. $ 21,600

Indirect labor ………………………………………………. 82,260

Power ………………………………………………………. 23,100

Repairs and maintenance …………………………………… 46,800

Depreciation-Building ……………………………………… 24,000

Depreciation-Machinery …………………………………….. 75,000

Taxes and insurance …………………………………………. 16,500

Supervision …………………………………………………… 66,000

355,260

Total costs ……………………………………………………………_____

$1,056,600 _______

Required

- Examine the monthly overhead budget to (a) determine the costs per unit for each variable overhead item and its total per unit costs and (b) identity the total fixed costs per month.

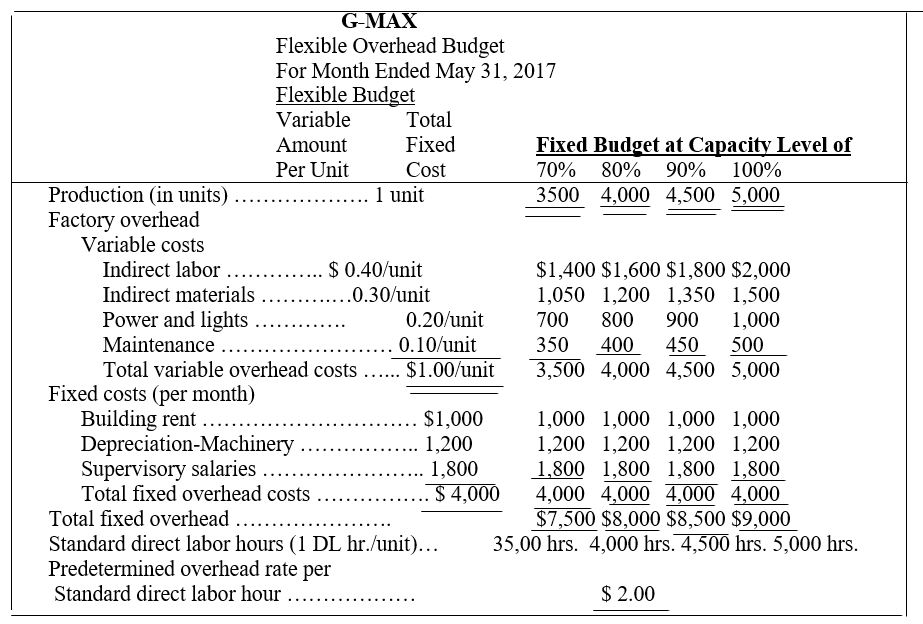

- Prepare flexible overhead budgets (as in Exhibit 23.12) for October showing the amounts of each variable and fixed cost at the 65%, 75%, and 85% capacity levels.

- Compute the direct materials cost variance, including its price and quantity variances.

- Compute the direct labor cost variance, including its rate and efficiency variances.

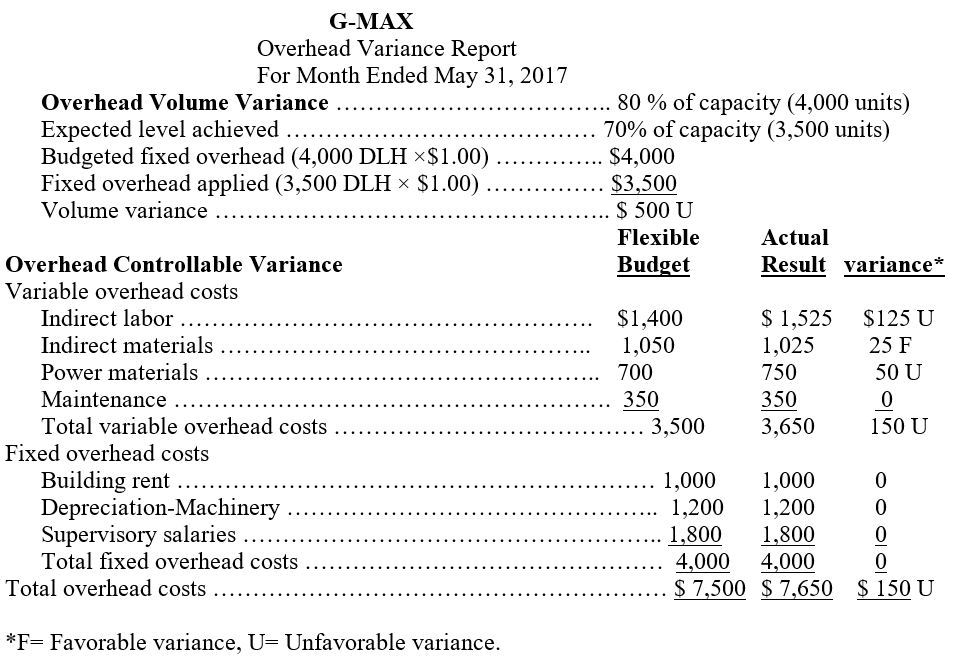

- Prepare a detailed overhead variance report (as in Exhibit 23.16) that shows the variances for individual items of overhead.

EXHIBIT 23.12 Flexible Overhead Budgets

EXHIBIT 23.16 Overhead Variance Report

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

Connect 2-Semester Access Card for Fundamental Accounting Principles

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning