Evaluating division performance

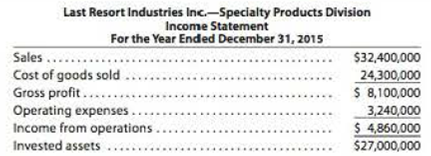

Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no Service department charges, is as follows:

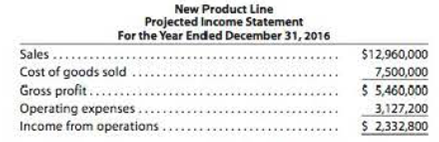

The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of $14,400,000. A

The Specialty Products Division currently has $27.000.000 in invested assets, and Last Resort Industries Inc.’s overall rate of

The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons why the Specialty Products Division manager rejected the new product line.

- 1. Determine the rate of return on investment for the Specialty Products Division for the past year.

- 2. Determine the Specialty Products Division manager’s bonus for the past year.

- 3. Determine the estimated rate of return on investment for the new product line. Round whole percents to one decimal place and investment turnover to two decimal places.

- 4. - Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected rate of return all investment for 2016, assuming that the new product line was launched in the Specialty Products Division, and 2016 actual operating results were similar to those of 2015.

- 5. Can you suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and rate of return on investment?

Trending nowThis is a popular solution!

Chapter 23 Solutions

FINANCIAL+MANG.-W/ACCESS PRACTICE SET

- Auditor should assess the likelihood of --------- when identifying potential criteria for the audit. material misstatement wrong answerarrow_forwardWhen information comes to the auditors' attention indicating that ----- may have occured, auditors should evaluate whether the possible effect is significant within the context of the audit objectives.arrow_forwardNeed help with this question solution general accountingarrow_forward

- Select the correct answerarrow_forwardWhat is a good response to this post? Hello everyone,The theory of facework is a beneficial instrument for preserving self-image and fostering mutual respect during exchanges. According to Nguyen-Phuong-Mai, Terlouw, and Pilot (2014), facework is the strategic approach individuals employ to validate their own identity while simultaneously considering the requirements of others. The necessity of these strategies has been evident to me during my nine years as a rideshare driver. I endeavor to understand the context and intentions of each passenger by dedicating sufficient time to attentive listening before disclosing undue personal information. This empathetic and respectful approach safeguards my identity and fosters trust, reducing the probability of rambling and mitigating the potential harm of receiving a poor rating.My experience in the restaurant industry, particularly at venues such as Tavern on the Green in New York City, has emphasized the significance of effective facework.…arrow_forwardCorrect answerarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning